- Yesterday's trading session was the most important for the bulls to gain more control over the direction of the USD/JPY currency pair.

- It rebounded upwards strongly towards the resistance level 144.68, recovering from the profit-taking selling operations that the currency pair was exposed to recently.

- It pushed it towards the support level 141.50 and settled around the 143.68 level.

- The currency pair's gains came as a reaction to the rise in US inflation rates, contrary to expectations that were indicating a decline.

Inflation in the US is showing signs of entering a more stubborn phase that is likely to require tough action by the Federal Reserve, a shift that has panicked financial markets and raised recession risks. Some of the old drivers of high inflation—rising gas prices, the hustle of supply chains, and soaring used-car prices—are fading. However, basic measures of inflation are actually getting worse.

Prices no longer rising

The continuing development of the forces behind the inflation rate, which is approaching its highest level in four decades, has made it difficult for the Federal Reserve to control it. Prices are no longer rising due to higher prices for some categories. Instead, inflation has now spread more widely throughout the economy, buoyed by a strong labor market that boosts paychecks, forcing companies to raise prices to cover higher labor costs and give more consumers money to spend.

Yesterday, the government said US inflation rose 0.1% from July to August and 8.3% from a year ago, down from a four-decade high in June of 9.1%. But excluding the volatile categories of food and energy, so-called core prices jumped an unexpectedly sharp 0.6% from July to August, after a smaller 0.3% rise the previous month. The Fed is watching core prices closely, and the latest figures have heightened fears of a more aggressive Fed and sent US stocks tumbling, with the Dow Jones crashing more than 1,200 points.

The core price figures have reinforced fears that inflation is now spreading to all corners of the economy. Demand-driven inflation is one way of saying that consumers, who account for roughly 70% of economic growth, continue to spend, even if they are upset about having to pay more. This is partly due to widespread income gains and partly because many Americans still have more savings than they did before the pandemic, after putting off spending on vacations, entertainment, and restaurants.

When inflation is primarily driven by demand, it may require more aggressive Fed action than when it is primarily driven by supply shocks, such as oil supply disruptions, which often can resolve on their own. Economists fear that the only way for the Fed to slow strong consumer demand is to raise interest rates too high in order to sharply increase unemployment and possibly cause a recession. Usually, as the fear of layoffs grows, the unemployed are not just cutting back on spending. So do many people who fear losing their jobs.

Some economists now believe the Fed will have to raise the benchmark short-term rate much higher, to 4.5% or higher, by early next year, more than its previous estimate of 4%. (The Fed's key interest rate is now in the 2.25% to 2.5% range.) Higher rates from the Fed would, in turn, raise the costs of mortgages, auto loans and business loans.

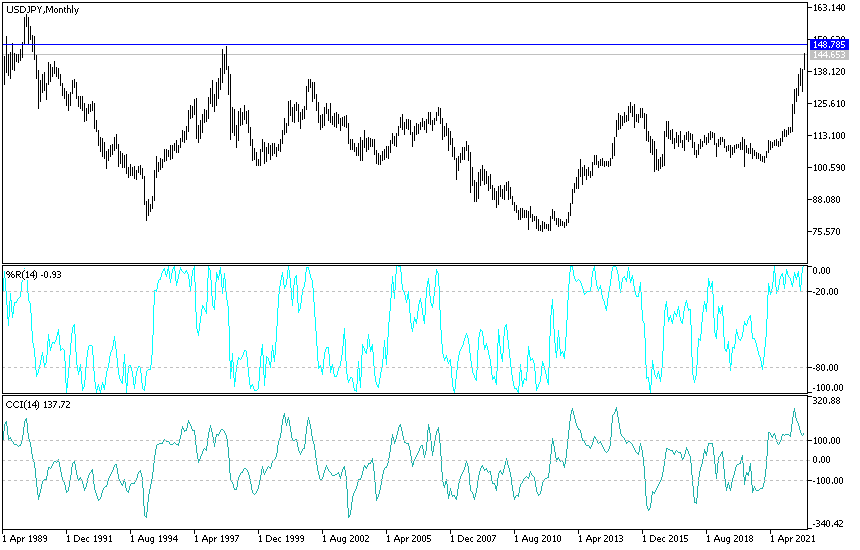

USD/JPY Forecast

There is no doubt that the recent gains of the USD/JPY currency pair pushed the technical indicators towards overbought levels. I expect to activate profit-taking selling operations at any time, as the Japanese intervention to stop the collapse of the Japanese yen has become the closest. The markets have absorbed the path of the economy which supports the path of raising US interest rates. Breaking the current upside trend needs to breach below the support level 140.70 according to the performance on the daily chart. In general, stability above the psychological resistance 140.00 still supports the bulls' control of the trend.

The closest resistance levels for the currency pair are currently 143.90 and 145.00, respectively. The dollar will remain the strongest until the release of the rest of the important US economic data this week.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.