Gold futures quickly ignored Federal Reserve Chair Jerome Powell's comments on inflation. Gold, affected by the price-rising environment, seemed to remain resilient in this inflationary landscape. Yesterday, the price of gold fell to the level of $1911 an ounce and settled around the level of $1923 an ounce at the time of writing the analysis. According to the performance, the price of gold is down more than 1% during the week, but it is still up more than 5% since the beginning of the year.

In the same way, silver, the sister commodity to gold, is trying to stay above the $25 level. Silver futures fell to $25.07 an ounce. Overall, the price of the white metal is down about 0.7% over the past week, but it's still 7.3% higher over the year.

Speaking at the National Association of Business Economics, Federal Reserve Chairman Jerome Powell made the comment: The central bank needs to raise US interest rates faster to deal with inflation, which is running at its highest level in four decades. He warned that the Fed's planned rate hike could be higher if deemed necessary.

"The US labor market is very strong, inflation is very high," Powell said in prepared remarks.

We will take the necessary steps to ensure the return of price stability. If we conclude that it is appropriate to move more aggressively by raising the fed funds rate by more than 25 basis points at a meeting or meetings, we will. And if we decide that we need to tighten beyond common measures of neutrality and into a more restrictive stance, we will too.”

The consensus among market analysts is that the Fed is completely wrong on inflation. The Eccles Building now expects higher inflation in the future. For example, the personal consumption expenditures price index, the Fed's preferred measure of inflation, rose 5.2%. The Fed's inflation target is 2%.

"In normal times, when employment and inflation are close to our targets, monetary policy would look through a short wave of inflation associated with commodity price shocks," Powell added. "However, the risk is growing that a prolonged period of high inflation could push long-term expectations uncomfortably higher, underscoring the need for the committee to move quickly as described."

Important factors influencing the gold market: The US Treasury market was in positive territory, with the 10-year bond yield rising to 2.341%. One-year bond yields increased to 1.366%, while 30-year bond yields increased to 2.573%. Another factor is that the dollar's weakness has eased the blow to gold prices. The US Dollar Index (DXY), which measures the performance of the US dollar against a basket of major currencies, fell to 98.42, from an opening at 98.5. A depreciating US dollar is a good thing for commodities priced in the currency as it makes them cheaper to buy for foreign investors.

In other metals markets, copper futures rose to $4.7585 a pound. Copper futures fell to $1031.50 an ounce. Palladium futures fell to $2,529.50 an ounce.

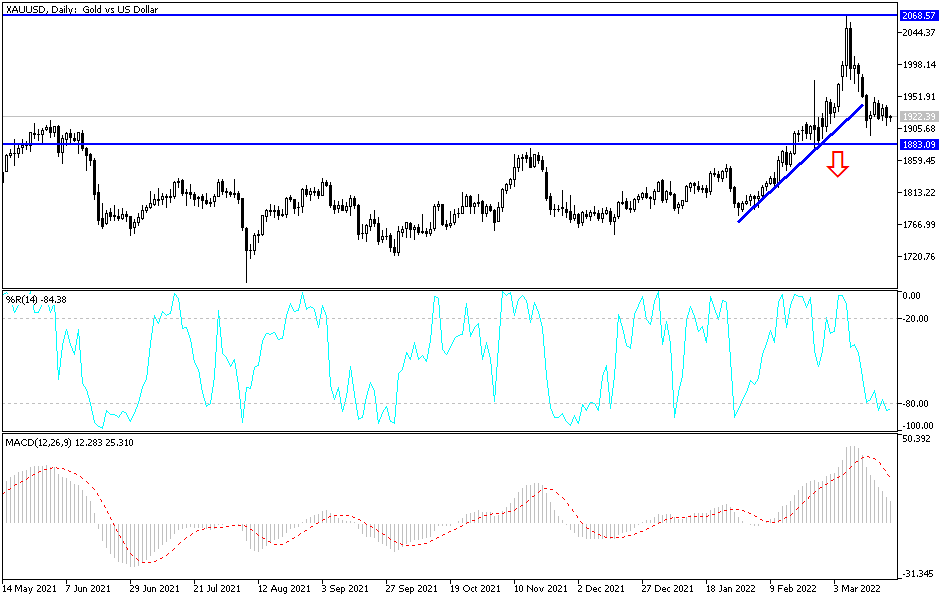

According to gold technical analysis: Despite the recent performance, the price of gold still can rise as long as it is stable around and above the $1900 resistance that supports the bulls in further progress. This may happen if fears increase over the protracted Russian-Ukrainian war and its consequences for the future global economic recovery. Currently the closest targets to the bulls are 1935 and 1960 dollars, respectively.

On the other hand, the support level of 1880 dollars will be important for the bears to control the trend, and from it and from below it is the best idea for the return of buying gold. The gold market will be affected today by the price of the US dollar and the extent to which investors are willing to risk or not, as well as the reaction from the announcement of British inflation figures and new statements by US Central Bank Governor Jerome Powell.