The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

There are a few long-term trends beginning to reassert themselves, so it can be a profitable time to trade the markets.

Big Picture 5th December 2021

Last week’s Forex market moved in line with the long-term bullish USD, but price movements were driven more by other currencies and falling stock markets for the second week running. The new omicron variant of the coronavirus, which is feared to be powerful enough to evade vaccines and potentially require economically painful measures, has sent risky assets lower and money flowing into safe havens. It is not known yet whether the effect of omicron will be bad or not, but until it is known, markets are likely to be dominated by fear.

In the Forex market, we see the greatest weakness in the Australian and New Zealand dollars, as commodity currencies are very vulnerable to a resurgent coronavirus, with the Australian dollar especially weak after falling by more than 6% over the past five weeks alone. Safe-haven currencies such as the Japanese yen, the Swiss franc, and the US dollar are all higher. Markets are clearly in risk-off mode.

I wrote in my previous piece last week that the best trades for the week were likely to be long of USD/ZAR and USD/MXN. Unfortunately, the USD/ZAR currency pair fell by 0.68%, and USD/MXN fell by 2.06%. This produced an average loss of 1.37%.

Fundamental Analysis & Market Sentiment

The headline takeaways from last week were:

A coronavirus variant of concern, named the omicron variant, has spread to more than forty countries. The variant is heavily mutated, and it is believed that it may have a strong capacity to evade current vaccines. Some countries have already closed their borders to non-nationals and enforcing isolation on all new arrivals. It remains unclear as to what extent this variant is more transmissible, more resistant to vaccines, or more deadly. There is some evidence of the first two but little yet of the latter, in fact there is some speculation that omicron causes milder disease. However, South Africa, where omicron is becoming dominant, has seen a dramatically exponential rise in cases and an increase in the number of young people hospitalized over recent days.

U.S. non-farm payrolls data came in much lower than had been expected, with only a net 210k new jobs being created compared to the expected 553k new jobs.

OPEC agreed to expand production of crude oil early in 2022 by an extra 400k barrels per day, despite already falling prices. This sent the price of crude oil even lower, although WTI Crude Oil did find some support near the key inflection point at $61.89.

The Chair of the Federal Reserve Jerome Powell heavily hinted that tapering would need to be expedited and also removed language about inflation being “transitory”, probably shoring up the US Dollar with this more hawkish tilt on monetary policy.

Australian GDP came in better than expected, but still showed a quarterly contraction of 1.9%, compared to an expected fall of 2.7%. This is recessionary if maintained. The poor Australian outlook is reflected in the plummeting Australian dollar.

The coming week is likely to see a similar amount of volatility, with direction likely to be determined mostly by how dangerous the omicron variant is believed to be as more tests are performed on it. The volatility will be more due to omicron than to anything scheduled for release, as it will be a relatively light week for data. The coming week’s major scheduled economic releases will be:

Reserve Bank of Australia monthly policy release.

Bank of Canada monthly policy release.

US CPI (inflation). This is likely to be by far the most important item as annualized US inflation is already running at its highest level in more than 30 years and has probably not peaked yet.

Last week saw the global number of confirmed new coronavirus cases rise for the seventh consecutive week after having fallen for two months before that. The situation was already not looking good in Europe before the omicron variant was discovered. Approximately 54.9% of the global population has now received at least one vaccination. Pharmaceutical industry analysts now expect a large majority of the world’s population will receive a vaccine by mid-2022.

The omicron variant has been confirmed as present in forty countries.

The strongest growths in new confirmed coronavirus cases overall right now are happening in Andorra, Belgium, Cyprus, Denmark, Finland, France, Germany, Italy, Jordan, Lebanon, Luxembourg, Mali, Malta, Monaco, Netherlands, Norway, Poland, Portugal, San Marino, South Africa, Slovakia, Switzerland, Spain, Slovenia, Trinidad, and the USA.

Technical Analysis

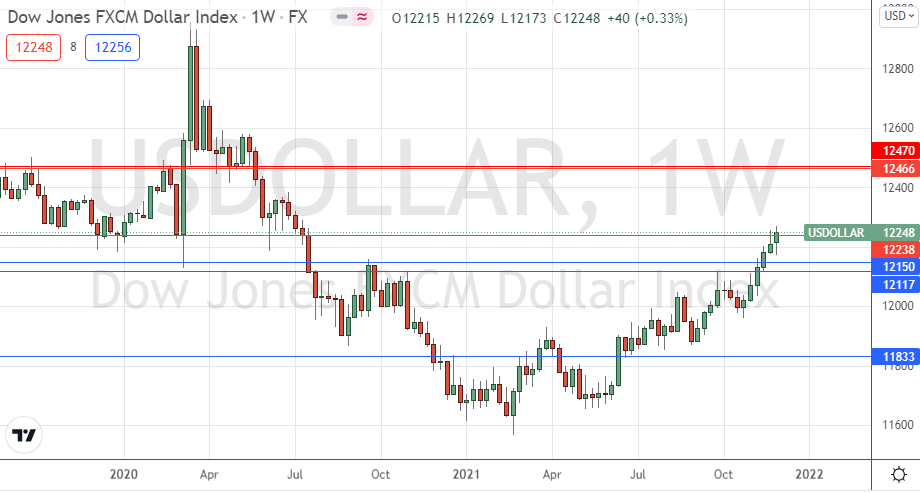

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a bullish candlestick last week, again making its highest weekly closing price in over one year. The price has broken above the level at 12238 which I had identified as key resistance, although the closing price was not high enough to be very confident this resistance has been invalidated. The price is above its levels from 3 and 6 months ago, which shows that a long-term bullish trend in the greenback is present. Generally, these are bullish signs, and are supported by the risk-off market environment being at least somewhat supportive of the greenback.

The best strategy in the Forex market over the coming week will probably be to look for trades long of either the USD or the CHF or JPY.

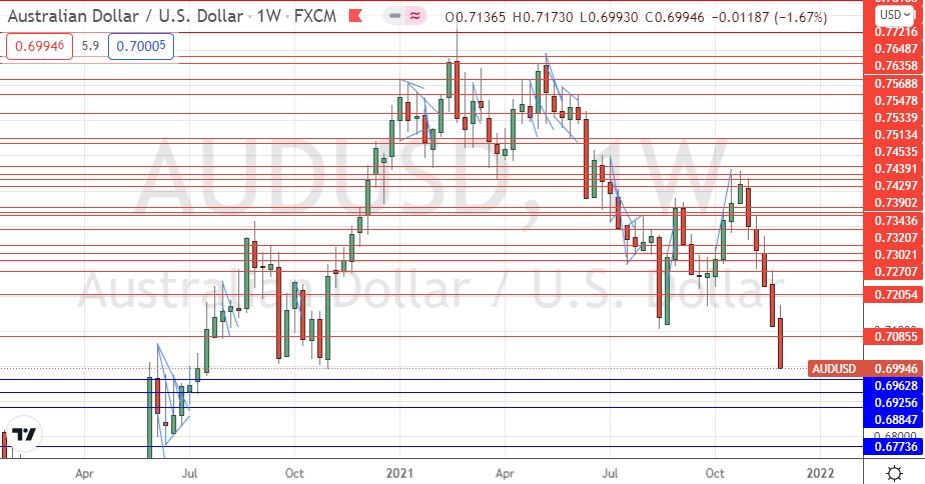

AUD/USD

The Australian dolar has been falling sharply, due to risk-off sentiment hitting hard as concerns rise about the economic impact of the new omicron coronavirus variant. The Australian economy is already contracting sharply, as was revealed by last week’s GDP data which showed a quarterly contraction of 1.9%. The USD is relatively strong, so this pair is a major focus of the Forex market and has seen lots of action. The price of this currency pair ended last week right near its low after falling by more than 1.66%, closing at an 18-month low price with strong bearish momentum. These are all bearish signs and there is a good chance that the price will see another strong fall last week, so there will probably be an opportunity for a short trade here.

NZD/USD

The New Zealand dollar has been falling sharply, due to risk-off sentiment hitting hard as concerns rise about the economic impact of the new omicron coronavirus variant. The USD is relatively strong, so this pair is a major focus of the Forex market and has seen lots of action, although the Australian dollar has been falling harder and getting more attention than the New Zealand dollar, with which it is highly correlated. The price of this currency pair ended last week right near its low after falling by more than 0.98%, closing at a 1-year low price with strong bearish momentum. These are all bearish signs and there is a good chance that the price will see another strong fall next week, so there will probably be an opportunity for a short trade here, although AUD/USD may be a better bet so be sure to be diversified between the two antipodean currencies if trading the NZD.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be short of AUD/USD and NZD/USD, following daily (New York closes) at new lows.