Today's USD/TRY Signal

Risk 0.50%.

None of the buy and sell transactions of yesterday were activated

Best Buy Entry Points

- Entering a long position with a pending order from 13.29 levels.

- Place your stop-loss point below the 13.10 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 13.79.

Best Selling Entry Points

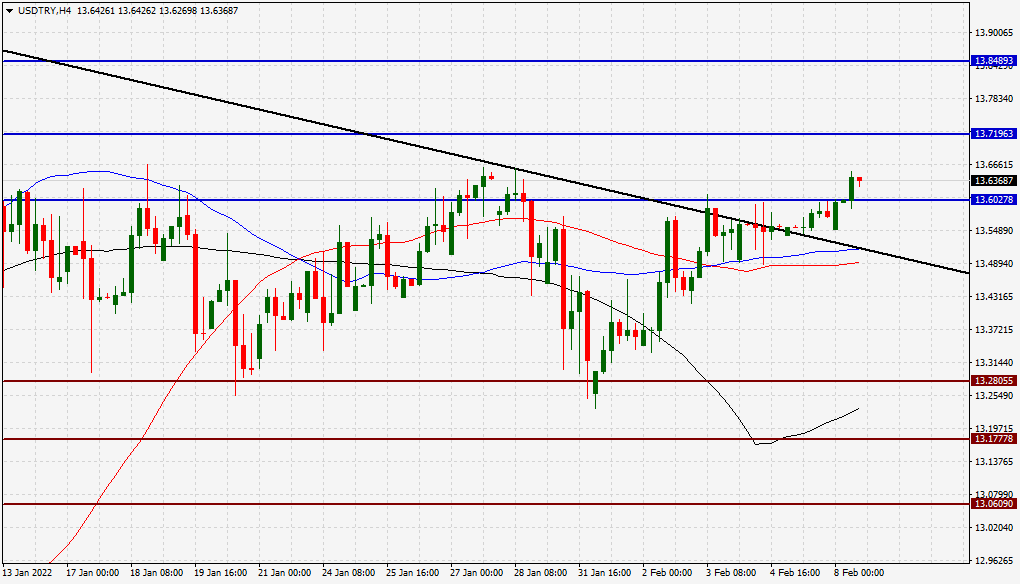

- Entering a short position with a pending order from 13.71 levels.

- The best points to place the stop loss are above 13.89 levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 13.30

The Turkish lira fell slightly on Tuesday, as investors followed a Reuters poll that showed expectations of a rise in the country's current account deficit by about 14.95 billion dollars during the month of December. The Turkish government expected to record a trade deficit of $21 billion in 2021, compared to a deficit of $36.72 billion in 2020. Meanwhile, reports said that the Turkish government is preparing to issue sukuk this month for the first time since the lira’s strong declines since October of last year.

The price of the Turkish lira fell against the dollar during today's trading where the lira continued to trade in a limited range. The lira is still trading below the resistance levels that are concentrated at 1371 and 13.84. On the other hand, the lira is trading the highest support levels at 13.28 and 13.06. In the meantime, the lira is trading above the falling trend line on the 240-minute time frame. The pair also rose to trade above the moving averages 50, 100 and 200, on the four-hour time frame, as well as the 60-minute time frame. We expect the price of the lira to rise, especially if it reaches the mentioned resistance levels, as it targets the mentioned support levels. Please adhere to the numbers in the recommendation with the need to maintain capital management.