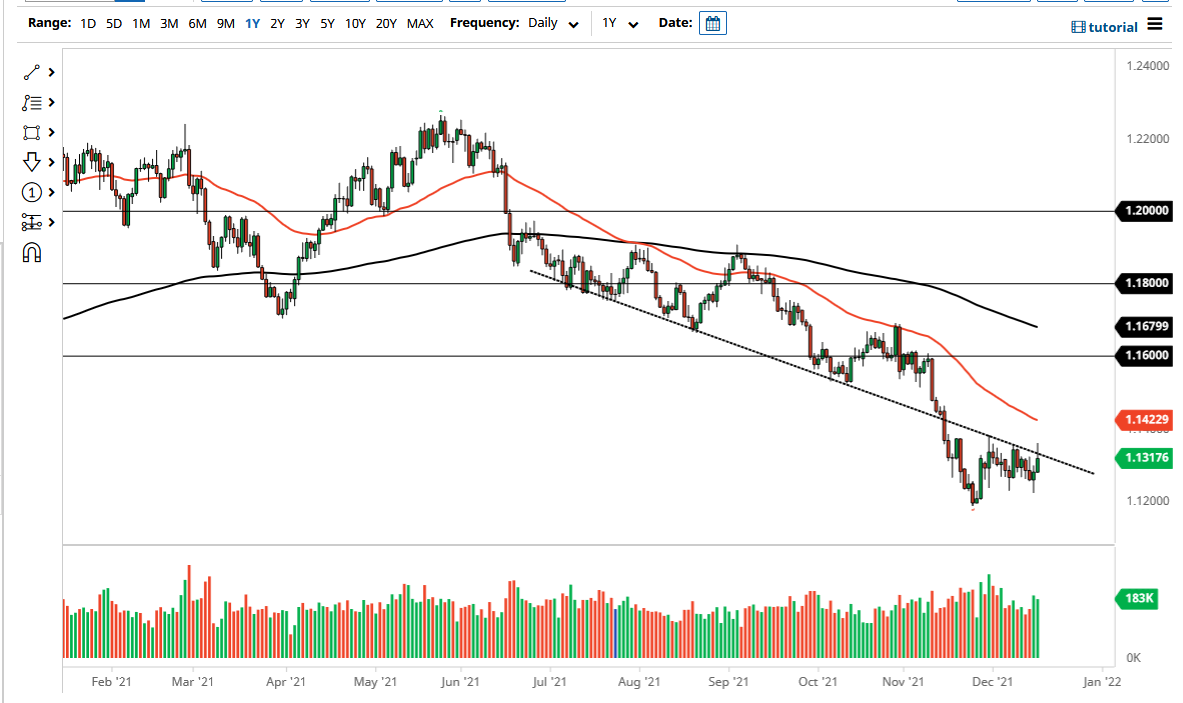

The Euro rallied a bit during the course of the trading session on Thursday as Christine Largarde suggested that the economy could come roaring back next year. However, it appears that the market has gauged Europe in a different light, as we have pulled back a bit during the session. Ultimately, this is a market that has seen consistent selling around the 1.1350 level, and with that being the case it is likely that we see sellers jump in every time we get close to that area.

To the downside, the 1.1230 level has been rather supportive, extending down to the 1.12 handle. A break down below that level would of course be a very negative turn of events and could send this market flushing much lower. At that point, I would anticipate that the Euro could go looking towards 1.10 level. That being said, I think that we have a lot of work to do in order to break down like that but it is worth noting that we gave back quite a bit of the gains. Whether or not we can break out is a completely different question, but right now it seems as if we are trying to figure out whether we get a bigger move, or if we simply grind sideways for the rest of the year. Quite frankly, it would not surprise me at all to see a bit of a sideways grind as we simply bounce around and look for some type of directionality. After all, the Federal Reserve is seen as tightening its monetary policy via bond purchases, but the European Central Bank does not seem to be as aggressive.

Nonetheless, this pair will probably put you to sleep over the next two weeks, that is essentially what EUR/USD does most of the year anyway. If we can break above the 1.1375 level, then it is likely that we could go looking towards 1.15 handle. On the other hand, a break down below that 1.12 level has the sellers excited again. In the meantime, I think it is more likely than not we will simply have to stick to the short-term charts, meaning that we need to stick to smaller positions as choppy behavior tends to be very destructive to trading accounts if some type of news breaks during the thin liquidity.