Since the start of trading this week, the price of the USD/JPY currency pair is in an upward retracement mode, breaching the psychological resistance 140.00. As mentioned before, it is important for the bulls to start advancing, and indeed it moved towards the resistance level 142.25, before settling around 141.85 at the time of writing the analysis.

- We noticed that the US dollar takes advanced positions against the rest of the other major currencies until the content of the minutes of the last meeting of the US Federal Reserve is announced.

- The increase in the tightening tone from the bank means more gains for the US dollar, as the rest of the global central banks began to calm down and limit the lifting rates in order to avoid recession.

Prior to announcing the minutes of the meeting

San Francisco Fed President Mary Daley said officials should be aware of the delays in transmitting monetary policy through the economy as they raise interest rates further in order to bring down inflation. “As we work to get policy in a sufficiently constraining position — the level required to bring down inflation and restore price stability — we will need to be careful,” she added in prepared remarks for the Orange County Business Council. “An adjustment too little would make inflation too high.” Excessive adjustment may lead to an unnecessarily painful contraction.”

Daly added that inflation is "unacceptably high" and that she and her colleagues note that more work needs to be done to bring it down, although the latest report on consumer prices, which showed a slowdown, was "encouraging".

Policymakers have raised the US Federal Reserve's benchmark interest rate from near zero to a target range of 3.75% to 4% this year, including four consecutive hikes of 75 basis points, the most aggressive tightening campaign since the early 1980s. Investors expect the Fed to adjust the pace of raising US interest rates to 50 basis points when officials meet on December 13-14.

But Daly said the interest rate is not the only component of monetary policy. The Fed's continued downgrade of its balance sheet and those responsible for forward guidance providing about the future path of policy also act as tightening mechanisms, which is reflected in financial conditions. "While the money rate ranges between 3.75 and 4%, the financial markets are behaving like this at around 6%," she added. And “As we make decisions about further rate adjustments, it will be important that we remain aware of this gap between the federal funds rate and the tightening in financial markets.” And “ignoring this increases the chances of tightening too much.”

She did not directly indicate how far she thinks the Fed needs to go in her prepared remarks. Daly said last week it would be "reasonable" for the benchmark price to top somewhere between 4.75% to 5.25% before policymakers pause their increases.

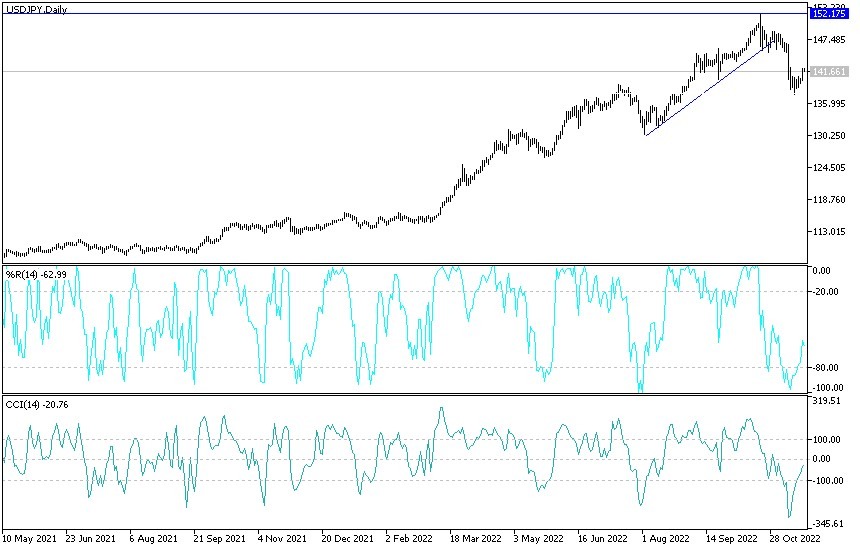

Elsewhere, as the trading year comes to an end, the sharp drop in the Japanese yen has been one of the most exciting market moves of 2022. All the JPY crosses moved higher, but one in particular stands out from the crowd - USD/JPY. It is the “currency” pair that everyone watches when trading the yen. It moved sharply higher shortly after the Russian invasion of Ukraine. The break-up was a surprise because the yen has so far acted as a safe-haven currency. Therefore, the war should have caused a strong demand for the yen, but the opposite happened.

Forecasts of the US dollar against the Japanese yen today:

- The breach of the psychological resistance 140.00 on the part of the USD/JPY currency pair will motivate the bulls to start advancing.

- According to the performance on the daily chart, the bulls still have more time for strong control, and this may happen if the prices move towards levels of resistance which is 143.00 and 144.60, respectively.

- The upward hopes may evaporate if the dollar yen pair returns to the vicinity of the support level 139.30.

- I still prefer buying the dollar yen from every downside level.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.