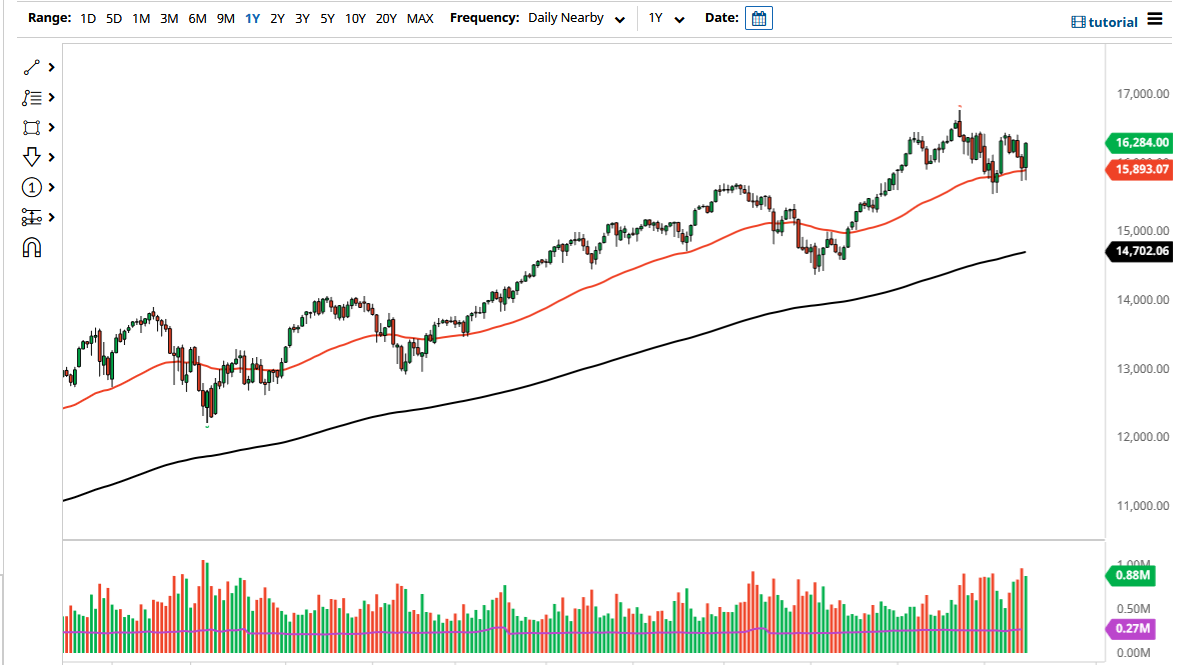

The NASDAQ 100 initially pulled back just a bit on Wednesday but then turned around to rally significantly after Jerome Powell was less hawkish than people had anticipated. After all, the market had been looking at the possibility of a significant acceleration and tightening, which is very bad for stocks in general.

Now that we have gotten out of the way, it is very likely that we will continue to see more of a “buy on the dips” type of attitude, and I certainly would not be looking at this market from the short side. I think any time you see bit oaf a pullback you should be thinking along the lines of whether or not it is offering value. We continue to see the 16,400 level as a significant barrier, and if we can break above there then it is only a matter of time before we take out the all-time high.

As we head towards the end of the year, there will be a lot of performance chasing, and fund managers out there will be looking for any reason whatsoever to buy the dip. I do not think that this is a market we will see a lot of selling pressure in, but if we do get a negative day, then it is very likely that I would be more than willing to jump in and buy the dip. On the breakout, I will simply buy-and-hold, as I think we will eventually go looking to take out the 17,000 level, perhaps sometime in the next 10 days.

Keep an eye on the same suspects as usual, as the handful of stocks that move the NASDAQ 100 continue to be the most important things to pay attention to, especially stocks like Tesla, Microsoft, and of course Google. I have no interest in shorting this market, but if we were to break down below the 15,500 level, then it is possible that I could be a buyer of puts. That is a very unlikely at this point, but it is the “alternate scenario” that we could be looking at. Over the longer term, I believe this is a market that is ready to rally for the next couple of months, but the last week of the year tends to be a bit wonky, so do not forget that.