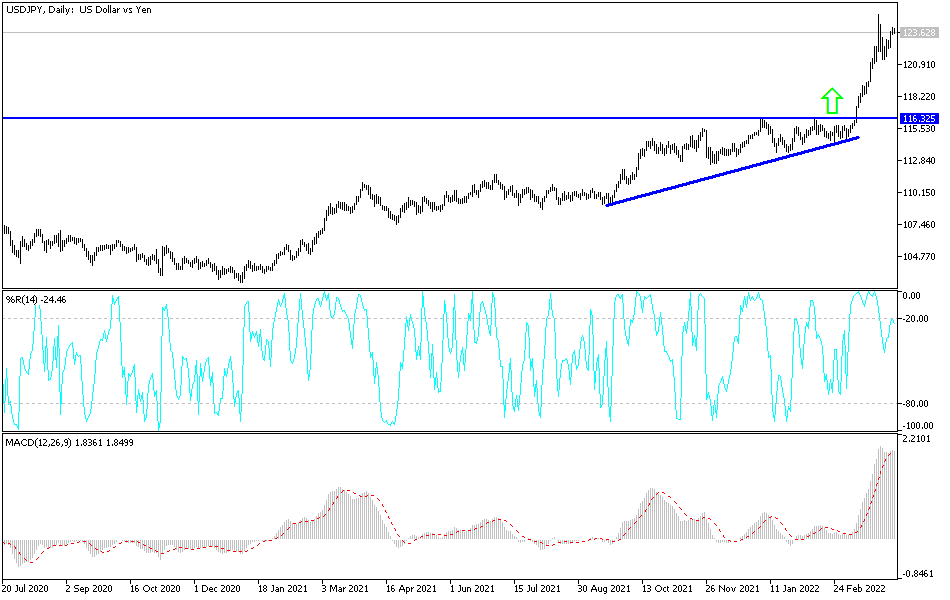

The price of the US dollar continued to rise against the rest of the other major currencies. This came aftr the minutes of the last meeting of the Federal Reserve revealed that the US central bank plans to reduce the balance sheet and may be more aggressive about US interest rates. This caused general losses, prompting investors to buy the US currency aggressively. In the case of the USD/JPY currency pair, it moved towards the resistance level 124.05, near its highest level in six years, before settling around the 123.70 level at the time of writing the analysis.

The Federal Reserve released the minutes of the Federal Open Market Committee (FOMC) meeting last month that highlighted interim efforts to shrink the over $9 trillion balance sheet by $95 billion per month. This includes $60 billion a month in Treasurys and another $35 billion in mortgage-backed securities.

Panelists also acknowledged that they need to be bolder about rates, especially if inflation remains high or rising. “Many participants noted that — with inflation well above the committee’s target, inflation risks to the upside, and the fed funds rate well below participants’ estimates of its long-term level — they would have preferred a 50 basis point increase in the target range for the interest rate over the Federal funds at this meeting.”

And based on comments from several Fed officials this week, including Governor Lyle Brainard and Philadelphia Fed President Patrick Harker, the central bank is likely to agree to a 50 basis point rate hike during the two-day FOMC meeting. .

On the economic data front, US mortgage applications fell 6.3% in the week ending April 1, according to the Mortgage Bankers Association (MBA). The 30-year mortgage rate rose to 4.9%. Earlier this week, the Services Purchasing Managers' Index (ISM) rose to a reading of 58.3 in March, below market estimates of 58.4. Non-manufacturing business activity rose to 55.5, employment jumped to 54, prices rose to 83.8, and new orders rose to 60.1.

The US Treasury market was mixed in mid-week trading, with the benchmark 10-year yield rising to 2.603%. Yields on one-year notes rose to 1.756%, while yields on 30-year notes jumped to 2.626%. Also, the US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose to 99.62, from an opening at 99.47, and overall, the US Dollar Index DXY rose by about 2% this week, raising its year-to-date rise to 3.8% .

So far, the general trend of the USD/JPY currency pair is still bullish, and the current stability is despite the confirmation of the bulls’ control of the trend. But it also indicates the arrival of technical indicators towards strong overbought levels, and with investors absorbing the factors of the US dollar’s gains, the pair may be exposed to profit-taking at any time. Currently, the closest targets for the bulls are 124.20 and 125.00, respectively. The first reversal of the trend will not happen without breaching the 120.00 support as a first stage. I still prefer selling the USD/JPY from every bullish level.

Today, the currency pair will be affected by the reaction from the Federal Reserve, the extent of risk appetite, as well as the weekly jobless claims announcement.