- At the beginning of this week’s trading, gold (XAU/USD) price tried hard to return to the vicinity of the psychological resistance of 1800 dollars an ounce again.

- This happened because of stronger and continuous control of the bulls on the trend, as a recovery for prices from selling operations that pushed it towards the support level of 1774 dollars an ounce last week.

- The price of gold (XAU/USD) settled around the level of 1788 dollars an ounce at the time of writing the analysis, waiting for anything new.

Stocks and US Treasurys fell as investors assessed the Federal Reserve's path next year after US central bank officials pledged to keep raising interest rates until they were confident inflation would ease. Accordingly, the S& P 500 index fell, as the losses of the Nasdaq 100 index of technology stocks exceeded 1 percent. The initial rally in shares of Tesla Inc. faded after Elon Musk suggested he might step back from the presidency of Twitter. Treasury yields rose, with the policy-sensitive two-year yield at around 4.25 percent.

Overall, investors remain on edge after recent comments from the Federal Reserve and other hawkish global central banks. Sentiment remained sour after former New York Fed President and Bloomberg Opinion columnist William Dudley told Bloomberg TV on Monday that bullish markets could make the central bank more hawkish. European Central Bank Governing Council member and Bundesbank president Joachim Nagel said it would take some time for inflation to slow to the central bank's 2 percent target, which also dampened the mood on Monday.

But some investors are looking forward to past fears of an economic recession caused by higher interest rates, betting instead that inflation could peak, which would allow the Federal Reserve and its peers some latitude in their tightening policy. Meanwhile, US homebuilder sentiment plummeted in December to a level not seen in more than a decade post-pandemic, amid soaring mortgage rates and construction costs.

The US dollar fell as investors weighed on the Federal Reserve's interest rate outlook ahead of new economic data this week. The euro strengthened after a series of hawkish comments from interest rate-setters. Earlier, global equity investors were somewhat encouraged by a pledge by China's top leaders to boost the economy next year by reviving consumption and supporting the private sector.

Gold (XAU/USD) Forecast:

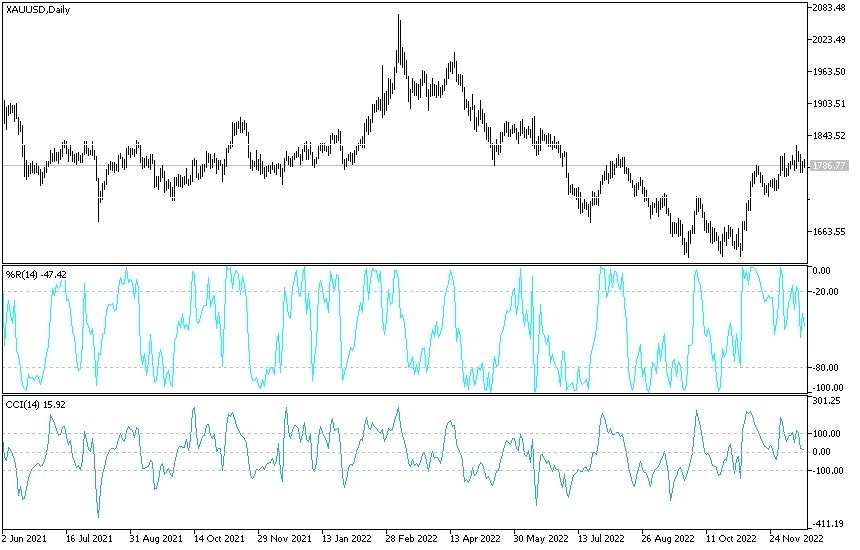

According to the performance on the daily chart below, the XAU/USD gold price is still the closest to the rise, especially if it returns to test the psychological resistance level of $1800 an ounce, which is the closest to it now. The bulls may motivate more to achieve the last levels of $1815 and $1825, respectively. They are sufficient to push the technical indicators towards overbought levels, among which I would prefer to think of selling gold again.

On the other hand, and for the same period of time, as I mentioned before, the return of the gold price to the vicinity of support at $1775 will be less important for the bears to control the trend again. The price of gold today will be affected by the level of the US dollar and whether or not investors are willing to take risks.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.