The Federal Reserve's decision to end its purchase program and raise US interest rates next year was priced in by the markets, which prompted the EUR/USD to increase its losses to the 1.2221 support level before rebounding and settling around the 1.2290 level as of this writing. The analysis after the investors understood the content of the decisions and the statements of Fed Chairman Powell. Today, the currency pair is awaiting the most recent announcement of the European Central Bank's policies.

For months, Federal Reserve Chairman Jerome Powell has responded to rising inflation by advising patience and emphasizing that the Fed wants to see unemployment return to pre-pandemic levels before it raises interest rates.

But Powell hinted yesterday that high inflation has not only persisted, but accelerated to its highest level in nearly four decades. Average wages are rising. Employment is strong, unemployment is declining. Powell told a news conference that all of these trends led him and the rest of the Fed's policymakers to decide that it was time to accelerate the Fed's tightening of credit. The US central bank said it will reduce its monthly bond purchases - which are aimed at lowering long-term interest rates - twice as quickly as it previously set and is likely to end purchases in March. This accelerated timetable puts the Fed on a path to start raising interest rates as early as the first half of next year.

On the other hand, the European Central Bank is preparing to unveil a gradual withdrawal from the extraordinary pandemic stimulus in the face of rising inflation, whose path is becoming increasingly ambiguous due to the omicron coronavirus variable. At a pivotal meeting on Thursday, Bank Governor Christine Lagarde is expected to confirm that net purchases of bonds under the 1.85 trillion euro ($2.1 trillion) program known as PEPP will expire as scheduled in March.

The regular asset purchase plan could be recalibrated to calm the winds. But in the absence of consensus about the health and economic risks posed by the new strain of Covid-19, officials will be keen to maintain flexibility and may delay some decisions. Highlighting policymakers' predicament, the Federal Reserve on Wednesday accelerated its exit from crisis stimulus to stem rising US consumer prices, while analysts meanwhile expected the Bank of England to delay rate hikes due to inflation to assess the economic damage caused by the recent wave of the epidemic.

Unlike the Fed, the ECB has stuck to its guns because the higher price gains are temporary — driven by supply crises and rising energy costs that will fade in 2022. And while countries like Germany question this assessment, the potential for an increase in record low rates remains far away with the omicron looming on the horizon affecting the economic recovery of the continent.

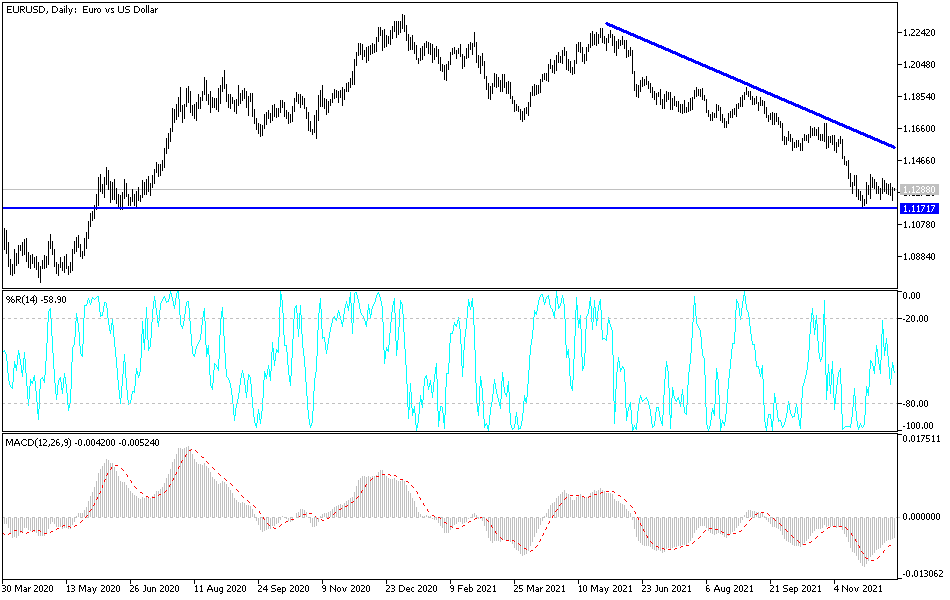

Technical Analysis

On the daily chart, the general trend of the EUR/USD currency pair is still bearish. Stability around the 1.1300 support level will bring the bears enough momentum to move further downwards to 1.1180 and 1.1070, which will push the technical indicators to strong oversold levels. On the upside, the closest targets for the bulls might be the 1.1390 and 1.1620, the latter being crucial for a breakdown of the current bearish channel.

The euro will be affected by the announcement of the PMI readings for the manufacturing and services sectors in the Eurozone, and then most importantly, the European Central Bank's announcement of updating its monetary policy decisions and the statements of Governor Lagarde. The US dollar will be affected by the announcement of the number of weekly jobless claims, the reading of the Philadelphia industrial index, housing data and industrial production.