The NASDAQ 100 futures market fell slightly on Monday, as most Americans were paying closer attention to the Martin Luther King, Jr. holiday than anything else, and of course the index was not moving. The futures market did have limited trading, but this is more likely than not going to be the gamblers or perhaps the longer-term traders making adjustments.

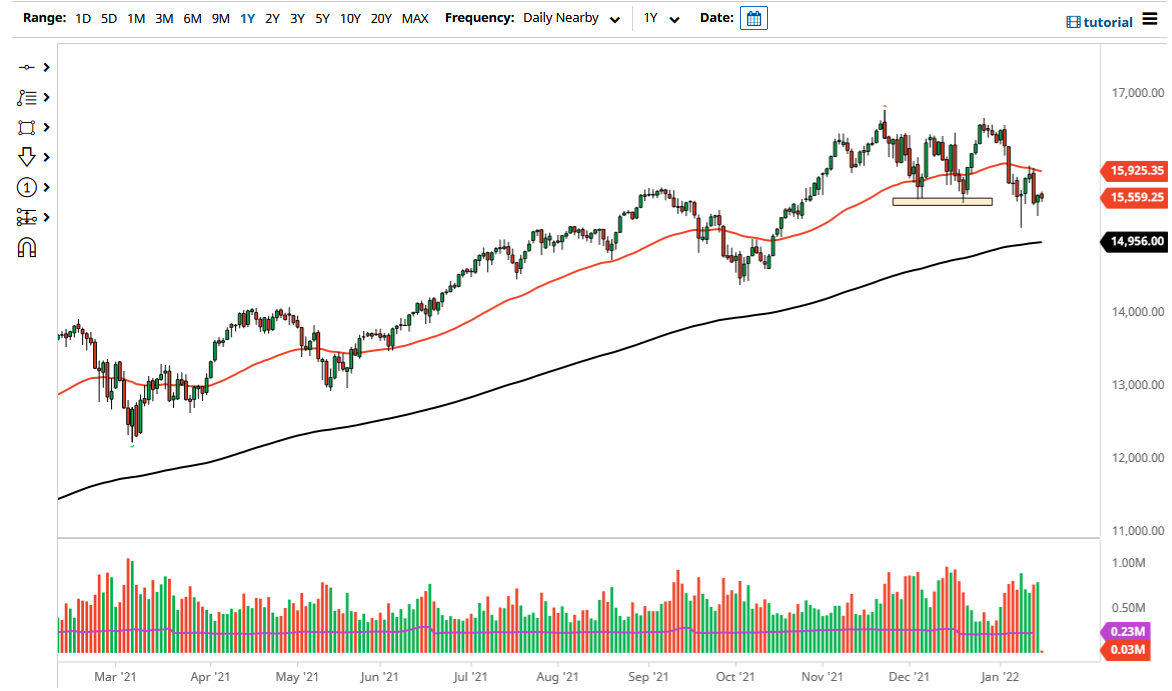

At this point, the market looks very likely to continue to see noisy trading behavior, but what I am paying more attention to is the Friday candlestick rather than the Monday candlestick, as it was a hammer right at a crucial level in the form of 15,500. As long as we can hold that area, the NASDAQ 100 has a real chance of trying to rally and go looking towards the 50 day EMA which currently sits at the 15,925 region. Keep in mind that this market is essentially driven by about seven stocks, so you need to keep an idea in the back of your head as to what Tesla, Microsoft, and Google are doing. There are about 90 stocks in this index that have nothing to do with anything.

The hammer being broken to the downside from the Friday session would of course be a negative sign, but I do not think that we have to worry about that in the short term. At that point, I anticipate that the market would probably go looking towards the 15,135 level, which was the bottom of the previous hammer. Keep in mind the 200 day EMA is sitting just below, so I think it is probably only a matter of time before value hunters would come back into the market regardless. Yes, the Federal Reserve is looking to tighten monetary policy, but everybody already knows this, so it is a bit difficult to imagine that the market is suddenly going to be shocked. Quite frankly, anything that is a “known known” almost never moves the market.

To the upside, if we can break above the 16,000 level, the market is more likely than not going to go back towards the 16,500 level, and perhaps even try to break out. We would have to wait and see whether or not that can happen, but regardless I will not be shorting this index. If we break the 200 day EMA, I might start buying puts for a short-term trade.