After returning from the American holiday, the positive activity of the US dollar increased again. Accordingly, the EUR/USD currency pair moved towards the support level of 0.9900 and the lowest of the most popular currency pair in the forex market in 20 years.

Investors prefer to stick to a strong US dollar despite recent strong signals that the European Central Bank may introduce a step towards tightening this week. The European Central Bank (ECB) is supposed to raise interest rates by 75 basis points on Thursday, but such a rise in eurozone lending rates is unlikely to boost the euro according to a new analysis. In this regard, Société Générale says that the European Central Bank is likely to raise interest rates by 75 basis points, higher than their previous expectations for a movement of 50 basis points, but for currency markets, it is what happens in European gas markets that matters for the single European currency in the end.

Raising Inflation

Such a big hike in interest rates was out of the question, just a few months ago. But rising inflation, which reflects higher gas prices, means the European Central Bank is expected to sharply raise its inflation forecasts from its June forecast of 6.8% for 2022, 3.5% for 2023 and 2.1% for 2024.

Thus, further hikes are likely after Thursday, and should raise the central bank's deposit rate to 1.50% by the end of the year, according to Societe Generale. But “support for the European single currency if the European Central Bank rises by 75 basis points this week is likely to be muted,” says Kenneth Brooks, analyst and strategist at Societe Generale, a view that suggests euro bulls may be disappointed. Thursday's result.

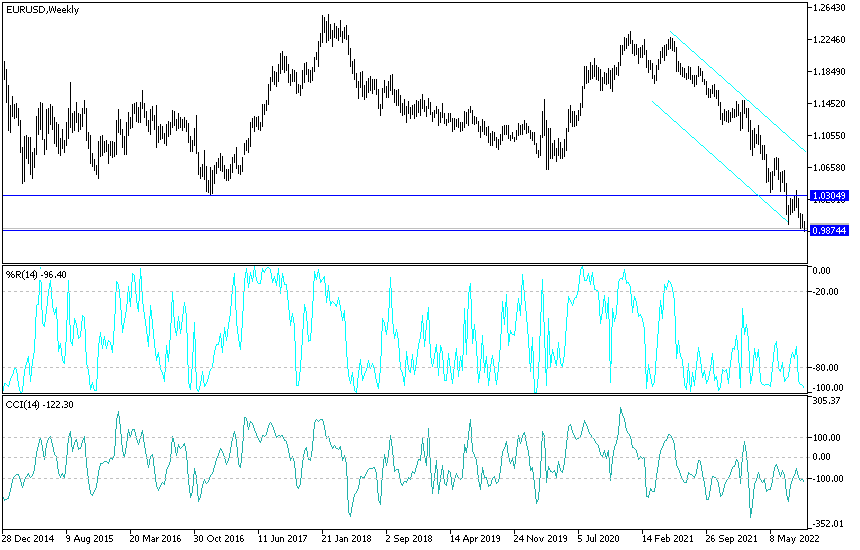

This call comes as the Euro continues to struggle against the Dollar, to remain stuck in a downtrend.

This week saw the EUR/USD exchange rate hit a new low of 0.9877 on Monday, despite expectations of a stronger rate reaction from the European Central Bank. Recent stabilization of selling pressure has seen it recover back to 0.9930 at the time of writing. It therefore appears that the EUR is poised to enter Thursday's meeting below par, as even recent market dynamics suggest that what central banks do may not matter at all to the EUR's near-term movements.

After the latest performance it seems clear that the EUR/USD exchange rate has stopped responding to interest rate differentials, which are strongly influenced by the central bank's interest rate expectations. Therefore, relative changes in the Eurozone and US monetary policy may not be relevant anymore, as markets instead focus on the Eurozone energy crisis for signals. "High bond yields are counterproductive for the euro and reflect doubts about the ECB's ability to control inflation," adds Société Générale, an analyst. And “tactically, we don’t rule out new lows for the currency pair if confidence in the European stock-earnings and credit outlook remains shaken, especially for discretionary consumers, real estate and industries.”

Soc Gen tells clients that the EUR/USD has renewed its bearish momentum after encountering resistance near the upper band of the descending channel at 1.0360. The continued decline may continue towards the next expectations at 0.9700. Daily Kijun line at 1.0080 / 1.0150 is up.

Forecast of the euro against the dollar today:

- Current bearish stability of the EUR/USD pair may remain in place until the reaction from the announcement of the monetary policy decisions of the European Central Bank.

- Stability around the 0.9900 support, the lowest in 20 years, moves the technical indicators towards oversold levels.

- The EUR/USD may remain vulnerable to further collapse if the pessimism continues regarding the future recovery of the euro zone.

So far, the Eurodollar gains will remain vulnerable to collapse until there are strong and persistent factors for an upward correction. There will be no reversal of the current trend without testing the 1.0200 resistance level. Today, the growth rate of the Eurozone economy will be announced.

Ready to trade our Forex trading predictions? Here are some excellent Forex brokers to choose from.