The bears are still eager to advance, and the currency pair is back to the bottom, as investors' aversion to risk is still stronger in light of the continuation of the Russian war. All indications point to the expansion of the scope and that calm is not on the cards until Putin reaches his goals in this conflict. The dollar-yen currency pair is stable around the 115.50 level at the time of writing the analysis.

According to the US Bureau of Labor Statistics (BLS), personal income was unchanged at 0% in January, while personal spending advanced 2.1% last month. The market expected a decline in income of 0.3% and a rise in spending of 1.5%. Durable goods orders also expanded by 1.6% in January, doubling market expectations of 0.8%.

The personal consumption expenditures (PCE) price index rose 6.1% year over year in January, rising to its highest level in nearly 39 years. The core PCE price index, which wipes out the volatile food and energy sectors, rose 5.2%.

US consumer confidence declined in February. The University of Michigan Consumer Sentiment Index fell to 62.8 this month, down from 67.2 in January. Consumer expectations and current economic conditions readings dropped to 59.4 and 68.2, respectively. Inflation forecasts for one and five years were 4.9% and 3%, respectively.

According to the experts, “The February drop was caused by inflationary declines in personal finances, near-global awareness of rising interest rates, declining confidence in government economic policies, and the most negative long-term prospects for the economy in the past decade…” Almost all interviews were conducted prior to the Russian invasion. So, consumers have not yet felt its impact. The most likely link to the domestic economy is through higher energy prices, as the size and length of potential increases are subject to a great deal of uncertainty.”

The US Treasury market was mostly in the green on Friday, with the benchmark 10-year bond yield flat at 1.972%. One-year bond yields rose 0.051% to 1.127%, while 30-year yields fell 0.024% to 2.269%. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, fell to 96.71, from an opening at 97.14. The index is preparing to achieve a weekly gain of 0.7%, which raises its rise since the beginning of 2022 to date to 0.8%.

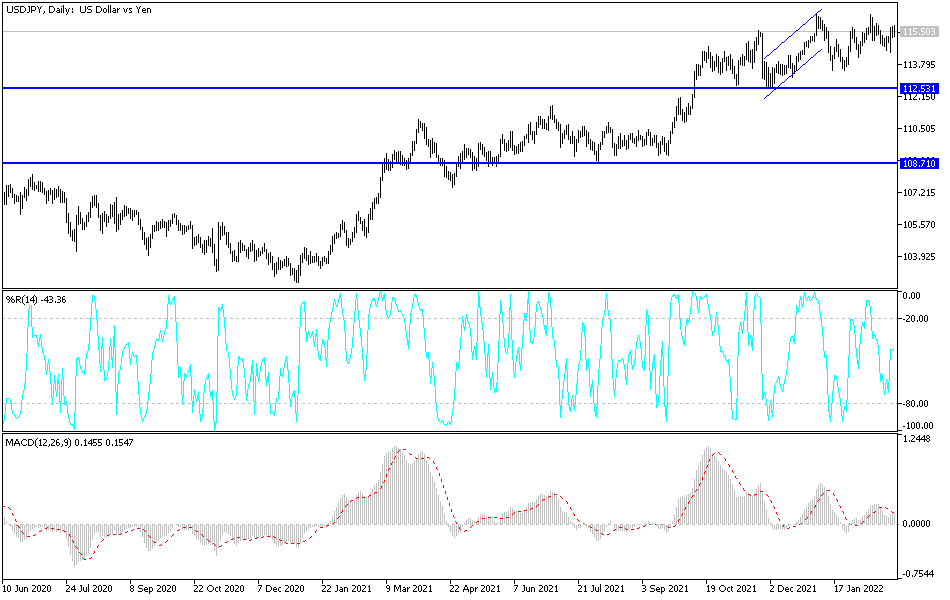

According to the technical analysis of the pair: I still prefer to sell the USD/JPY currency pair from every bullish level, as the case of risk aversion is stronger, especially with the continuation of that European war. Accordingly, I expect selling from the resistance levels 115.75 and 116.30 again. On the downside, the bears moved below the support level of 114.65 as the performance on the daily chart will be important for the stronger downside trend. In light of the absence of the economic calendar from important US data, investors' appetite for risk or not will have the strongest impact on the dollar-yen pair during today's trading.