It's a particularly bearish trading week for the Japanese yen against the other major currencies. In the case of the USD/JPY currency pair, the weakness of the yen was offset by strong expectations that the US Federal Reserve is close to tightening its monetary policy, which supported the upward move strongly in recent trading sessions, reaching the 113.78 resistance level, near its highest level in three years, and stabilizing around the 113.55 level as of this writing. The markets are awaiting the announcement of US inflation figures and the content of the minutes of the last meeting of the Federal Reserve.

Global financial markets have been in flux for weeks. As investors try to see how the US economy will continue to recover with COVID-19 remaining a threat, rising inflation is likely to hamper consumer spending and corporate finance. The latest round of earnings reports will give Wall Street a clearer picture of companies' performance in the last quarter amid an increase in COVID-19 cases. It will also shed some light on how they expect to perform over the rest of the year.

JPMorgan Chase will start reporting bank earnings on Wednesday. It will be followed by Bank of America, Wells Fargo and Citigroup releasing their latest quarterly results on Thursday.

Investors will also keep a close eye on the latest updates on US inflation from the Labor Department. The September CPI will be released on Wednesday, a measure of how inflation is pressing costs for consumers. Additional information on inflation pressures on businesses will be released on Thursday when the Labor Department releases its Producer Price Index.

A wide range of industries are feeling the pinch of rising inflation with rising freight and raw materials costs. Many companies have warned that their financial results may be affected by supply chain problems. The supply chain crisis has also driven up prices of many goods for consumers, which could hurt consumer spending and further impede the economic recovery. Investors will get an update on consumer spending when the Commerce Department releases the US retail sales report for September on Friday.

One reason employers in America are having trouble filling jobs was starkly laid out in a report on Tuesday: Americans are quitting in droves. The Department of Labor said that resignations jumped to 4.3 million in August, the highest percentage in records dating back to December 2000, and up from 4 million in July. This equates to approximately 3% of the workforce.

The report showed that US employment also slowed in August, and the number of jobs available fell to 10.4 million, from a record high of 11.1 million the previous month.

The data help fill in the puzzle looming over the labor market. Hiring slowed sharply in August and September, even as the number of jobs posted neared record levels. And last year, open jobs increased by 62%. However, overall employment, according to a report on Tuesday, declined slightly during that period. The jump in resignations strongly suggests that fear of the delta variable is partly responsible for the labor shortage.

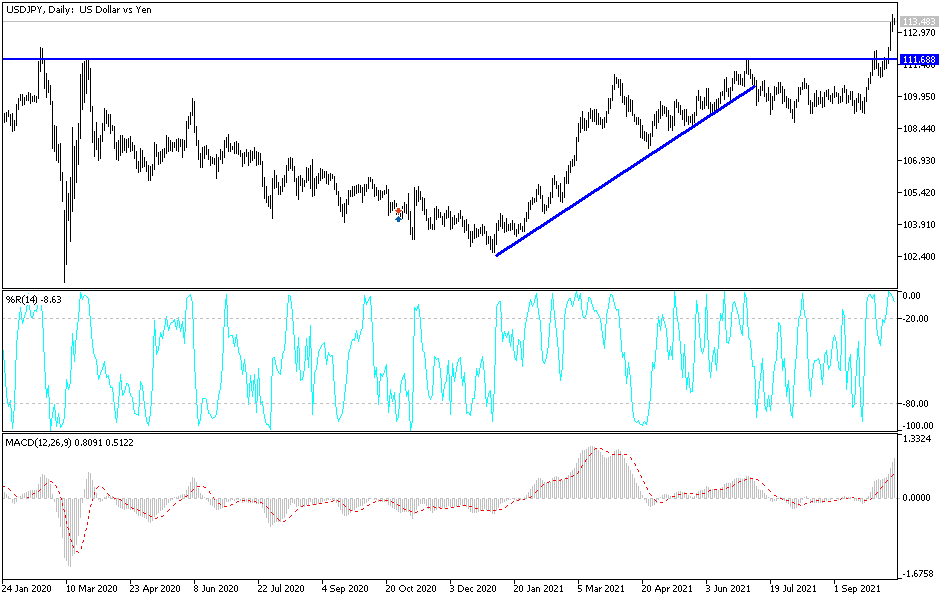

Technical analysis of the pair

Undoubtedly, the gains of the USD/JPY currency pair have taken the technical indicators towards strong overbought levels, and unless the dollar gets more momentum, profit-taking will happen soon. So far, the general trend is still bullish, and the bulls have the opportunity to move higher if today's data and events favor the dollar's gains factors, especially the Fed's tightening policy. The closest targets for the bulls are 114.20 and 115.00.

On the downside, the 110.00 support will remain crucial for the bears to control performance again, otherwise the trend will remain bullish.