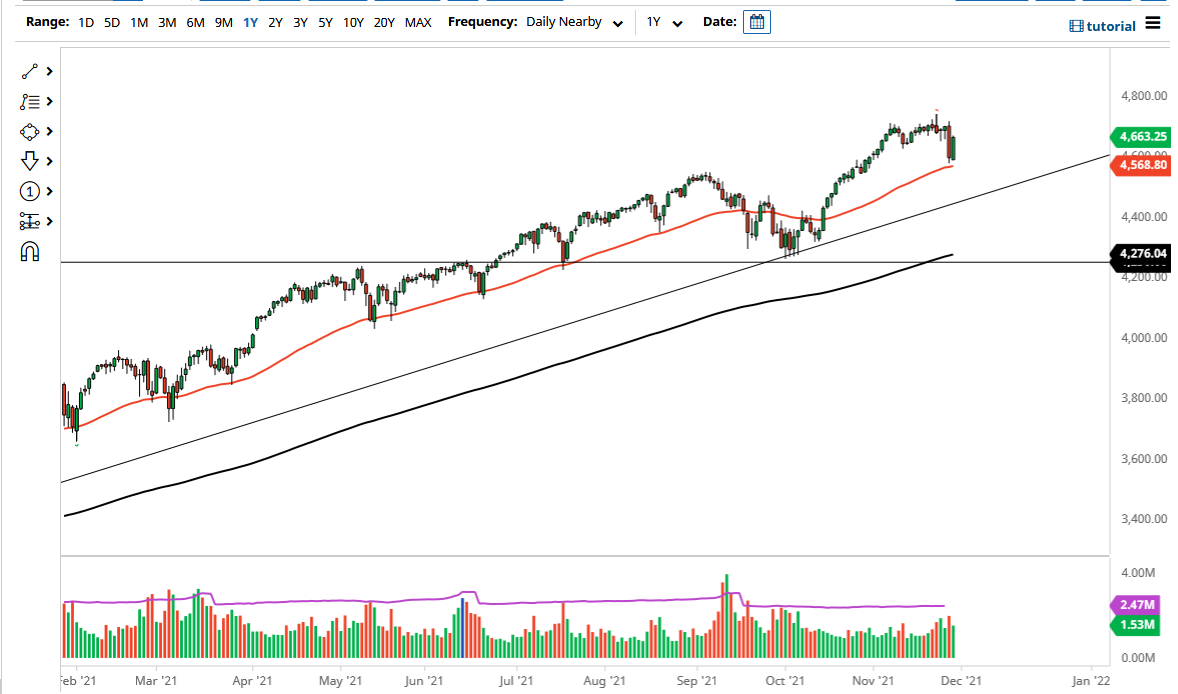

The S&P 500 bounced on Monday using the 50-day EMA as support. The market had gotten sold off quite drastically on Friday, but it was the day after Thanksgiving, meaning that there would not have been much in the way of volume. Also, given the fact that bad news came out on the same session, it should not be a huge surprise to see that the futures market got hammered.

The 50-day EMA is an indicator that a lot of people pay attention to, so I do believe that it is probably quite telling that we bounced from there, meaning that the market needs to see these opportunities in order for people getting involved in a market that has been difficult over the last couple of days. Nonetheless, the “Santa Claus rally” continues to see signs of life as traders are trying to make up underperformance by the end of the year. The candlestick did not wipe out all of the losses like we saw in the NASDAQ 100, but it still looks rather strong. If we can break above the candlestick on Friday, it is almost certain that we will go looking towards the all-time highs, and then perhaps even breaking above there. At that point, I would anticipate that the market would go looking towards the 4800 level.

To the downside, if we break down below the 50-day EMA, it is very likely that we could go looking towards the previous uptrend line, which might have this market looking a little closer to the 4500 level. That is an area that I think a lot of traders will be paying close attention to, because it offers even more in the way of value, in what has been a very strong uptrend. Ultimately, this is a market that I do believe in buying the dips at least until the end of the year, as traders chase returns. Remember, the US economy is outperforming many of the other ones, so it makes sense that we would see a lot of money flowing towards the United States. This is a market that I think will find all-time highs rather soon heading into the next year.