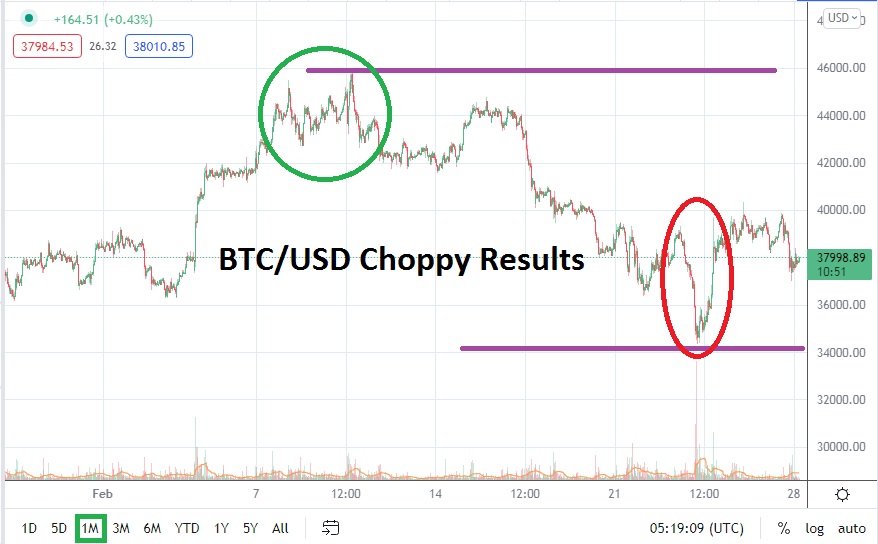

As the month of February draws to a conclusion BTC/USD is trading near the 37,850.00 level and traders may be rather suspicious of Bitcoin technically. The world’s largest digital asset was able to attain a high of nearly 45,900.00 on the 10th of February, but has been pushed lower while displaying choppy conditions. However on the 19th of February BTC/USD did break below the 40,000.00 juncture and since then has shown a sincere inability to break above this mark for a solid amount of time.

The past couple of days have seen a test of the 40,000.00 ratio fail and support has been durable near the 37,300.00 price. Essentially Bitcoin is trading within the same vicinity it finished the month of January within and speculators have dealt with a rather consolidated framework of BTC/USD to wager. However the low that BTC/USD did hit on the 24th of February should be noted. Bitcoin touched the 34,445.00 ratio at its lowest depth for the month, and the last time the price of BTC/USD had traded near this vicinity was on the 24th of January, yes exactly one month between the two dates.

The timing of the lows may be of interest, but it likely has no real correlation, what should be of interest is that the lows of February did not exceed the lows of January. In other words it is possible that Bitcoin may have begun to show signs that its bearish trend, which it has been suffering from since the 10th of November that produced a high of nearly 69,000.00 may be drawing to a conclusion. However, this is all based on a bullish technical perception, because in reality BTC/USD remains dangerous close to long term lows.

Traders who are optimistic that BTC/USD is ready to turn the tide and start producing upwards momentum may want to remain cautious. Day trading BTC/USD is much different than taking a mid or a long term approach to the digital asset. The broad cryptocurrency market has continued to demonstrate nervous results and speculators who attempt to bottom fish for lows while looking for reversals higher should practice strict risk taking techniques.

BTC/USD Outlook for March:

Speculative price range for BTC/USD is 30,010.00 to 47,850.00.

If BTC/USD continues to run into headwinds and is not able to break above the 38,000.00 ratio which is relatively nearby as of this writing, this could spark additional negative sentiment. In the short term if BTC/USD were to break below the 37,600.00 mark again and challenge the 37,500.00 levels, traders may believe the 36,900.00 price will again come into focus.

Downward pressure if it shows teeth could propel BTC/USD towards the 36,700.00 level. If this juncture were to prove vulnerable it could set off a test within Bitcoin as speculators may start to believe February lows of 34,445.00 could be challenged. If BTC/USD kept a negative trend sustained and breaks below this lower value, then Bitcoin certainly could see a test of marks produced in January when the 33,000.00 level was disturbed.

However, it BTC/USD is able to find a spark upwards and show that its current price levels near the 38,000.00 can actually be flirted with and surpassed this may produce optimism and the belief a solid floor is being constructed. After experiencing a long bearish trend, BTC/USD does need to produce a solid amount of higher price action and traders will likely want to see value sustained above the 40,000.00 juncture for a durable timetable. If BTC/USD can push past the 41,000.00 ratio and produce solid support, bullish traders may start to make their intentions apparent and become buyers. However, BTC/USD may still need to drive past its February highs of 45,900.00 in order to convince some speculators its bearish trend is dead.