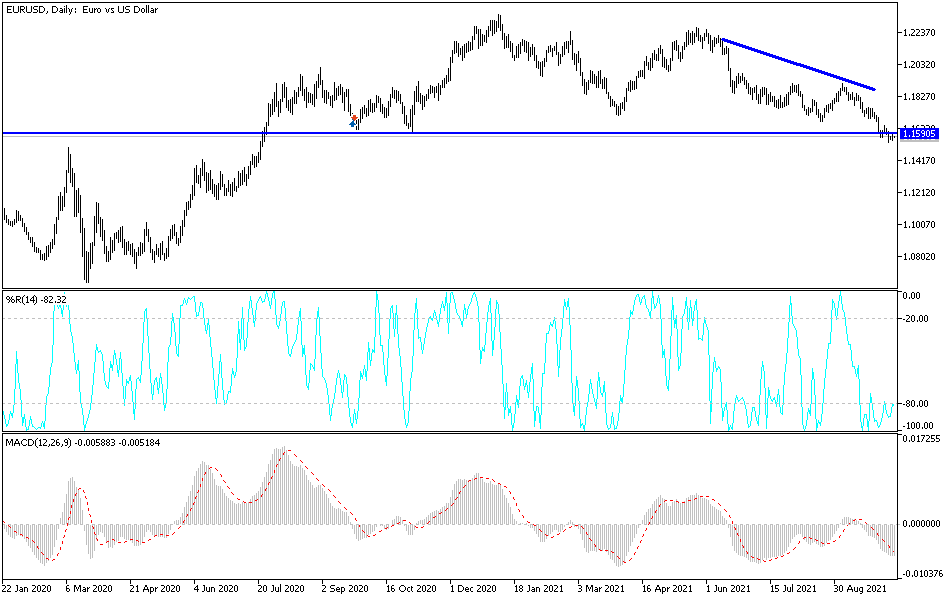

The euro rallied a bit on Friday, reaching towards the 1.1580 level before pulling back a bit. While this was a bullish turn of events, we are still well below a significant resistance barrier, and it should be noted that a lot of this was a bit of a “knee-jerk reaction” to the non-farm payroll numbers coming out much weaker than anticipated. This initially had the US dollar selling off against almost everything, but you can see this has turned around to show signs of weakness.

The European Central Bank will continue to add to its balance sheet, while the Federal Reserve is in the midst of looking at tapering. At this point, it looks as if this pair will continue to see a “fade the rallies” type of situation. That is what we have seen for a while, and the euro simply cannot seem to get off its back to change the narrative. The market should see a significant amount of resistance at the 1.16 level, which extends to the 1.1650 level at the very least.

If the market were to break higher, it is not until we close above the 1.1750 level on a daily chart that I would be bullish. At that point, the market will have changed momentum quite drastically, and I think it is only a matter of time before the market would go looking towards 1.18 level. That being said, this is a market that looks very unlikely to make that happen, and I think it is much easier to break down below the lows of the week to go looking towards 1.15 handle. If we break down below there, it is likely that the market would go looking towards the 1.1250 level, and perhaps even lower.

A lot of this comes down to the idea of the market looking towards concern around the world, and the idea of the Federal Reserve looking to taper. If they do in fact taper, that then will send the interest rate differential between Germany and the United States diverging even further. At this point in time, the market is likely to continue seeing downward pressure regardless of what happens next, and it would take a Herculean effort to change things.