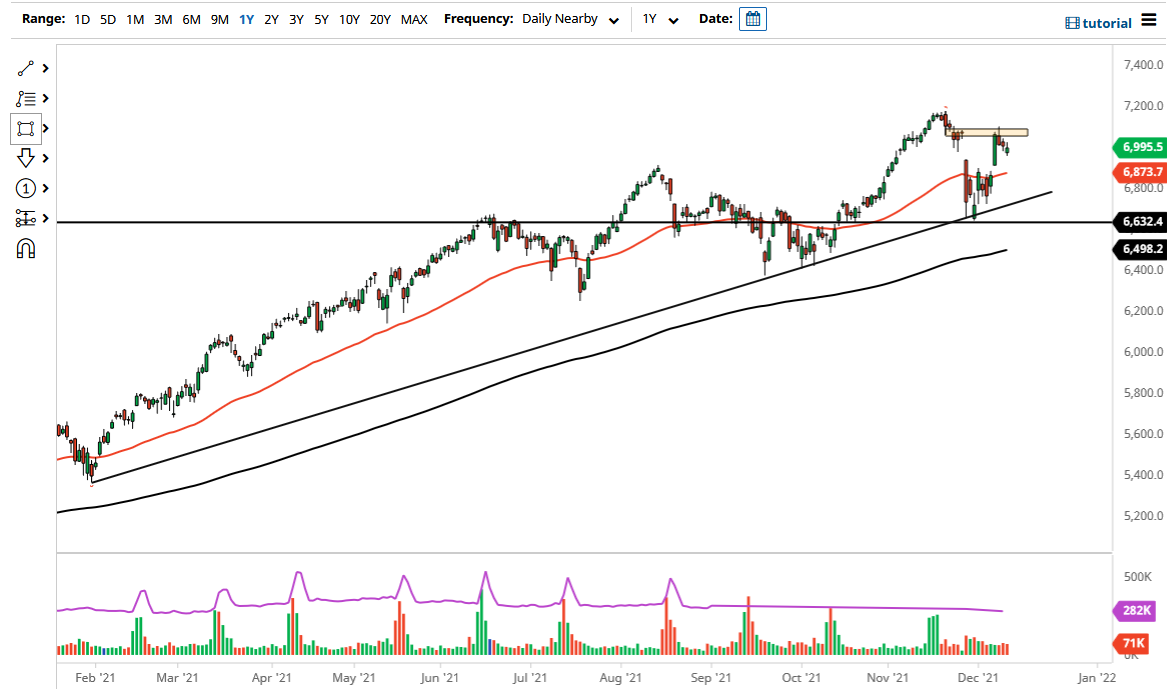

The CAC 40 Index drifted a little bit lower on Friday after filling the gap a couple of days ago. By doing so, it looks as if the market is starting to stabilize, perhaps getting rid of all of that fear that came out due to the omicron variant being announced. Nonetheless, we have the 50 day EMA sitting at the 6873 level and turning higher. Because of this, I think the 50 day EMA will continue to be important enough for the market to pay attention to as support. This is a market that I think will continue to attract buyers on dips, so value hunters will be a big part of what happens next.

To the upside, the €7000 level has offered a little bit of resistance during the day, but we have sliced through it enough times to think that it is probably minor at best now that we have seen this move. Looking at this chart, it is very likely that we will continue to see an upward move over the longer term, but it does not necessarily mean that is going to be easy. Remember that the CAC tends to move based upon luxury items, so we need to have to pay close attention to whether it is going to be “risk on” out there or “risk off.”

If we were to break down below the 50 day EMA, then it is likely that the uptrend line will come into the picture, and we are likely to see that area as a bit of a “floor in the market.” To the upside, the €7100 level is an area that has been resistance previously, so if we were to break above there then it allows this market to rocket to the upside. Whether or not traders are looking to chase gains into the end of the year is a completely different question, but I would not rule that out. The market will be a scenario where it is “long only”, but the question is whether or not that will happen between now and the end of the year. I suspect we probably will, but pay attention to other stock indices around the world to get a bit of a feel as to how things are going. One outlying question could be the fact that the EU does have a few countries that are looking likely to lock down.