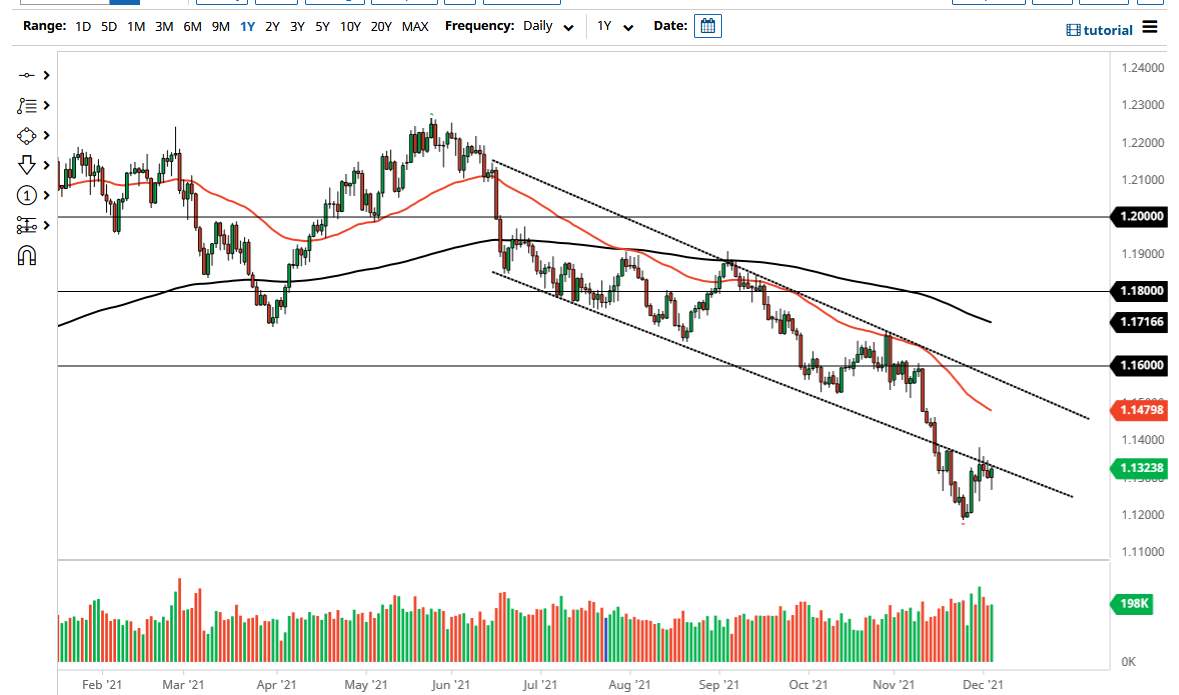

The euro initially fell on Friday, but the jobs number came out much lower than anticipated, sending the US dollar falling. At this point, the market is pressing the 1.1350 level yet again, which is an area where we have seen a bit of selling pressure and is also the bottom of the downtrend channel that I have marked on the chart. In other words, there is a certain amount of “market memory“ in this vicinity. The euro has been beaten down quite significantly, so it does make sense that we would see a bounce from a recovery standpoint.

The 1.14 level above is resistance, as is 50-day EMA. The 50-day EMA is starting to reach lower, as it is sloping quite significantly. The 50-day EMA is a large indicator that a lot of people pay close attention to, so that being said, it is likely that we would see some type of reaction. I do believe that we will rally from here, but I think that given enough time, it is likely that the market will find sellers yet again. The euro suffered at the hands of the European Union and its lockdowns, but if we do get some type of change when it comes to Germany or Austria, then it is possible that the euro could be the place to go.

It will be interesting to see what interest rates in the United States do, because that will have a lot to do with what happens with the greenback. The greenback has a massive implication on Forex markets in general, and the euro is considered to be the “anti-dollar.” At this point, the market looks as if it is ready to correct a bit, but that correction should give me an opportunity to short this market at the first signs of significant exhaustion. That is exactly what I am looking for, and I think that if you are patient enough you should see that happen. On the other hand, if we were to break down below the bottom of the hammer for the trading session on Friday, then I would be a seller there as well, opening up the market for a move down to the 1.12 handle.