Today’s AUD/USD Signals

Risk 0.75%

Trades must be entered before 5pm Tokyo time Tuesday.

Short Trade Idea

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7223 or 0.7302.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7189, 0.7169, or 0.7123.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

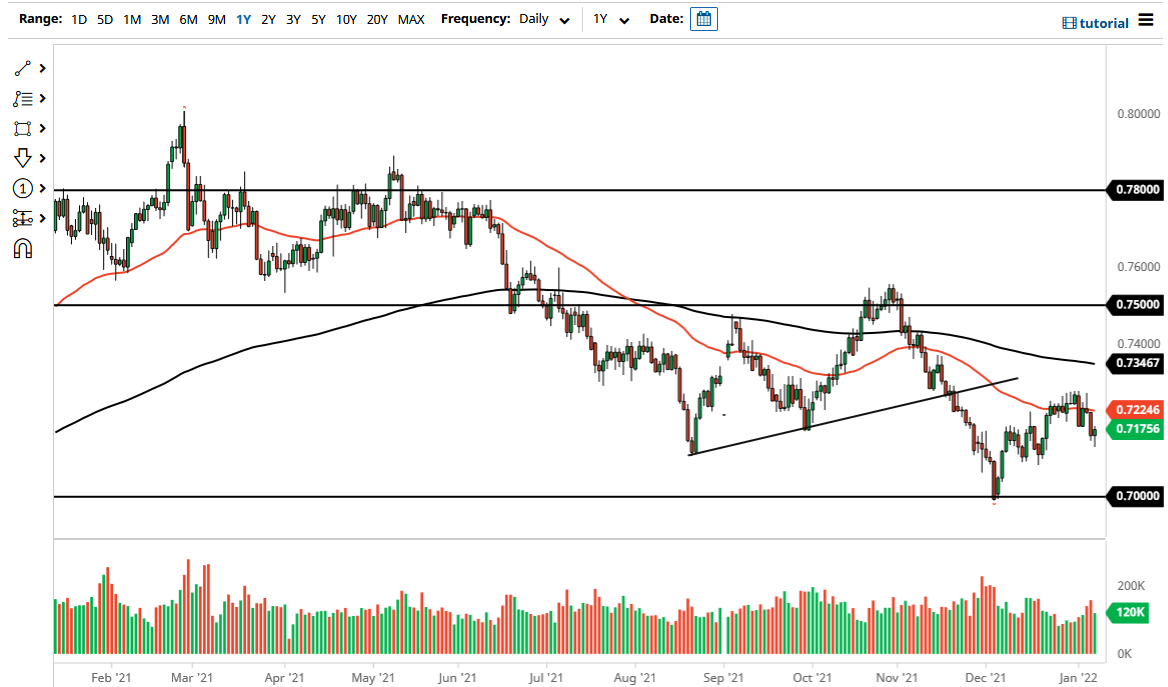

AUD/USD Analysis

I wrote in my last analysis on the 28th of December 2021 that the technical picture was bullish, but unfortunately, there were no obvious support levels above 0.7123 so I thought that it may be best to stand aside from trading this currency pair for the day. This was an OK call as the price did little that day.

We have seen some strength in both these currencies recently and since this week’s Forex market opened, but it is nothing special. Technically, the picture is weakly bullish as we have seen the price rise over recent hours and print new higher support levels at 0.7189 and 0.7169. The support level at 0.7169 looks stronger – I have little faith in 0.7189. The support level below that at 0.7123 looks the most attractive of all of them but we are unlikely to reach it today.

It might be possible to find a good long trade from a bullish bounce which might happen later at 0.7169. The problem with being bullish is that I feel risk sentiment is a little shaky and may only get worse as analysts focus on the Federal Reserve’s hawkish tilt from last week, and the possibility that the omicron coronavirus variant may be somewhat more troublesome economically than had been expected, especially in the United States which has a relatively low vaccination rate for a G7 nation. I’m not saying we are likely to see any dramatic price movements, I just think today may not be exactly the right time to be buying stocks or the Australian Dollar. For this reason, if there is somehow a fast spike up to the next resistance level at 0.7223, I will be very comfortable taking a short trade from a bearish reversal there.

There is nothing of high importance scheduled today concerning either the AUD or the USD.