The S&P 500 bounced a bit from the 50-day EMA during a very volatile session on Tuesday. Jerome Powell shook the markets up by suggesting that inflation was “no longer transitory.” In other words, Capt. Obvious has spoken. That being said, he is about 18 months behind the curve, which is typical for central banks. As he worries about inflation, it is very likely that we are starting to peak. Take a look around you; we are seeing the word inflation everywhere, and it has suddenly become a major talking point. That typically means that we are closer to the end than the beginning. Think of Bitcoin a few years ago. Think about the US dollar and when models were demanding to be paid in euros about 12 years ago. It is normally when you hear the most hysterical wailing that you are towards the end of something.

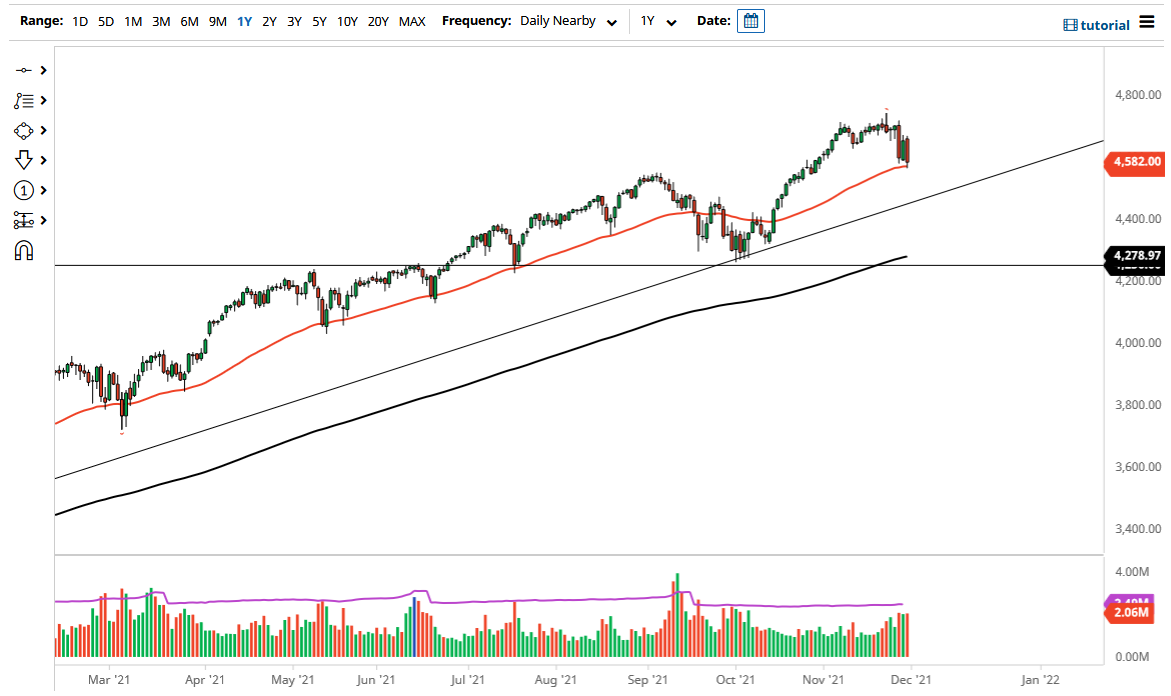

Looking at this chart, we have slammed into the 50-day EMA which quite often offers a bit of support, so it is worth paying attention to. I think given enough time, we will probably see this market try to find buyers, but it may be closer to the 4500 level. After that, we have the uptrend line that comes into the picture as well. The S&P 500 typically has the “Santa Claus rally” at the end of the year were money managers try to make up for a lack of returns. After all, they have people that they need to pay attention to in the form of clients, who will most certainly demand some type of return. This is a well-known phenomenon, and therefore that is why December is one of the most profitable months for the S&P 500 from a historical perspective.

I have no interest in shorting this market, and if it falls apart, I think that January will simply end up being at a great longer-term buying opportunity as traders will look to be putting on risk to kick off the new year as per usual. While I would not necessarily be a buyer right here, I am waiting to see if we can get some type of stability to get involved. Keep in mind that the jobs number comes out on Friday as well.