We have often noted that buying gold after breaking record highs will be a risk. The recent gains pushed the technical indicators towards oversold levels, and therefore, profit-taking is expected at any time. Indeed, the price of an ounce of gold fell from the resistance level of 2060 dollars to the level of 1976 dollars per ounce before settling around the level of 1995 dollars per ounce at the time of writing the analysis. Gold futures fell in the middle of the week's trading, ending a series of victories over four sessions. The broader commodities market appears to be taking a breather after this month's meteoric gains. But is the downturn in gold prices permanent, or is this just the formation of a new buying base before another rally?

The price of gold is up more than 3% this week, taking its year-to-date rally to nearly 10%.

Silver, the sister commodity to gold, is also paring some of its massive gains. As silver futures fell to $26.515 an ounce. The white metal is also up 4% this week, bringing its 2022 high to more than 13%.

While global financial markets are still monitoring the situation in Ukraine, it appears that investors are profiting after gold hit an all-time high. Commenting on the performance, Fouad Razakzadeh, market analyst at ThinkMarkets wrote, “So, the price of gold may head away from its record highs and stocks are more stable, but sentiment could turn negative very quickly.” And “volatile market conditions are not going anywhere until Putin ends the invasion of Ukraine.”

With the Federal Open Market Committee (FOMC) meeting scheduled for next week, investors are focused on tightening monetary policy once again. The US central bank is widely expected to raise the trigger by 25 basis points to the benchmark Fed funds rate, while markets are finding a 50 basis point increase unlikely.

The European Central Bank is preparing to provide a policy update on Thursday. The institution is expected to postpone any quantitative tightening efforts to later in the year, despite the intensification of inflationary pressures.

Gold is usually sensitive to a high interest rate environment because it raises the opportunity cost of holding non-yielding bullion.

As for the factors influencing the gold market: The US Dollar Index (DXY), which measures the performance of the US currency against a basket of currencies, paused its rise on Wednesday. The index fell 0.65 percent to 98.42 points, from an opening at 99.06. The double profit is beneficial for dollar-denominated assets because it makes them cheaper to buy for foreign investors.

Bonds were mostly in the green on Wednesday, with the 10-year Treasury yield rising 0.035% to 1.906%. One-year yields fell 0.025% to 1.111%, while 30-year yields rose 0.02% to 2.263%.

In other metals markets, copper futures contracted to $4.59 a pound. Platinum futures fell to $1,144.70 an ounce. Palladium futures rose to $3,002.00 an ounce.

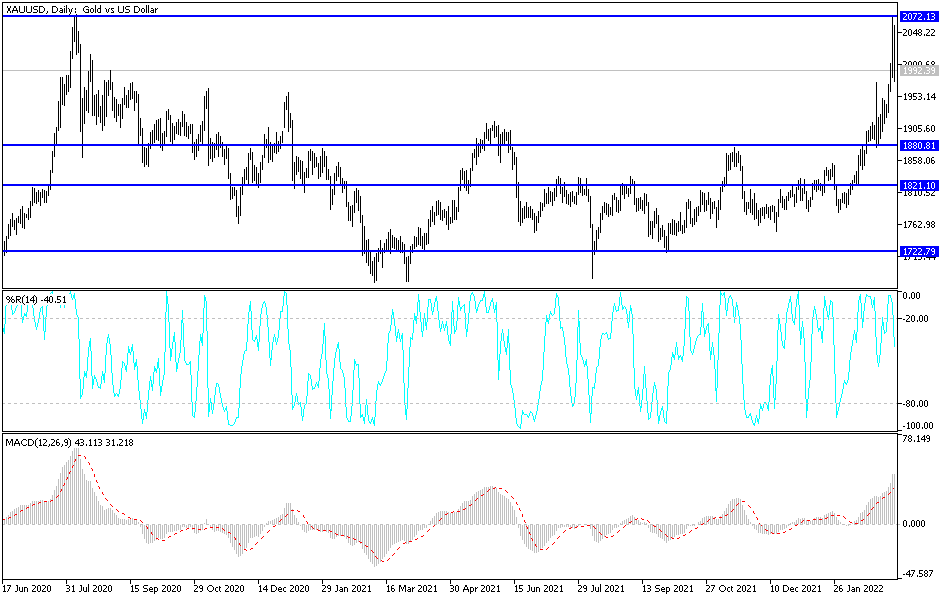

According to the technical analysis of gold: The last rebound of the gold price after the recent sharp gains will not continue to take profits in the event that the concern returns from renewed military clashes and the failure of negotiations between the Russians and the Ukrainians. It threatens a longer period of the crisis, and it is the optimal environment for the price of gold to achieve its gains. Stability above the $2000 psychological resistance still highlights the stronger control of the trend by the bulls. The closest resistance levels for gold are currently 2020, 2065 and 2085, respectively.

On the other hand, the current ascending channel will not be broken without breaching the $130 support per ounce, according to the performance on the daily chart below. The price of gold today will interact with the extent to which investors take risks or not, as well as any surprises from the European Central Bank and US inflation readings.