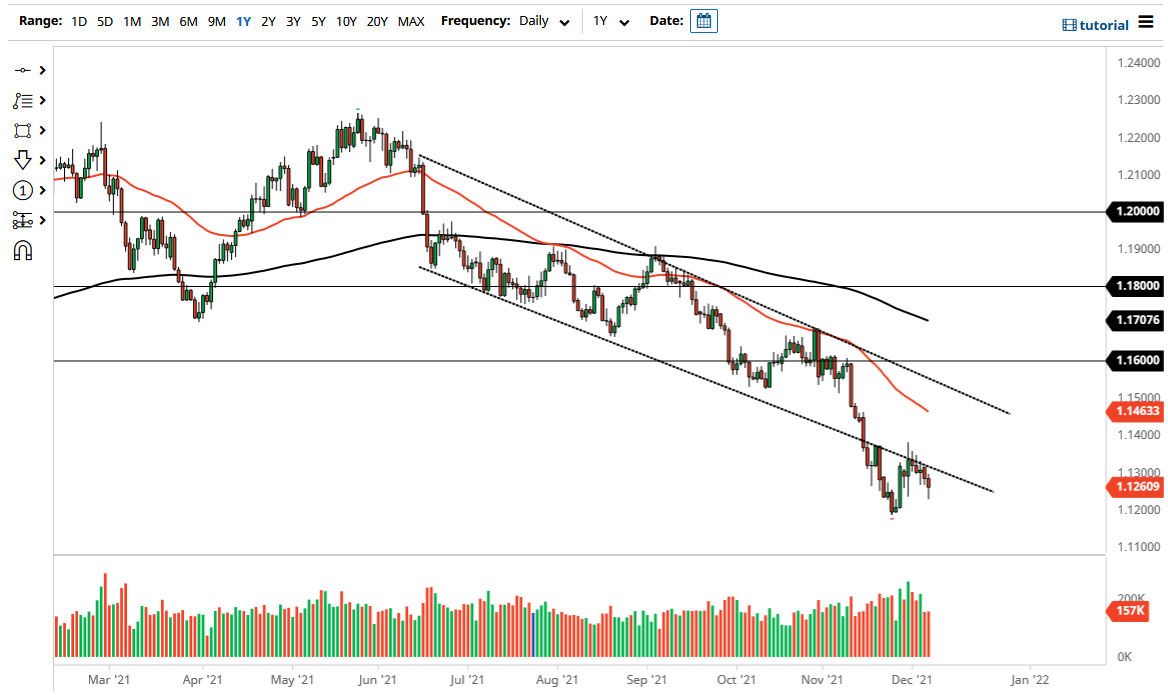

The euro fell during the better part of Tuesday but continues to see buyers trying to pick up bits and pieces of value. By doing so, the market ended up forming a bit of a hammer, suggesting that perhaps we are trying to reach towards the 1.13 level again. The level is an area that has attracted a little bit of attention over the last several weeks, but at the end of the day it is simply just another handle that traders will be looking at for the short term. Longer-term chartists are going to be looking at the 1.12 level underneath as a major support level, just as the 1.14 level above is a major resistance barrier. Currently, we are sitting smack dab in the middle of all of this, so I do not know that the euro has whole lot to say.

Yes, the hammer-like candlestick is worth paying attention to in the sense that it is supportive, but I do not necessarily think that it denotes anything more than the simple choppiness of the market. The 1.14 level is rather difficult to break above as you can see, so I think in the meantime it is likely that we will continue to see a lot of noisy behavior. The European Central Bank of course is likely to continue to be very loose with its monetary policy, especially as Austria and Germany both are talking about potential lockdowns. On the other side of the Atlantic Ocean, you have the Federal Reserve, which is looking to tighten monetary policy via bond purchase tapering, which makes them much more hawkish than the Europeans.

I am looking for short-term rallies that show signs of exhaustion that we can start selling, or perhaps a break down below the 1.12 level, which would open up a move down to the 1.10 level over the longer term. When I look at this chart, I think the only thing you can count on is a lot of noisy behavior, and you have to look at it through the prism of short-term range-bound trading with a negative outlook. Ultimately, this is a market that continues to be noisy, but overall it certainly looks as if we are going to continue the longer-term downtrend.