The West Texas Intermediate Crude Oil market rallied a bit on Friday to recover quite nicely heading into the weekend. In fact, the market closed towards the very high of the day, and that will typically signify that we have more gains ahead of us. Because of this, I think you need to seriously look at this through the prism of a potential bullish flag, which could measure for a move all the way to $100 before it said and done.

Obviously, this does not necessarily mean that we will get there overnight, but I do think that it is probably only a matter of time before we do in fact try to reach there. After all, the crude oil market continues to see a lot of demand, and now that the members of OPEC have decided against increasing output, it should continue to drive the price of oil higher. This was further magnified by the better-than-anticipated jobs figure coming out of the United States on Friday, showing that in fact the world is going to continue to grow economically as the world’s largest consumer is getting back to work.

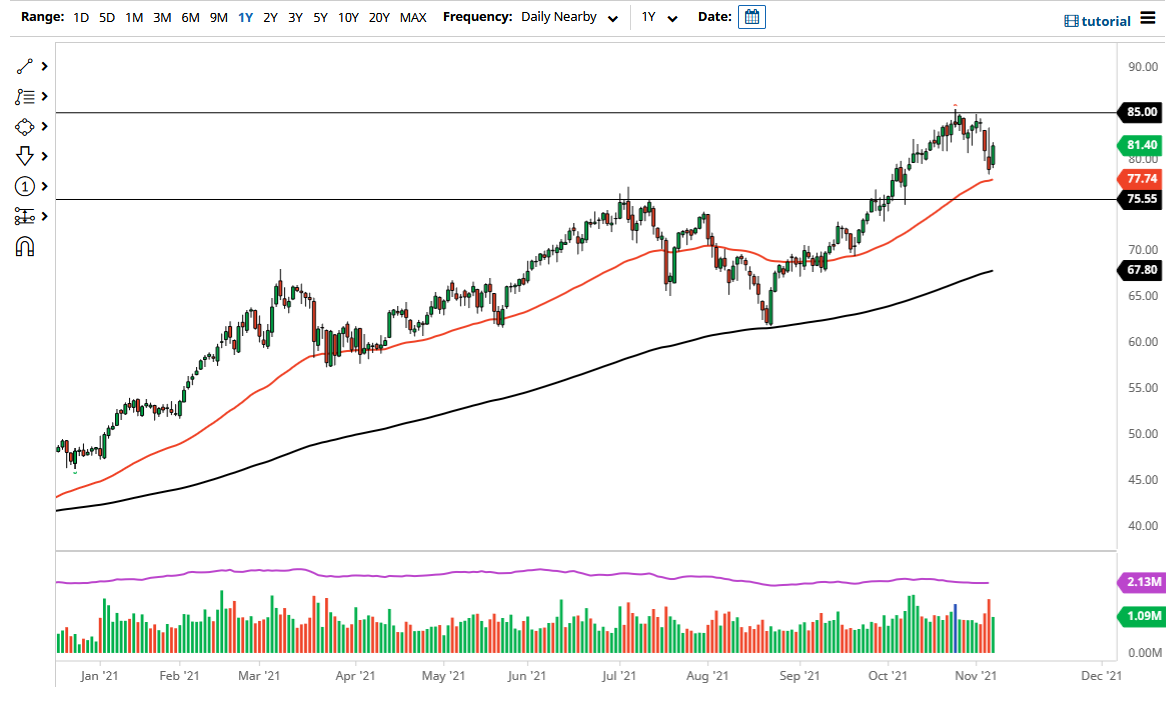

When you look at this chart, it does not take much imagination to see that the 50-day EMA offers support, and that we have seen the potential selloff averted. Because of this, I think that the early part of this week should continue to be a bullish opportunity. If we can break above the $85 level, then it is likely that this market will continue to go even higher, and that would probably kick off the move to $85 that the bullish flag does in fact suggest. The shape of the Thursday candlestick was a bit of an inverted hammer, but it looks as if the market is going to be resilient enough to finally break out to the upside. It is not until we break down below the $75.00 level that I would be a seller, but I do not see that happening anytime soon. If we did break down below there, it would probably lead to a lot of selling in multiple markets, not just this one. At that point, I would anticipate that we would go racing towards the 200-day EMA.