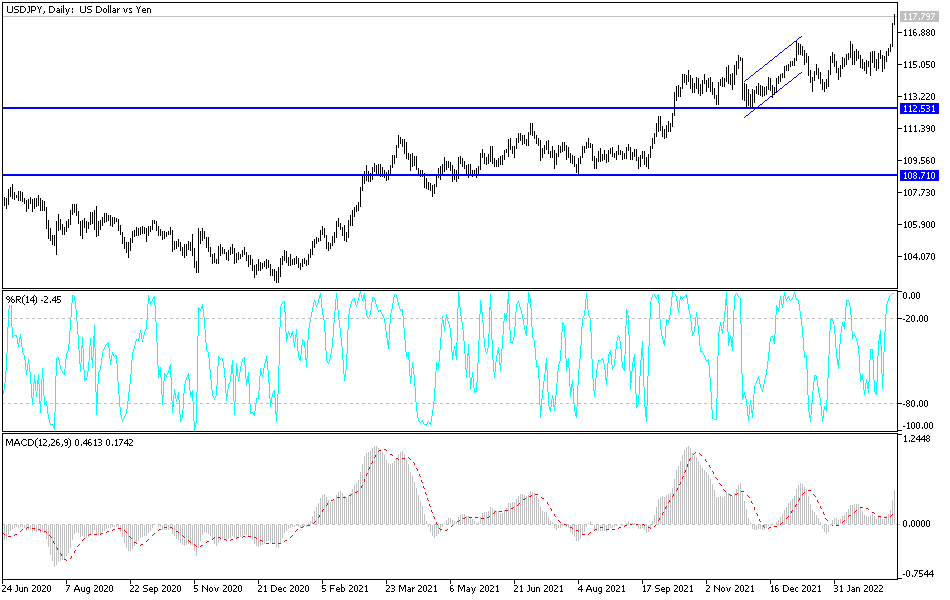

Last Friday's trading session was the most prominent in the bulls' dominance over the direction of the USD/JPY currency pair, as the currency pair jumped from the 116.06 level to the 117.35 resistance level, its highest in five years. It closed the week's trading stable around that top. The US dollar pairs are on important watch this week, which is expected date for raising US interest rates, and that this event will be the first time to do so since 2018.

Futures pricing shows more than six quarter-point increases in US interest rates by the Fed through 2022, pushing the benchmark index over 1.5% to 1.7%. Rapidly rising rates will test borrowers. As outstanding US corporate bonds have risen by more than $1 trillion since the end of 2019, so has US household debt. The federal government has also borrowed heavily to fund pandemic aid, pushing the marketable debt to nearly $23 trillion.

Debt was particularly cheap to service thanks to the Federal Reserve's near-zero interest rate policy, with corporate and Treasury yields hitting record lows during the period. A noisy section of the bond market would prefer Fed Chair Jerome Powell to focus more on reducing bond holdings, allowing policy makers to raise US interest rates less sharply as he struggles to bring down 40-year high inflation. This would ease some of the pain of rising borrowing costs — a closely related concern given the risks to the economy from the effects of Russia's invasion of Ukraine.

Proponents cite a number of potential advantages from focusing more on so-called quantitative tightening, rather than simply letting it run "in the background," as Powell says. A key advantage, they say, may help prevent an inverted yield curve, or prevent an especially deep reversal.

The US Federal Reserve has a lot of potential for holding back from the bond portfolio: its assets ballooned to $8.9 trillion after it launched a massive quantitative easing push in March 2020. The Fed now holds more than $5.7 trillion in Treasuries and $2.7 trillion in paperwork. Finance backed mortgage agency. It ended its asset purchases this month.

According to the technical analysis of the pair: The general trend of the USD/JPY pair is still bullish. It should be noted that the technical indicators have reached overbought levels. Unless the dollar gets the momentum to complete the trend, profit-taking may start quickly. The closest ascending levels for the current trend are 117.65 and 118.20, respectively. On the other hand, there will be a break in the trend by moving the currency pair below the support 115.80. Today, an important trading session is expected, and the biggest concern will be whether investors take risks or not.