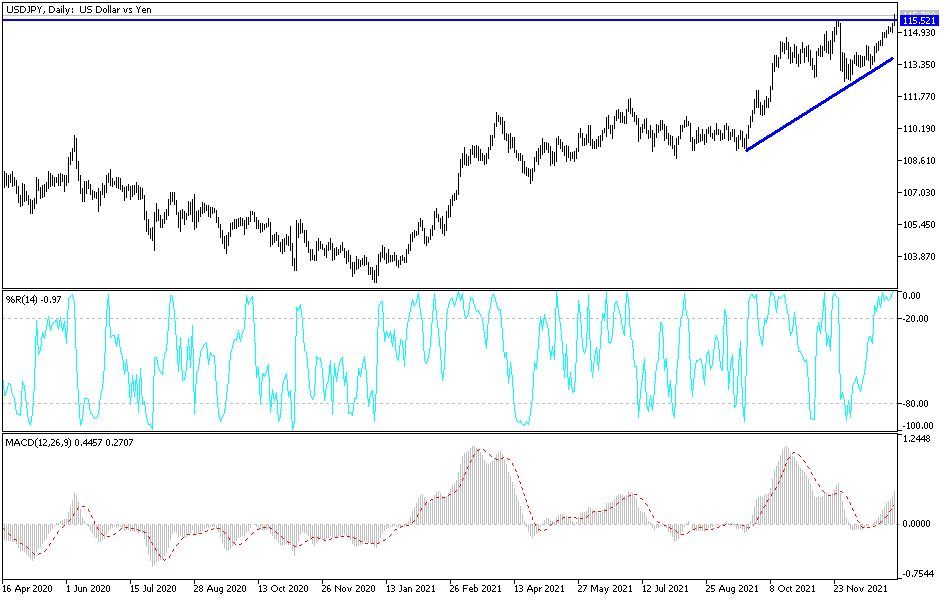

The jump in US Treasury yields helped the US dollar make its biggest daily gain in nearly two months into the start of the new year 2022 trading. This is indicating that the currency may extend last year's rally as markets expect the Federal Reserve to start a cycle of increases in interest rates this year. Accordingly, the price of the USD/JPY currency pair completed its ascending path, stable around the resistance level 115.80 at the time of writing the highest analysis for the currency pair in five years.

Markets still expect the US Federal Reserve to raise its benchmark interest rate three times over the course of the year, with the first move expected in May. The prospect of higher returns from betting on a dollar has made it one of the most popular currency trades for 2022, with net buying positions for leveraged funds at their highest levels since June 2019. While some traders see limited gains for the dollar in the new year, a technical indicator indicates It measures the dollar's relative strength, indicating that the currency may have more room to operate even after posting its biggest annual gain in six years. The indicator is trending higher but still near the middle of its range, well away from levels that could be taken as a sign that the currency has gained a lot.

However, liquidity in the market is weak and the dollar has not breached the 2021 high, which is a closely watched technical limit that indicates that the advance may continue. A breach of that high, or about 1% from Monday's level, could signal a more sustainable breakout. Commenting on the performance, Erik Nelson, a currency analyst at Wells Fargo in New York, said he sees the Bloomberg dollar index breaking above 1,200 in the next month or two, about 2% more than its current level.

"The Fed and other central banks remain the biggest mover of foreign exchange right now, in our view," he added. “The minutes from this week’s FOMC meeting will be useful in gauging the likely timing of both the first rate hike, and potential balance sheet normalization.”

Yesterday. US stocks rose on Wall Street, marking a strong start to the new year after closing 2021 with significant gains for the third consecutive year. Tesla shares jumped 12.1% with the biggest gain in the S&P 500 after reporting strong 2021 delivery numbers.

Overall, the main challenges to the economy and corporate earnings that investors faced in 2021 may remain potential headwinds in the new year, including the viral pandemic. Wall Street has been busy since December monitoring the latest wave of cases with the omicron variant. Businesses and consumers also continue to contend with supply chain problems and ever-increasing inflation that has made a wide range of goods more expensive. The rising costs could threaten to dampen consumer spending and dampen economic growth.

The long list of concerns regarding a volatile end to 2021 do not prevent the US market from posting another year of strong gains. The S&P 500 ended the year with a gain of 26.9% in 2021, or a total return of 28.7%, including dividends. This is roughly equivalent to what the benchmark gained in 2019.

USD/JPY technical analysis: The USD/JPY's breach of the psychological resistance level of 115.00 still supports a stronger control for the bulls over the general bullish trend currently. It should be noted that technical indicators give signals of reaching overbought areas, and with the momentum stopping, profit taking may occur at any time. The resistance levels 115.85, 116.30 and 117.00 may be the next targets for the rise, and at the same time to think about selling positions, waiting for the moment to sell to take profits. On the other hand, there will not be a breach of the current trend without moving towards the support level 113.80. The US dollar may continue to maintain its gains until the contents of the minutes of the last meeting of the Federal Reserve are announced tomorrow and the US jobs numbers on Friday.