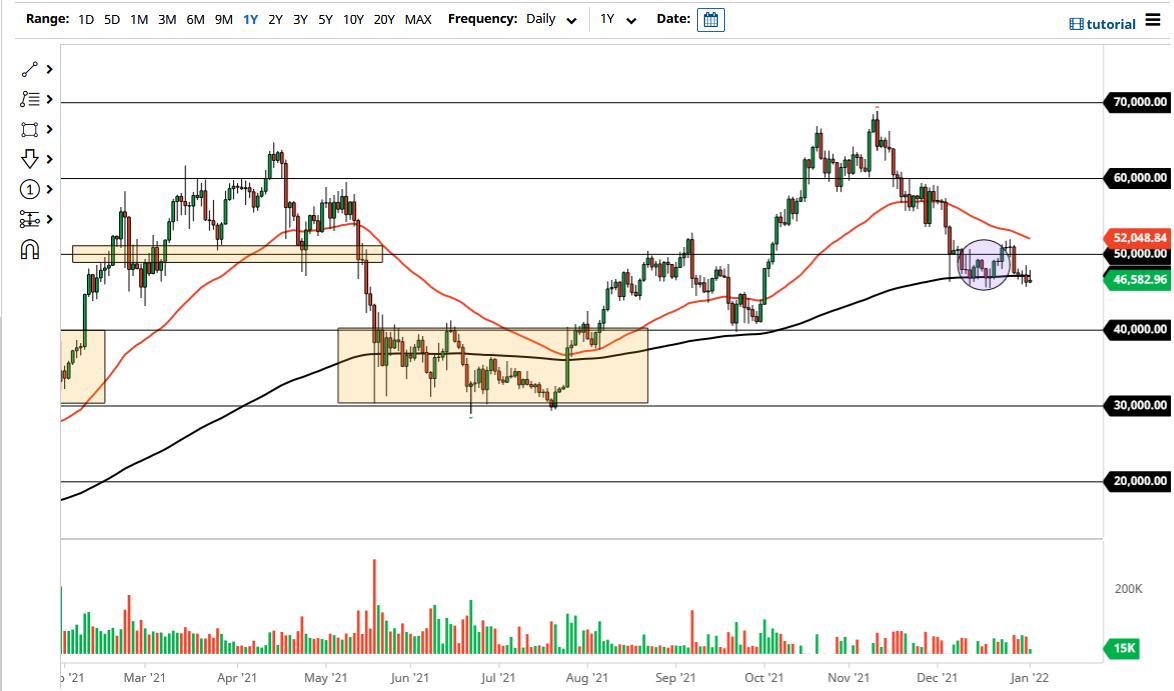

Bitcoin initially tried to rally on Monday, but as you can see, we continue to see resistance just above. We are currently hanging around the 200 day EMA, which in itself is worth noting. At this point, every time we try to rally there seems to be selling pressure, but I think it is probably only a matter of time before we make a bigger move.

If we can take out the highs of the last couple of candlesticks, then I think we will go looking towards the $50,000 level, which has a lot of psychology built into it. Furthermore, the 50 day EMA is sitting at $52,000, so that would be your next target. However, it is worth noting that it is sloping lower, so we may meet that indicator closer to the $50,000 level by the time Bitcoin gets there. This is the best scenario at the moment, as Bitcoin does not look very ready to go to the upside.

At this point, we have to decide whether or not Bitcoin is simply consolidating, or is it ready to fall apart yet again. As the biggest problem with trading Bitcoin, you have to be willing to accept 30% losses at times, while the market simply just shakes everyone down. If we do break down from here, then I believe that the next major support level is probably closer to the $40,000 level, an area that not only has a lot of psychology built into it, but also has been rather supportive a couple of times already, as well as resistance on the way up. No matter what is going on at the moment, Bitcoin looks rough.

The market stabilizing in this general vicinity is what you wish to see, and so far, it has held up its end of the bargain, albeit just barely. At this point, it will be interesting to see how this plays out, but it certainly looks as if Bitcoin does not have a lot of demand at the moment, meaning that perhaps we may have further to go to the downside. If we were to turn around and take out the 50 day EMA, that could lead to a fresh bullish market, but right now it looks like the positive scenario is to simply grind sideways.