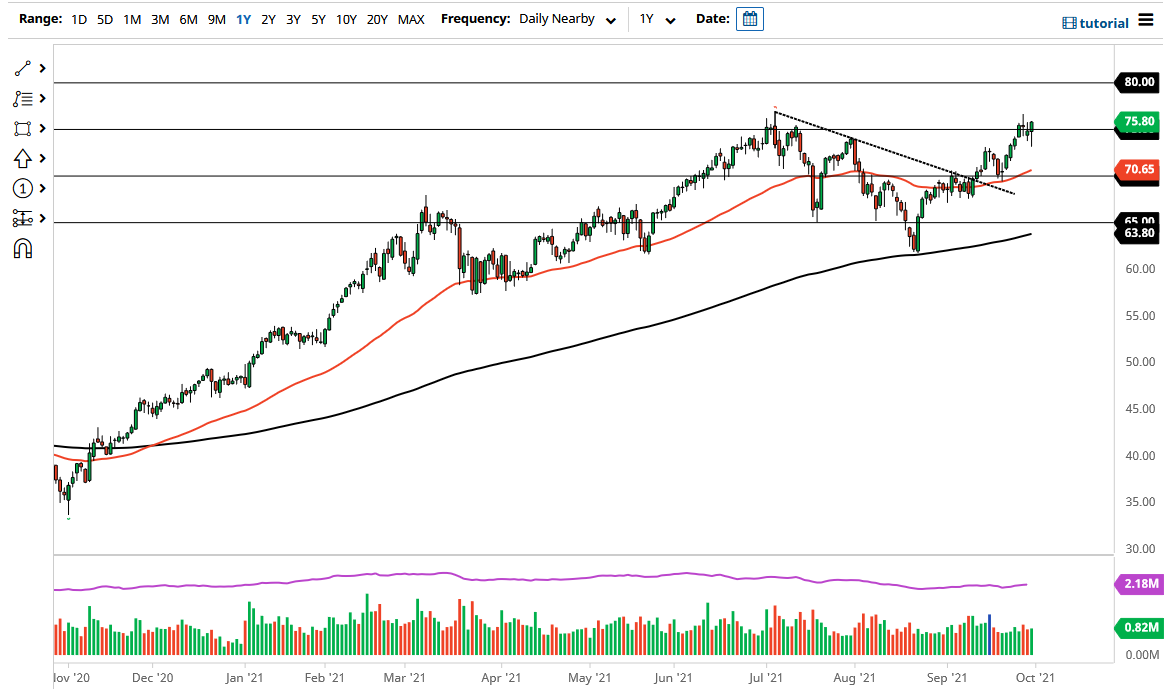

The West Texas Intermediate Crude Oil market has initially pulled back during the course of the trading session on Thursday, but then turned around quite drastically to threaten the highs again. If we can break above the top of the shooting star on Tuesday, then it is likely that we go higher, perhaps reaching towards the $80 level. The $80 level of course is a large, round, psychologically significant figure, which of course will attract a certain amount of attention as well as invoke large options barriers.

If we were to turn around and break down below the bottom of the candlestick for the trading session on Thursday, then it is possible that we go looking towards the $70 region, which is sitting just below the 50 day EMA, so if with all of this coming into the picture, I think that there will be a lot of value hunters in that general vicinity. The markets are obviously bullish and have been for quite some time, so I think it is only a matter of time before the value hunters find reasons to get long. After all, there are a lot of concerns out there when it comes to the supply of crude oil, as it is getting tighter by the day.

I think the one thing that you will count on here is a lot of volatility, but as things stand right now it is almost impossible to short this market. In fact, it is not until we break down below the $70 level on a daily close that I would consider shorting, which is roughly $6.00 level underneath. That in and of itself would be a significant move, so at that point in time you have to think there was a major change in attitude that needs to be paid close attention to.

The US dollar has a bit of a negative correlation to the crude oil market over the longer term, but recently we have seen the correlation break down a bit. That being said, if the US dollar does get hit rather hard, then it is possible that might boost oil in and off itself. Either way, I do not see a scenario where you can short this market anytime soon, so keep that in mind.