The West Texas Intermediate Crude Oil market initially tried to recover after a gap lower on Tuesday. However, the IEA has announced that the crude oil market has gone from a shortage to being oversupplied. That is a complete reversal from where we were, and this does suggest that perhaps we are going to see more negativity over the longer term.

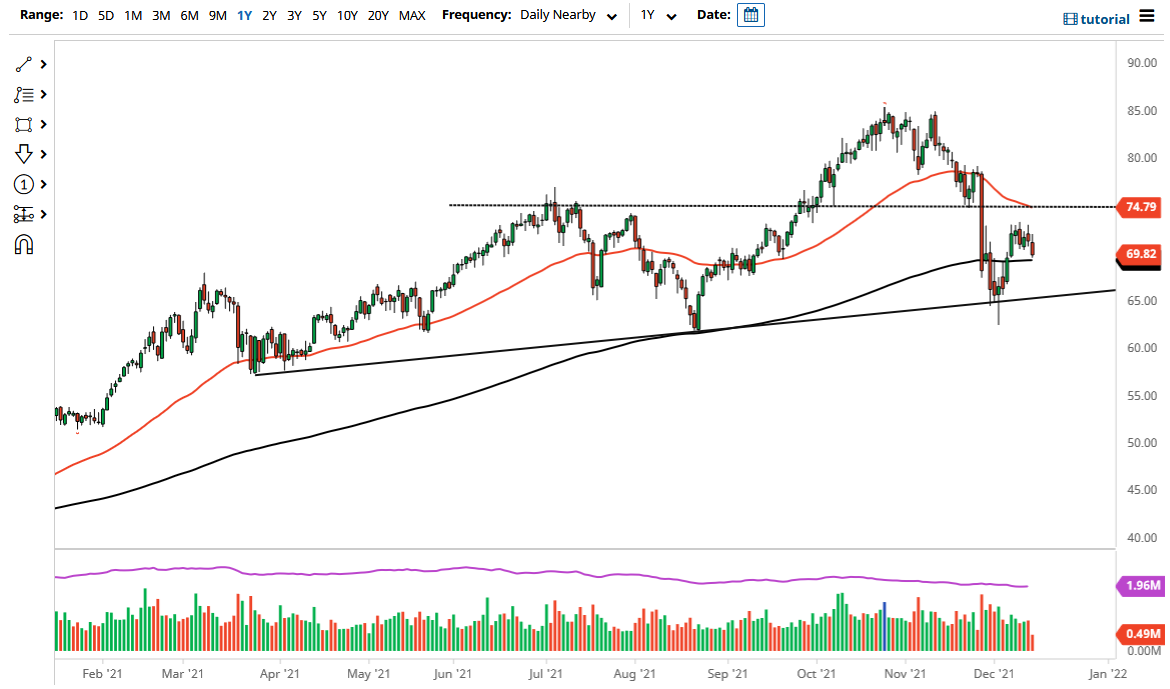

It is worth noting that we are sitting just above the 200 day EMA, which is followed by a lot of technical traders around the world. We are below the $70 level though, so that bit of psychology has been worked through. If we break down below the 200 day EMA, then it is likely that we could go looking towards the $65 level. The $65 level underneath is coinciding with the massive uptrend line, which suggests that we are ready to test that area and see a big battle on our hands. If we were to break down below the $65 level, then we could see a real capitulation by oil traders.

To the upside, we would have to break out above the $73 level for me to even remotely consider buying this contract at this point. Keep in mind that above there we have to worry about the 50 day EMA and the $75 level, both areas which would attract a lot of technical attention. There are a lot of concerns out there about various parts of the world shutting down to the latest headlines of whatever version of the virus we are on right now, and that has everybody freaking out. The reality is that if oil producers have caught up, then the entire situation has changed in general.

Pay close attention to the US dollar, because if it does start to strengthen again, it will work against the value of this contract. Remember, crude oil is priced in US dollars so that has a certain amount of inverse effect on this market, but it does not have to. A lot of it comes down to why oil is rising or falling. We have fully priced in the reflation trade at this point, and I think at this point we are starting to see traders unwind what has been a really good trade for months.