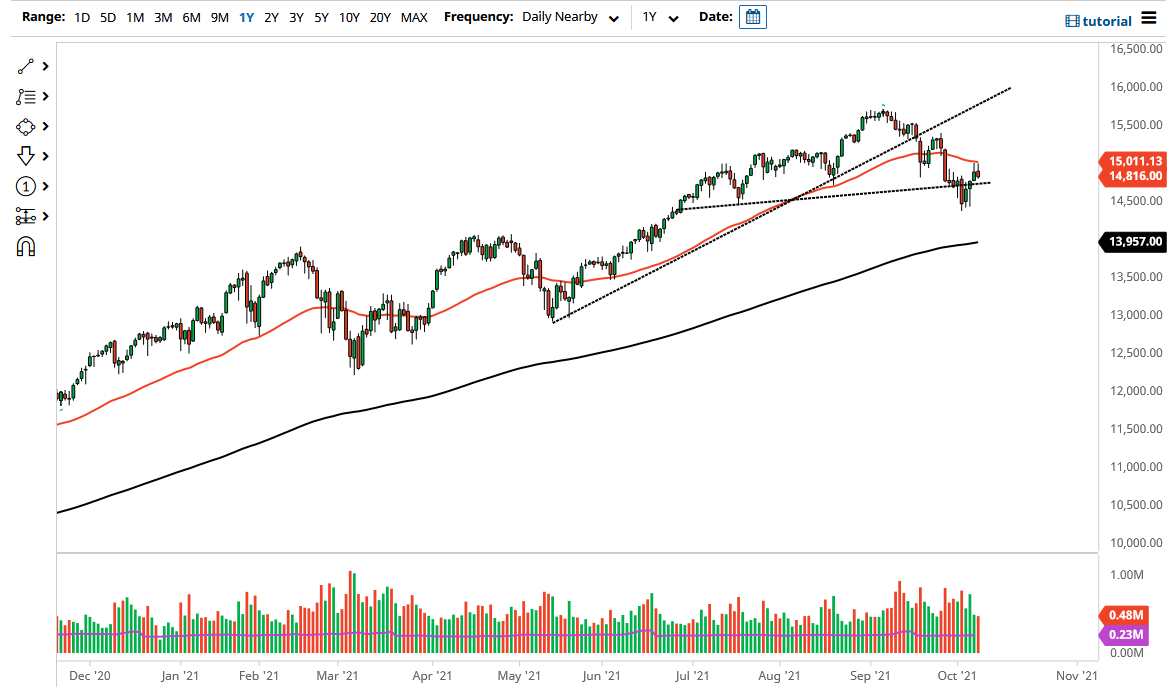

The NASDAQ 100 rallied on Friday to slam into the 50-day EMA. That being said, the market pulled back from there to show signs of exhaustion and form a bit of a shooting star. It is sitting on top of the previous trendline that has been so important. I think that we have a lot of work to do to figure out where we are going to go next, and as a result you will have to pay close attention to the bond market.

Bonds initially saw rates fall after the weaker-than-anticipated jobs number, but as we turned around to show signs of strength in rates, that turned things around for the NASDAQ 100 as we had seen selling pressure. The market breaking down below the 14,800 level could open up a move down to the 14,500 level, which is where we have seen a significant amount of support, and so I think that is an area that you need to pay close attention to.

If we were to break down below that level, then I would be a buyer of puts, as I suspect that the market is going to go down towards the 200-day EMA. That being said, we also have to worry about issues when it comes to the Federal Reserve coming into the markets and manipulating things. Quite frankly, Wall Street will find a way to spin a positive narrative that they can take advantage of and go to the upside. If we can break above the 50-day EMA on a daily close, then I think we could continue to go higher in the longer-term trend that we have been in for what seems like a lifetime.

The markets will continue to see a lot of volatility, and I think that what we are seeing is the market trying to figure out whether or not we are in a situation where we need to play the “growth stocks” or if we have to start to look towards cyclical stocks, which would favor other indices and not the NASDAQ 100 itself. With that, I think volatility is about the only thing you can expect going forward, so position sizing will be crucial.