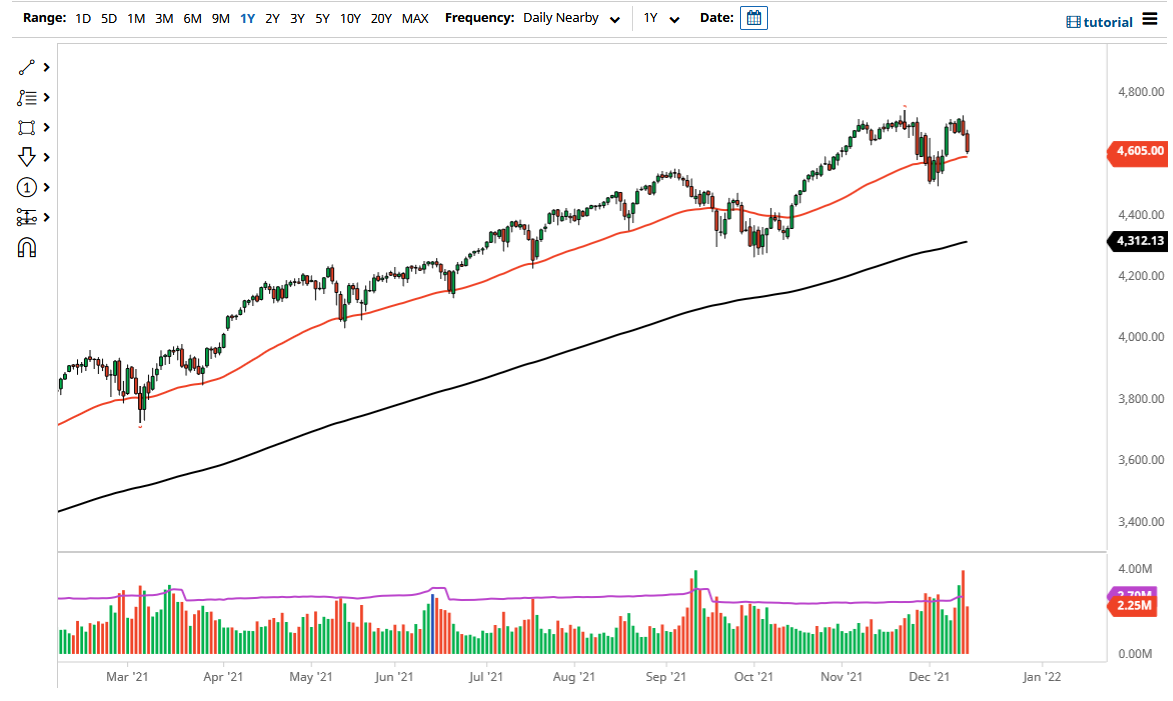

The S&P 500 fell rather hard on Tuesday as we try to discern what is going to happen next. The Federal Reserve has a two-day meeting that concludes on Wednesday, and traders around the world will be paying close attention to what they have to say. If they do in fact intend on speeding up the tapering process, the reality is that it will be like a wrecking ball for stocks. The acceleration of tapering is the same thing as tightening monetary policy, which typically works against the value of equities.

Further exacerbating the situation is that we are in a situation in which after that we essentially just have holiday trading. In other words, we could see a lot of volatile and choppy behavior over the next two weeks. Regardless, the market has been in an uptrend for a while, and I think that is the most important thing to pay attention to. The markets will sometimes be a bit erratic, but I still prefer buying overselling, just simply because that is what Wall Street does over the longer term.

I suspect that there is a significant barrier near the 4500 level, offering a bit of a short-term “floor in the market.” The market has been in an uptrend forever, and as we start to head towards the end of the year a lot of people will be out there looking to take profit. Because of this, it is going to be very difficult to trade over the next two weeks, especially right after that announcement. Nonetheless, the default attitude of the market is to rise, so you still have to look at it through the prism of something that typically goes higher.

The only thing that you can do to protect yourself at this point is to keep your position size relatively small. While many retail traders do not like hearing that, it is probably the best advice you can get, because it will keep you out of serious trouble. Nonetheless, this is a market that will be in a holding pattern until the end of the day on Wednesday, so keep that in mind. I would not read too much into any move between now and then as it will simply be position squaring.