The EUR/USD has been in a cautious bullish correction range, moving towards the 1.1670 resistance before settling around 1.1640 as of this writing. The pair is anticipating the announcement of inflation figures in the Eurozone with the Consumer Price Index reading. The US dollar witnessed heavy losses against all major currencies, as the price of the euro rebounded against the dollar on Friday, Monday and Tuesday, while many analysts attributed this to profit-taking by investors who were betting that the US Federal Reserve would raise the interest rates faster than previously expected.

For its part, the EUR has not had much momentum given the European Central Bank (ECB) directives which indicate that it will take years for interest rates in the Eurozone to recover. Meanwhile, many economists also suspect that the ECB may eventually retain part of its quantitative easing program in the pandemic era long beyond the point where others elsewhere have wound up their entire program and started raising interest rates.

"Next week's ECB meeting is very much a precursor to the December meeting, where the new task force's forecasts will form the basis for careful calibration of its instruments," says Pete Heinz Christiansen, chief analyst at Danske Bank.

Technical analysts at Commerzbank are of the opinion that the rebound could lift the EUR around 1.1750 over the coming days. The price of the EUR/USD entered this week’s trading by breaking through the 1.1600 and at the same time it seems that it is impeding its upward path in the same way it was during the previous week, although the dollar was quick to decline in trading on Monday and the price movement that followed lifted the EUR/USD above 1.1650 before Tuesday.

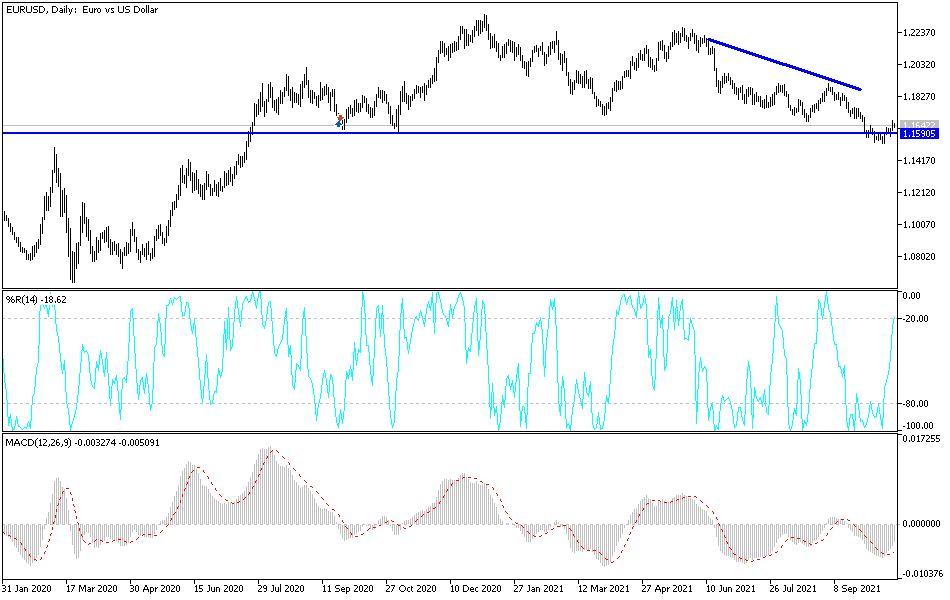

The rebound follows another case of “bullish divergence” on the charts last week when the euro set a new year low at 1.1525 which was accompanied by a higher RSI momentum meter, which could signal a trend change in the pipeline. The Commerzbank team cited this as one of the factors that influenced last week's decision to buy EUR/USD around 1.1540 last week, although this week they called for clients to exit bets on the single currency at or before 1.1720.

Accordingly, Karen Jones, Head of Technical Analysis for Currency, Commodities and Bonds at Commerzbank said, “The EUR/USD broke higher during the accelerating downtrend as expected. Elliott wave daily counts remain positive and we will allow a deeper dip to 1.1746.” Jones and colleagues said on Tuesday that the euro and dollar could now benefit from technical support around 1.1565 and also noted that if the single currency recovers above 1.1746, it is likely to pave the way for further advance to about 1.19.

While the 10-month downtrend in EUR/USD slowed significantly during October, the euro was unable to attempt a recovery until last Friday's heavy selling in dollar exchange rates, while both sets of price action extended into this week.

Accordingly, Kenneth Brooks, an analyst at Societe Generale, says: “Yesterday’s disappointing manufacturing data in the US, and the drop in capacity use to its lowest levels after the crisis, confirms the message that supply constraints are hampering manufacturing activity, also in the US.”

Technical analysis of the pair

On the daily chart, the last rebound of the EUR/USD pair is still in its infancy and needs more momentum, as a bullish transformation depends on moving towards the 1.2000 psychological resistance; otherwise, the general trend will remain bearish. Moving below the 1.1600 support gives the bears the opportunity to move towards lower levels again, as the euro would be weaker against the dollar, especially with factors that strengthen the dollar's current gains. This is due, as mentioned before, to the discrepancy in economic performance and the future of monetary policy between the Eurozone and the United States.