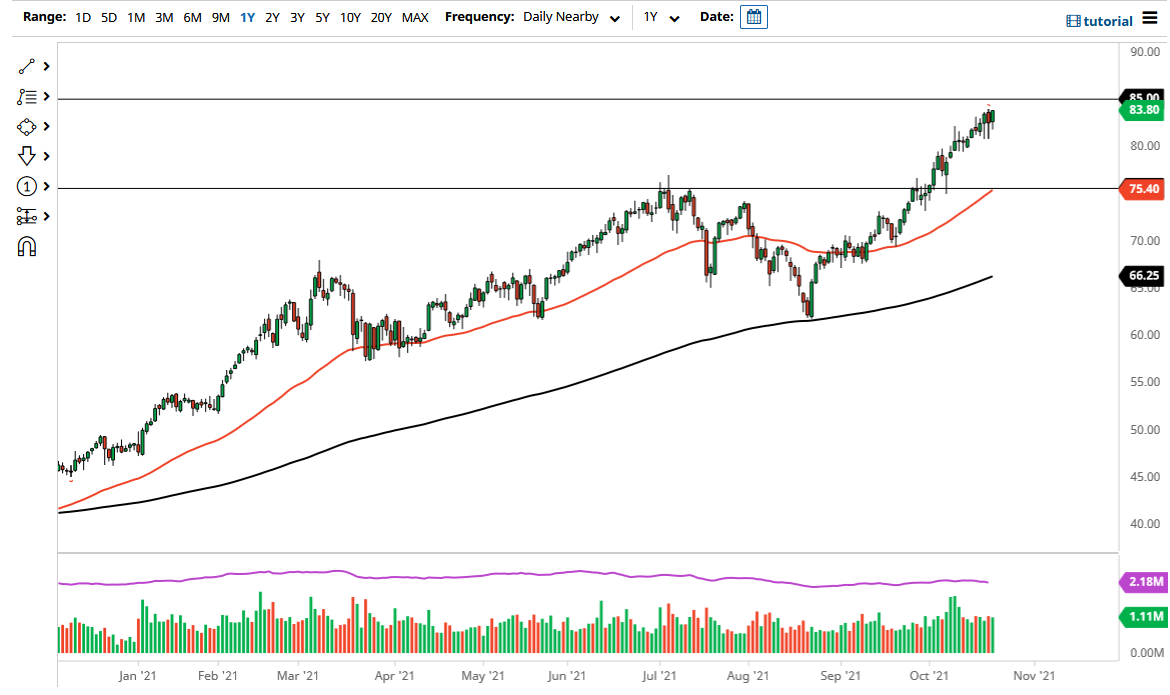

The West Texas Intermediate Crude Oil market pulled back ever so slightly on Friday, only to turn around and show signs of extreme strength yet again. As we close out the week, we are threatening the $84 level, and it is very likely that we will continue to find buyers every time we dip. The supply situation continues to be a major concern, with oil not being produced for almost a straight year. One cannot simply “flip the switch”, and I expect oil to rise in production again, because there is a huge surge in demand that has not been backed up by capital expenditure.

What most people do not get right about this is that crude oil has been neglected for quite some time as far as exploration and capacity are concerned, and this could be an issue that lasts much longer than people expect. That being said, this is a market that has extended itself a bit, so it would not surprise me at all to see it pull back. Any pullback at this point would have to be looked at as a gift, with perhaps the ability to find a lot of value near the $80 level, maybe even as low as $75.50, which is basically where the 50-day EMA is at the moment. I would be surprised if we pull back that far, but that is what I am considering to be the “floor in the market.”

The three candlesticks in a row that look like hammers do suggest that we are going higher, and the fact that we are closing at the weekly high does nothing to dissuade the idea of further momentum. The markets have been on an absolute tear over the last two months or so, so one would think that sooner or later we will get a red candlestick for the week, but we clearly did not get this one.

If we can break above the $85 level, that could bring in fresh buying, perhaps sending this market towards the $90 level over the longer term. There is nothing structurally right now that suggests crude oil shouldn't go higher, and the US dollar has been a bit soft as well, so that helps the market at the same time.