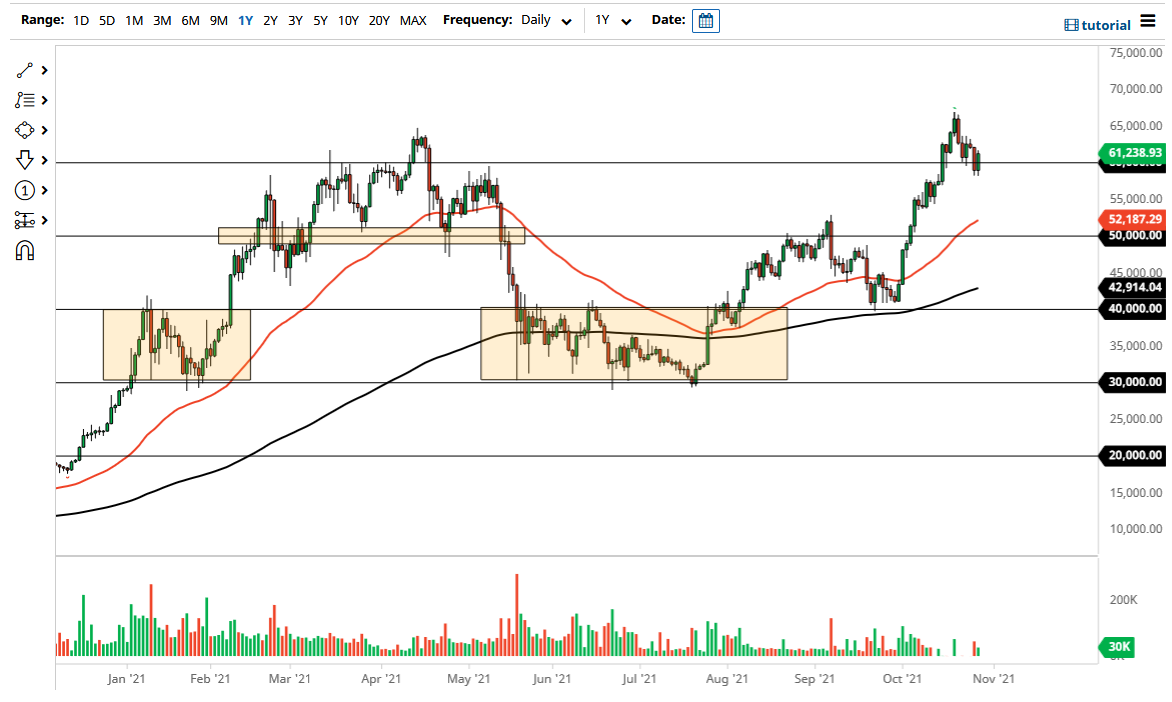

The Bitcoin market has rallied significantly during the course of the trading session on Thursday to show signs of life again at the $60,000 level. By recovering in the manner that we have, we are still in the midst of potentially forming a bullish pennant, which would be obvious for most traders. At this point, the market is likely to see this as a potentially strong signal, so therefore I think that Bitcoin will continue to rally. At this point, I believe that the market is going to go looking towards the $65,000 level. The $67,500 level is also an area of resistance. If we can break above there, then it is likely that we could go looking towards the $70,000 handle.

On the other hand, if we were to turn around a break down below the bottom of the candlesticks of the last couple of days, then it is likely that we may have to go looking towards the next support level which I see as the $55,000 level. The $55,000 level is a significant cluster of trading flow that should offer a certain amount of support. Furthermore, the 50 day EMA is likely to go looking towards that area, and that could attract a certain amount of attention.

If we were to break down below the 50 day EMA, then it is likely we go looking towards the $50,000 level. The $50,000 level has shown itself to be important more than once, and it of course has a certain amount of psychology attached to it. If we were to break down below the $50,000 level, then it is likely that we could break down rather significantly at that point. Short-term pullback should continue to be buying opportunities, and Bitcoin looks very likely to continue going much higher. With this being the case, I think it is only a matter of time before we can take advantage of value as it occurs, which is the case with most crypto currencies at this point. With that being the case, buying on the dips continues to be the way forward, and shorting is all but impossible. I do think that we will eventually see a huge move higher yet again, as we may be forming a massive bullish pennant that could reach as high as $80,000 based upon the “measured move.”