The USD/JPY returned to a 3-year high at the beginning of this week's trading, as the bulls moved to the 114.45 resistance before settling around 114.00 as of this writing. Last Thursday, the currency pair plunged to the 113.25 support level. The US dollar pair will be affected in general this week by the US Federal Reserve's monetary policy announcement, at 18:00 GMT on Wednesday, November 3rd.

The US Federal Reserve has indicated for some time now that it is ready to reduce stimulus now that the economic recovery looks strong and inflation pressures are starting to rise significantly. Economists are looking for the US central bank to reduce its monthly asset purchases by $15 billion starting in November, with $10 billion coming from Treasuries and $5 billion in mortgage-backed securities.

A move to reduce the size of quantitative easing may be a necessary first step before raising the interest rate in 2022.

Arguably, the timing of this first lift - and the number of increases that can be passed in 2022 and 2023 - will have the greatest impact on the market going forward. Therefore, it is guidance on future policy rather than an actual decision to reduce quantitative easing that will be important for the dollar in the middle of this week's trading. Commenting on Simon Harvey, Senior FX Market Analyst at Monex, “Confirmation of market expectations may provide relief in the dollar's rally, especially against lower-yielding currencies such as the euro and Japanese yen. However, any upside in the US dollar from the Fed's strong turnaround is likely to be temporary."

He adds that markets have already "tapered" pricing that the Fed is still likely to lag behind other G10 central banks in raising interest rates due to its tolerable inflation framework. And remember, the Fed is now targeting labor market dynamics as well as inflation, while the likes of the Bank of England are explicitly directed at ensuring price stability.

Therefore, analysts are of the opinion that the dollar's continued decline will likely be visible against currencies where the hawkish policy adjustments have been if the Fed does not surprise with a more aggressive view of normalization.

Business leaders in nine Midwest and Plains states are reporting big jumps in employment and inventories over the past month, but confidence in the economy over the next six months has remained at an all time low, according to a new monthly survey. The Creighton Mid-America University general Business Conditions Index released on Monday rose to 65.2 from 61.6 in September. Any reading above the 50 level in the poll indicators indicates growth, while a degree below the 50 level indicates a recession.

But the survey's Business Confidence Index, which looks six months into the future, failed to budge from the 37 recorded in September. This is the lowest reading the Confidence Index has reached since March 2020, when the global COVID-19 pandemic began. The report notes that the region is adding manufacturing activity at a positive but somewhat slower pace. Business leaders reported strong job growth, with the Employment Index rising to 66.1 in October from 56.7 in September. However, the region has not yet recovered from the job losses from the pandemic. Wholesale prices continued to rise, with this indicator recording 96.5 from 94.9 in September, indicating the mounting pressure from inflation.

The monthly survey covers Arkansas, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, Oklahoma and South Dakota.

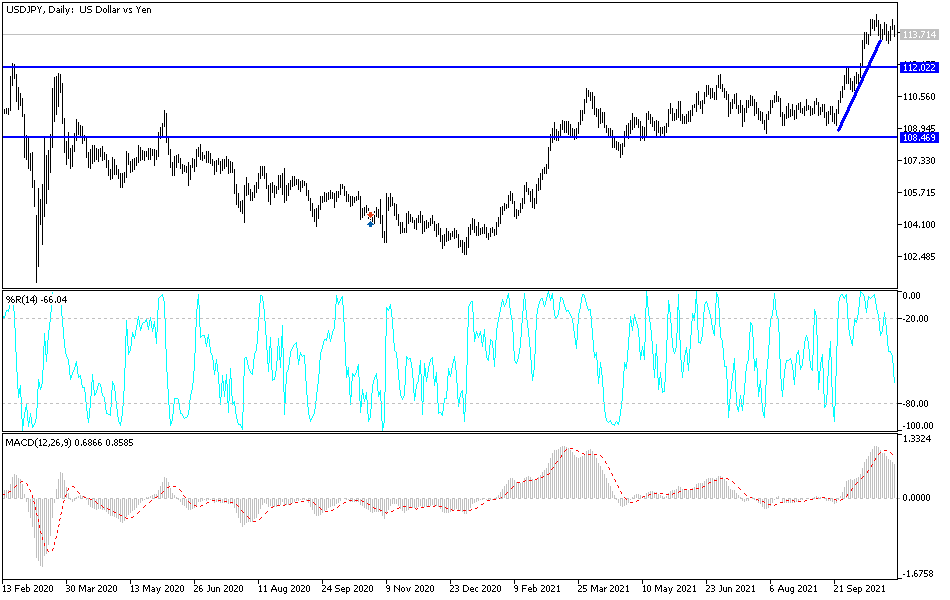

Technical Analysis

The USD/JPY will remain stable around and above the 114.00 psychological resistance, supporting the upward trend and motivating the bulls to move towards stronger bullish peaks. Raising US interest rates as desired by the markets. On the downside, breaking the 113.00 support motivates the bears to launch and change the direction of the pair, which is still bullish.

Today's performance of the USD/JPY may remain neutral in narrow ranges until the Fed announces tomorrow its monetary policy update.