The markets await a new rate hike announcement from the European Central Bank, the tone of its policy statement and the statements of the ECB governor that will determine the extent to which the euro benefits from the update. The EUR/USD pair is still near the lowest level in 20 years and is settling around the 1.0000 level at the time of writing the analysis, and its recent losses affected the 0.9862 support level.

The main focus for the Euro this week is the European Central Bank's decision on Thursday, when it is expected to raise interest rates by 75 basis points. This move may be a clear indication of the intent that policy makers in Frankfurt will quickly keep pace with inflation expectations before the onset of a possible recession in the Eurozone. Commenting on this, Barclays analyst Marek Rachko says: "Given that the markets did not fully price 75 basis points at the September meeting, such optimistic results may push the euro higher in the short term."

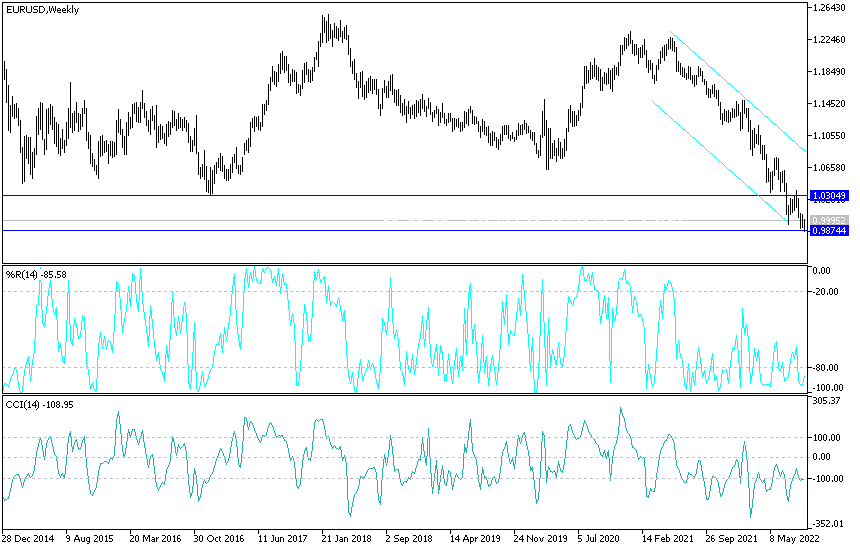

May Test New Lows

Indeed, the long-established rule of thumb in the forex currency markets is that such a hard policy shift in a central bank would support its currency. On this basis, if the ECB does not meet expectations for a 50 basis point hike, the EUR/USD exchange rate may test new lows again, according to Barclays.

Analysts also recognize that these are certainly not normal times for the FX markets, and any increase in the Euro through a 75 basis point central bank hike may be fleeting. "The ECB is still meaningless for the euro," says JPMorgan analyst Mira Chandan. "It's too early to strengthen."

The euro fell rapidly against the dollar in 2022 and is now hanging under the $1.0 level.

The EUR/USD drop comes amid a broader dollar bullish trend, embodied in Tuesday's all-time high in the Bloomberg Dollar Index amid marked weakness in the yen and euro. Thus, fighting this trend may not be something the ECB can do at a time when investors are more focused on global growth and energy markets.

Another short term risk for the EUR is the tone set by the European Central Bank and the new expectations it is unveiling. Higher inflation, which reflects higher gas prices, means that the European Central Bank is expected to sharply raise its inflation forecast from its June forecast of 6.8% for 2022, 3.5% for 2023 and 2.1% for 2024. Hence, further hikes are likely. After Thursday, it is supposed to raise the central bank's deposit rate to 1.50% by the end of the year, according to analysts at Société Générale. In this regard, says Kenneth Brooks, analyst at Societe Generale, "support for the single currency if the European Central Bank rises by 75 basis points this week is likely to be muted."

"We don't expect the euro to be driven by an inflation-stimulated ECB hike that comes despite the stagnation baseline," adds JPMorgan's Chandan.

For the euro, what matters most in the near term are developments in the gas market, analysts say. In their words, “The potential opening in NS1 and pressure in natural gas prices could be a catalyst for the EUR to bounce. However, persistent energy concerns should keep the EUR under pressure in the medium term. If the ECB delivers less by raising 50 basis points, EURUSD may test its lows again.”

EUR/USD forecast today:

- The stability of the EUR/USD price around and below the parity price that still supports the continuation of the bearish trend.

- Any bullish rebound of the euro dollar after the European Central Bank decisions will be temporary because the euro faces other strong pressure factors that impede any efforts to change the current bearish outlook.

- The nearest levels for the current trend are 0.9945 and 0.9860, respectively, which are sufficient to push the technical indicators towards sharp oversold levels.

According to the performance on the daily chart, and as I mentioned before, a break of the resistance 1.0200 will be important for a first exit from the current descending channel.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.