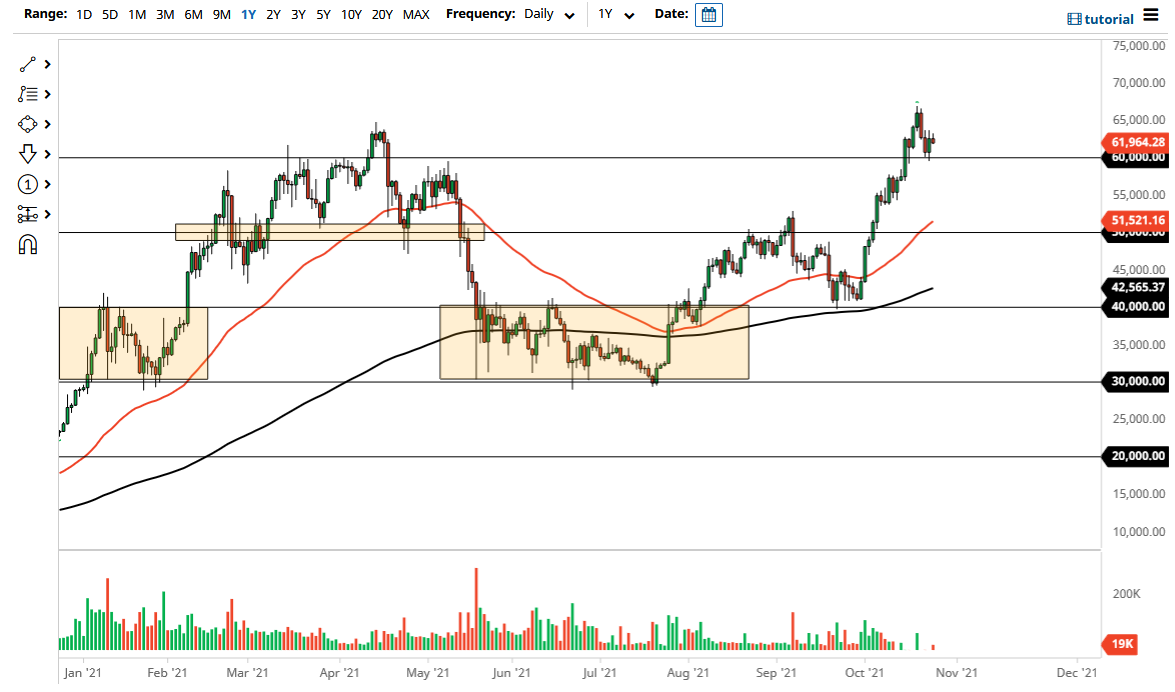

Bitcoin markets have gone back and forth on Tuesday as we continue to try and digest gains from the massive move higher. The $60,000 level of course is an area that a lot of people will pay close attention to, as the market appears to hang about these large, round, psychologically significant figures. The $60,000 level does make for good headline noise, but at the end of the day the reality is that the market will almost certainly continue to go higher over the longer term.

Currently, the $64,000 level is an area that has been resistance recently, so I do think that it is a very good sign if we can break back above that level that we would continue to see value hunters in that region. Currently, the 50 day EMA is sitting just above the $51,000 level and sloping higher, which suggests that we are going to continue to see upward pressure. That being the case, I think it is a breakdown below the $50,000 level you have to worry about Bitcoin in general. After all, the large figure of course caused quite a bit of headline noise, and therefore I think a lot of attention will be paid to the market if we were to break down below there. If Bitcoin does use the $50,000 handle, it is very likely that we would see more selling pressure.

Keep in mind that the recent run up needs to see a certain amount of digestion after this big of a move, and it does make quite a bit of sense that there will be a need for the market to find some type of catalyst to continue going higher. Quite frankly, we have seen crypto find one reason after another to go higher, not the least of which would be the fact that the US dollar has gotten pummeled, and of course there is a lot of concern when it comes to inflation. While Bitcoin is not traditionally thought of as a hedge against inflation, that is what it has been used as over the last couple of months, so there is no real reason to think that it may not continue being so going forward. Because of this, it is very likely that we will see continued upward pressure.