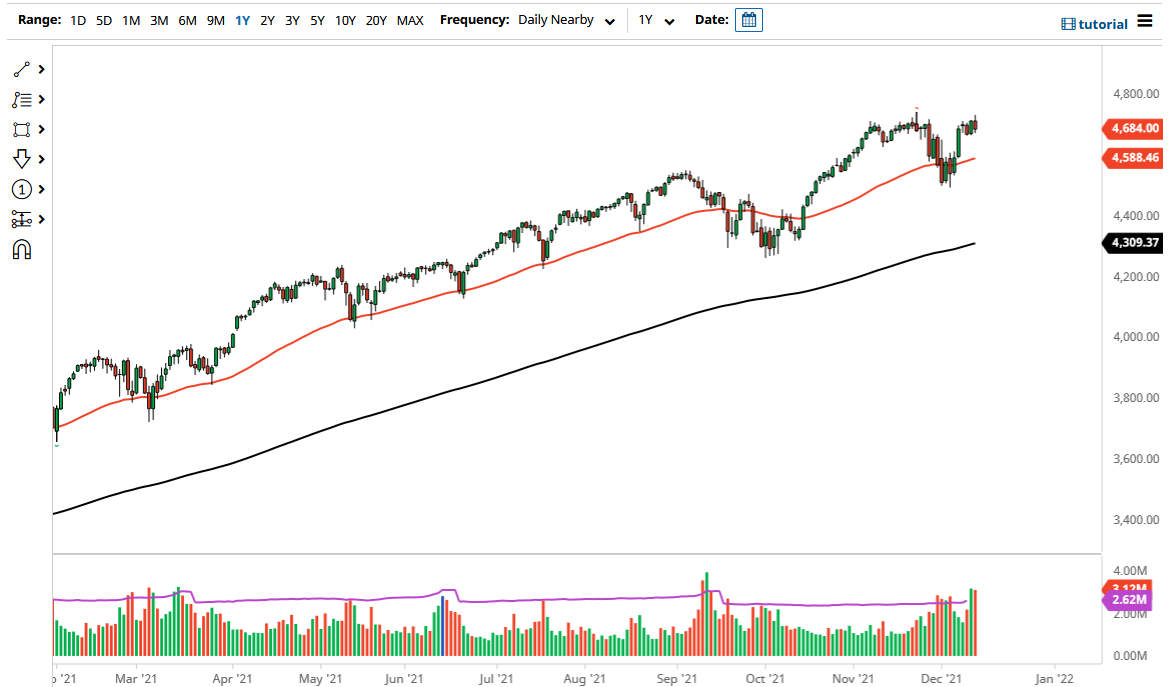

The S&P 500 gave up gains after initially trying to rally during the Asian session, showing signs of hesitancy at the all-time highs. That being said, the market is still very bullish, and it is very likely to continue seeing buyers on dips. Remember, we have the “Santa Claus rally” going on, and that is when people are trying to catch up to their benchmarks, as we are likely to see traders chase any type of returns they can get as missing the benchmark is a good way to get fired.

Looking at this chart, it does not take too much in the way of imagination to suggest that we are still very bullish, so I think that any time there is a pullback, there will be a certain amount of buying pressure underneath coming into the picture due to the fact that the 50 day EMA sits at the 4588 handle, and the 4500 level underneath offers plenty of support. Beyond that, and before we even have to worry about that situation, the 4666 level is present as far as support is concerned. This is an area where we have seen buyers come in over the last couple of days, and I think that is something that we need to pay close attention to. Breaking down below that then tells you there will be value to be had, and people will more than likely take advantage of it.

If we break to the upside, then it is likely that the market will go looking towards the all-time highs, and then the 4800 level after that. The 4800 level being broken to the upside opens up the possibility of a move towards the 5000 level after that. I have no interest in shorting this market, because we are in an uptrend, and it makes sense that we will continue to see the overall trend continue. If the Federal Reserve sees a significant selloff in this market, it is very likely that we will see the Federal Reserve do whatever it can to pick the market up, regardless of what they are suggesting as far as tapering is concerned. It is absolute nonsense the think that the Federal Reserve is going to change its tune, and I believe that Wall Street knows this.