The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

There are a few valid long-term trends in the market, so it can be a profitable time to trade right now.

Big Picture 19th December 2021

Last week’s Forex market saw a lot of important news releases and the early stages of a big wave of coronavirus starting to hit western countries, mainly in Europe. However, directional volatility was not especially high, but we did see quite active markets during the second half of the week following the FOMC release.

The US dollar rose a little in line with its long-term bullish trend, but the hawkish tilt from the FOMC on Wednesday did not move the price of the greenback by much. The US Dollar Index ended the week roughly where it started just before the release.

Risk sentiment worsened over the week, with most stock markets lower, including the benchmark US S&P 500 Index. Most global stock markets fell over the week, as did the Australian, New Zealand and Canadian dollars which are commodity currencies and key risk barometers. The worsening of risk sentiment globally is probably mostly because there is increasing fear over the impact of the omicron coronavirus variant which has begun to spread extremely rapidly in some European nations and is just getting started in the USA. Safe-haven currencies such as the Japanese yen, the Swiss franc, and the US dollar are all higher, but only marginally so in the case of the yen and the franc. It is worth noting that all these movements are relatively small and the swings in risk sentiment I am describing are nothing special and probably do not represent especially strong trading opportunities.

I wrote in my previous piece last week that the best trades for the week were likely to be long of the S&P 500 Index and short of silver in US dollar terms following a daily (New York) close below $21.45. Fortunately, silver in USD terms did not close below $21.45 at the end of any day during the week. Unfortunately, the S&P 500 Index fell by 1.9% over the course of the week.

Fundamental Analysis & Market Sentiment

The headline takeaways from last week were:

The US FOMC announced it would double the pace of winding up its tapering program, so that tapering would finish in March 2022, after which three rate hikes should be expected over the course of the rest of that calendar year to reach a total of about 1%. This hawkish tilt was expected by the market, but it still seems to be having a chilling effect upon risk sentiment. The Fed also warned of the potential impact of high inflation and the omicron coronavirus wave which has yet to really hit the US and may well cause some economic damage. US PPI data came in at an annualized rate of almost 10%, which is high.

The Bank of England made a surprise rate hike of 0.15% in its base rate to a rate of 0.25%, a day after UK inflation data came in at an annualized rate of 5.1%, higher than the 4.8% which had been expected.

Monthly policy releases from the European Central Bank, the Swiss National Bank, and the Bank of Japan contained no surprises and had little impact on the market.

The Turkish lira plunged to new record lows as the prospect of another Turkish rate cut emerged.

A coronavirus variant of concern, named the omicron variant, has continued to spread around the world. The variant is heavily mutated, and latest studies suggest that it has a strong capacity to evade current vaccines. However, latest studies suggest that a maximal course of vaccination will still offer strong protection against severe disease. Some European countries have announced new restrictions to try to prevent the spread of the disease, most notable in the Netherlands which just began a full month-long lockdown. The UK is currently announcing almost 100,000 new confirmed cases a day, an all-time high by far.

Australian unemployment data came in better than expected, showing a rate of 4.6% when 5.0% had been expected.

The coming week is likely to see a lower level of volatility due to the slow economic calendar and wind-down to the Christmas holiday period which begins at the weekend, with direction likely to be determined by the impact of the omicron variant which is currently spreading rapidly in the UK, the Netherlands, Denmark, and Norway. The coming week’s major scheduled economic releases will be:

The Reserve Bank of Australia will release the minutes of its recent Monetary Policy meeting.

There will be a release of Canadian GDP data.

Last week saw the global number of confirmed new coronavirus cases rise to its highest level since last August. Approximately 56.8% of the global population has now received at least one vaccination. Pharmaceutical industry analysts are beginning to doubt the earlier belief than the pandemic would effectively end in 2022, with some seeing it likely to continue until 2024 or 2025.

The omicron variant has been confirmed as present in more than eighty countries.

The strongest growths in new confirmed coronavirus cases overall right now are happening in Australia, Bolivia, Canada, Denmark, Finland, France, Iceland, Italy, South Korea, Malta, Nigeria, Norway, Portugal, San Marino, South Africa, Spain, Sweden, Switzerland, Vietnam, and the UK.

Technical Analysis

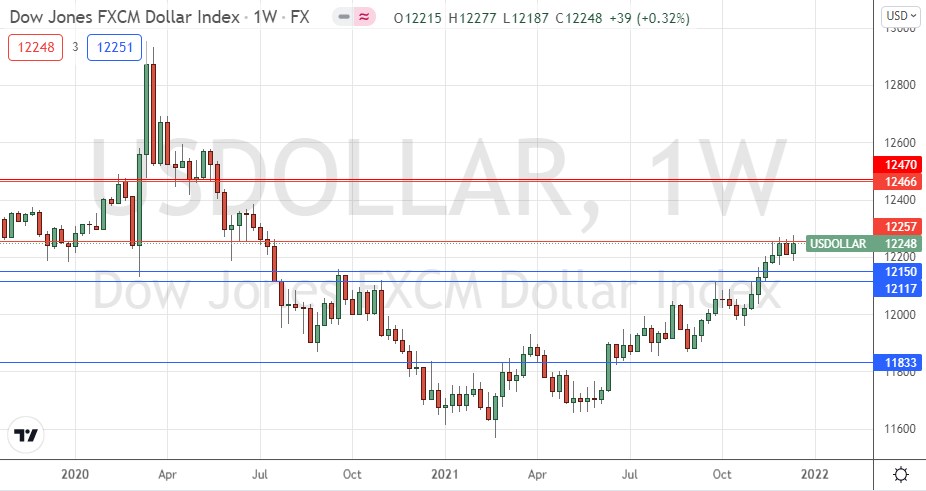

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a bullish candlestick last week, after retreating from the resistance level identified at 12257 over the previous week. Note how this key resistance level has held again – in fact it held just after the FOMC release when it was tested, which is possibly a bearish sign. While this continued failure at resistance is not enough to invalidate the long-term trend (the price is well above its levels from 3 and 6 months ago), it is notable that there is clearly strong resistance here, which is having impact. This suggests that despite the long-term bullish trend, we may be due for a bearish pullback or even a reversal. I would not look towards the USD as a key driver for any trades over the coming week.

EUR/USD

The EUR/USD currency pair made its lowest weekly close in 18 months, printing a healthy sized bearish candlestick which closed very near the low of its range. These are bearish signs that we are likely to see a further fall over the coming days and weeks. The coronavirus surge in the European Union and the UK is highly likely to continue and require more lockdowns like the one which has just been implemented in the Netherlands, which is likely to provide some tailwind for the decline in the euro. There may be deep bullish retracements as the US dollar is bullish but finding it hard to break beyond overhead resistance.

USD/TRY

The Turkish lira has been falling very strongly and losing an enormous amount of its value. The pace of the decline increased last week, as there are indications of a further rate cut, although Turkey’s business community is beginning to lobby strongly against such a measure. We again saw the lira reach a new record low against the US dollar and close at a record low too. There is a strong trend here against the lira, the problem for traders is that it is very difficult to exploit this as Forex brokers are asking for huge spreads and overnight fees on long positions. However, the odds remain strongly in favor of further declines in the Turkish lira.

USD/CAD

The USD/CAD currency pair printed a reasonably large and firmly bullish candlestick last week, which closed in the top quarter of its price range, making the highest weekly closing price seen in more than one year. Although these are bullish signs, it is important to note that the price has been failing to break above 1.3000 all year, so it is important for bulls not to get too excited just yet but to keep an eye on the situation instead. Bulls will probably be well advised to wait for a weekly or at least a daily close above 1.3000, while braver traders might wish to look for a short trade entry if there is a strong failure following an attempt at the 1.2960/1.3000 area.

Bottom Line

I see the best opportunity in the financial markets this week as likely to be short of the EUR/USD currency pair.