Spot natural gas prices (CFDS ON NATURAL GAS) continued their decline in early trading on Wednesday, to deepen their losses yesterday. It recorded new daily losses until the moment of writing this report, by -0.76% to settle at a price of $ 5.900 per million British thermal units, after falling during Yesterday's trading increased by -7.47%.

US natural gas futures fell about 7% to a three-month low on Monday, with European futures collapsing, thanks to expectations of milder weather in the US and lower demand next week than previously expected.

US gas futures have already fallen over the past eight weeks due to record production and reduced liquefied natural gas exports that have allowed utilities to pump much larger than usual volumes of gas into storage over the past month.

The weather forecast for the next few days from the National Oceanic and Atmospheric Administration shows warmer-than-normal temperatures in the eastern and central US. This should reduce heating demand during this period, as the bulk of heating demand this time of year comes from regions Northeast and Midwest.

In addition, US LNG exports could start to pick up later this week if the Cove Point terminal is back in service as some traders expect.

Natural Gas Forecast

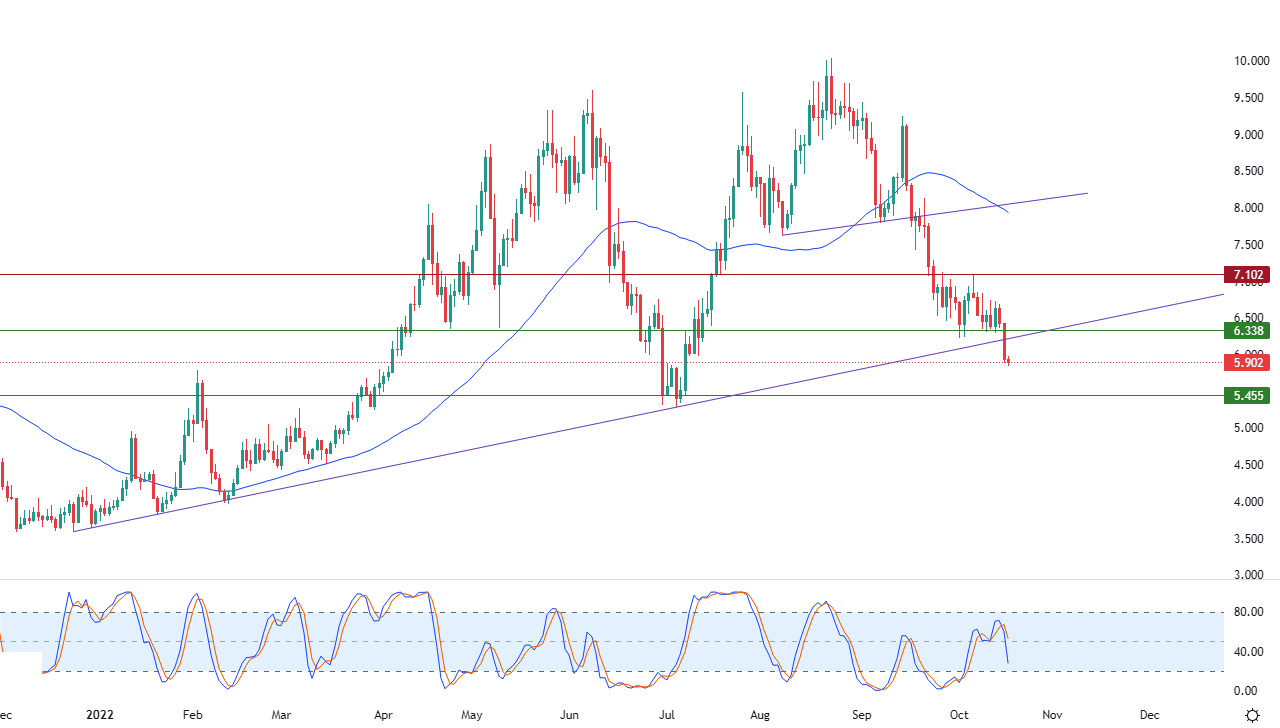

- Technically, and with the recent price decline, natural gas broke a major bullish slope line in the medium term, as shown in the attached chart for a (daily) period.

- This was amid the continuation of negative pressure for its trading below the simple moving average for the previous 50 days, in addition to that, we notice the influx of negative signals relative to strength indicators, after reaching overbought areas, compared to the price movement.

Therefore, our expectations indicate more decline for natural gas during its upcoming trading, especially throughout its stability below the 6.338 level, to target the first support level at 5.455.

Ready to trade Natural Gas in Forex? Here are some excellent commodity trading platforms to choose from.