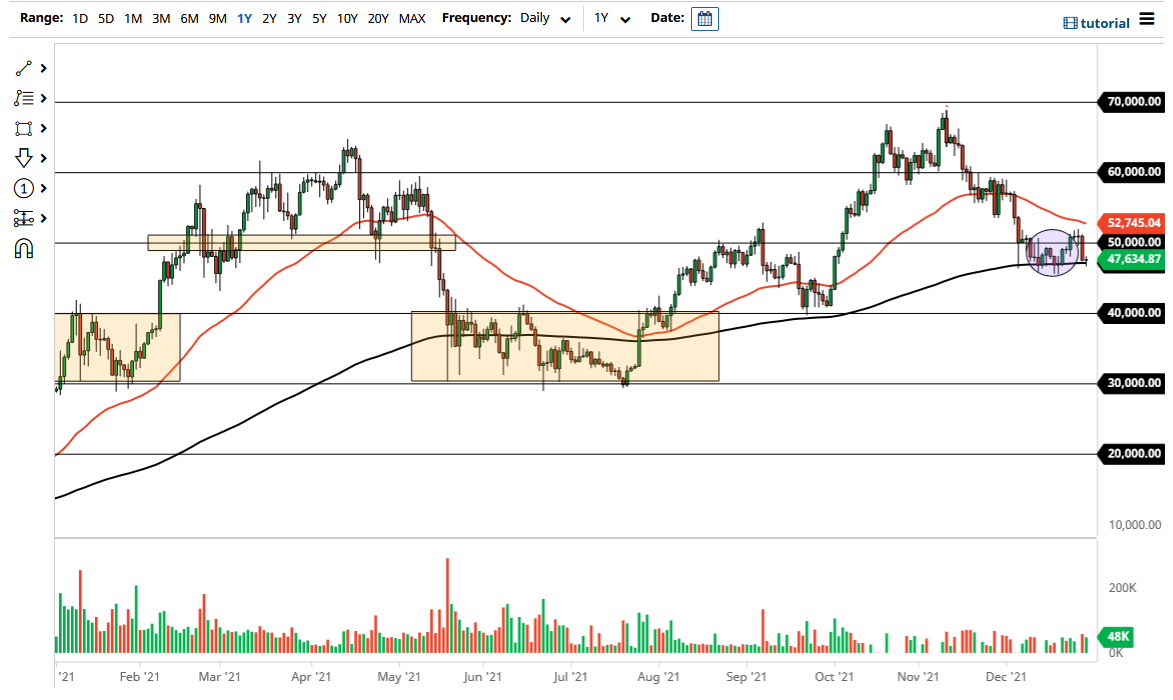

The Bitcoin market did very little on Wednesday as we continue to hang about the 200 day EMA. The 200 day EMA has been very supportive for a while, and I think it is worth paying close attention to the fact that we did stall during the day. The 200 day EMA tends to be closely followed by retail traders, and you will notice that we have stopped there multiple times.

We are heading towards the end of the year and liquidity is going to become a major issue. Because of this, I would not read too much into any of the price action, and I still believe that Bitcoin is bullish overall, but the next couple of days are going to be an absolute waste of time. This can be true with most markets and, as a result, I'm really not planning on buying much. I certainly would be a seller though, and I suppose if we got some type of major illiquid drop, then I might buy a little bit more Bitcoin, but that is about the only thing that I think will happen between now and next week.

We are currently stuck between the 200 day EMA and the 50 day EMA, and that typically means we are going to continue to consolidate. Adding to that is the fact that we are between Christmas and New Year’s, and that just sets up for a perfect sideways type of situation where we will simply grind away. I think Bitcoin will have a good year next year, but we probably have a few weeks to go before money starts to work hard again. Once we get past the New Year’s Day celebrations, traders will be out there looking to put risk on, and Bitcoin is one of the favorite places to do so. I do not see that changing this year, and I would not be surprised at all to see Bitcoin looking towards the 70,000 level sometime in the spring. It is going to be noisy and choppy, but is still a very bullish market longer term both from a fundamental and technical point of view. Ultimately, this is about building a position over the longer term and adding once it works in your favor.