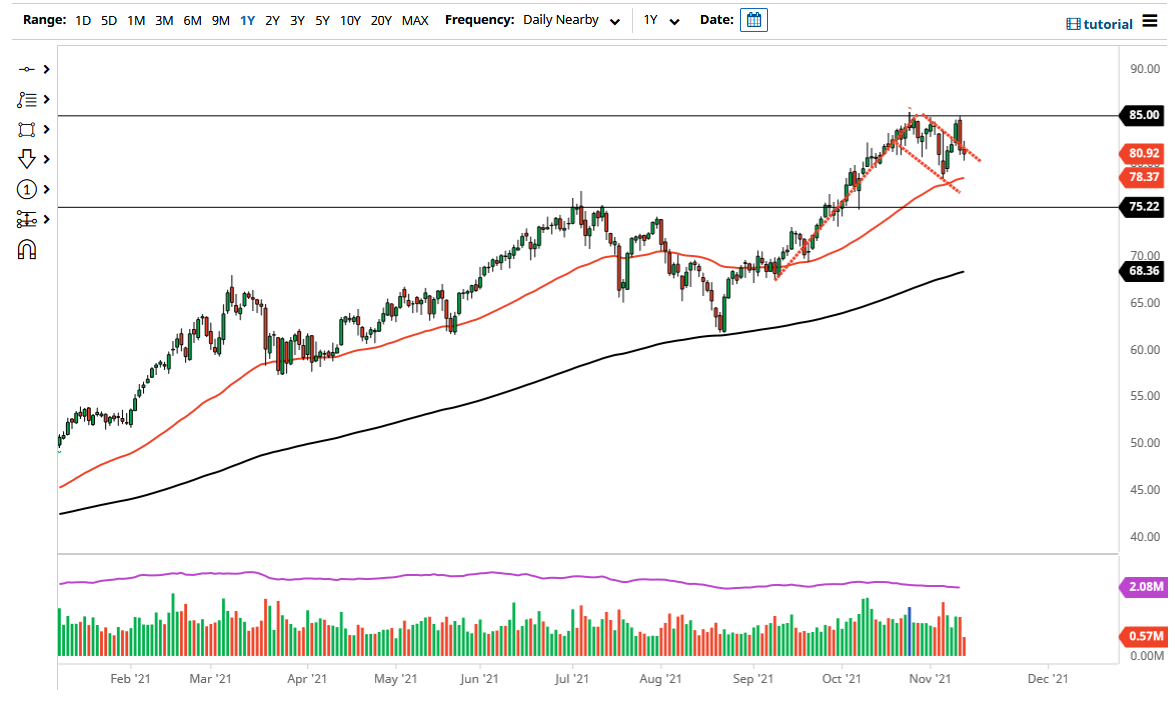

The West Texas Intermediate Crude Oil market has pulled back a bit during the course of the trading session on Thursday but continues to see the previous downtrend line as a potential support level. The downtrend line was the top of the bullish flag that I have marked on the chart, and therefore it is worth paying close attention to. Crude oil continues to be in significant demand, so it does make a certain amount of sense that we will see quite a bit of recovery.

At this juncture, the reopening trade continues to push the crude oil markets higher, as we have seen so much in the way of demand. Supply is still not where once was, and now that the entire world is demanding energy, it does make a certain amount of sense that we will see more pressure to the upside. The members of OPEC have rebuffed comments coming out of the White House when it comes to expanding production, so now the only real threat to pricing is going to be the Strategic Petroleum Reserve in the United States being released. If that happens, it could not prices down for a little bit, but longer-term it very rarely has any lasting effect.

With the Biden administration doing everything they can to destroy US energy production, there is no real threat of shale coming in and picking up the slack. Because of this, it is very likely that the crude oil market will continue to see plenty of upward pressure. The US dollar has rallied a bit, so that may cause a little bit of downward pressure here as well, but at the end of the day this comes back to the entire reopening situation.

When you look at the chart, you can see I have drawn this bullish flag, and the “measured move” from the pole of that flag suggests that we are going to go looking towards the $100 level. It may take a while to get there, but I do think that we could see this in the next six months. Quite frankly, inflation alone may make that happen, as it is starting to get somewhat out of control. The market will continue to be very noisy, but I still favor buying dips until we break down below $75.