The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. There are some valid long-term trends in the market right now, which might be exploited profitably. Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 26th December that the best trade opportunities for the week were likely to be a long trade in Silver against the US Dollar (XAG/USD) following a daily close above $24.15 and in the EUR/USD currency pair following a daily close higher than the two previous daily closes. A short trade in the USD/JPY currency pair was also attractive following a daily close below €131.56. The Silver trade did not set up, but the EUR/USD gave an entry at $1.0634, with the price ending the week at $1.0699, a gain of 0.61%. The USD/JPY currency pair ended the week lower by 1.24%.

The news is currently dominated by continued strength in the Japanese Yen following the Bank of Japan’s upwards revision of its yield curve control policy, which gave a major boost to the Yen and put Yen futures shorts at their lowest level since August, and the continuing bearish trend in the US Dollar.

There were no important data releases last week in the market, due to the Christmas holiday observed in many major markets.

Global stock markets ended the week mostly unchanged, or a little lower. The Forex market again saw most strength in the Japanese Yen last week, with the US Dollar the weakest major currency.

Rates of coronavirus infection worldwide again fell slightly last week according to official data. However, there are credible reports suggesting millions of new infections after China’s “zero covid” measures were recently scrapped. The most significant growths in new confirmed coronavirus cases overall right now are happening in China, Japan, Peru, and Taiwan.

The Week Ahead: 2nd January – 6th January 2023

The coming week in the markets is likely to see a higher level of volatility, as there are some major data releases scheduled, and as it is markets come back online following the week of the Christmas / New Year holiday. The scheduled major releases, in order of importance, are:

- US FOMC Meeting Minutes

- US Non-Farm Employment Change

- US Average Hourly Earnings

- Swiss CPI (inflation) data

- US Unemployment Rate

- US ISM Manufacturing PMI

- US JOLTS Job Openings

- US ISM Services PMI

- Canadian Unemployment Rate

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a bearish candlestick which showed a fall over the week, closing hard on its low which is just a few pips off the 6-month low. The former support level at 102.94 has continued to act as effective resistance. The chart is clearly bearish.

The long-term bullish trend in the US Dollar is over technically, and we see a new long-term bearish trend established already with the price continuing below its levels of both 3 and 6 months ago.

The short–term direction in the US Dollar looks likely to be bearish – there are no bullish signs at all. Therefore, it will be wise to only take trades short of the US Dollar over the coming week.

XAU/USD (Gold)

Last week Gold printed a bullish inside bar which made the highest weekly close seen since April this year. The price also reached a new long-term high, and closed just above the high of last week, which are bullish signs.

It is significant that the price has managed to get well established above the former area of major resistance at about $1807.

The technical picture is unquestionably bullish, and we are now seeing better momentum here than in Silver.

Although most commodities are not performing strongly in today’s market, precious metals such as Gold and Silver have been notable exceptions.

The price of Gold is likely to continue to rise this week.

XAG/USD (Silver)

Last week saw Silver print a small bullish inside bar which made the highest weekly close seen since April this year. This keeps the technical picture bullish, but the momentum has faded, and the resistance at $24.15 is also significant and a potential blow to bulls hoping for the price to reach the big round number at $25.

Although most commodities are not performing strongly in today’s market, precious metals such as Gold and Silver have been notable exceptions.

I think that Silver will continue to rise, but I want to see a daily (New York) close above $24.15 before making any new long trade entries.

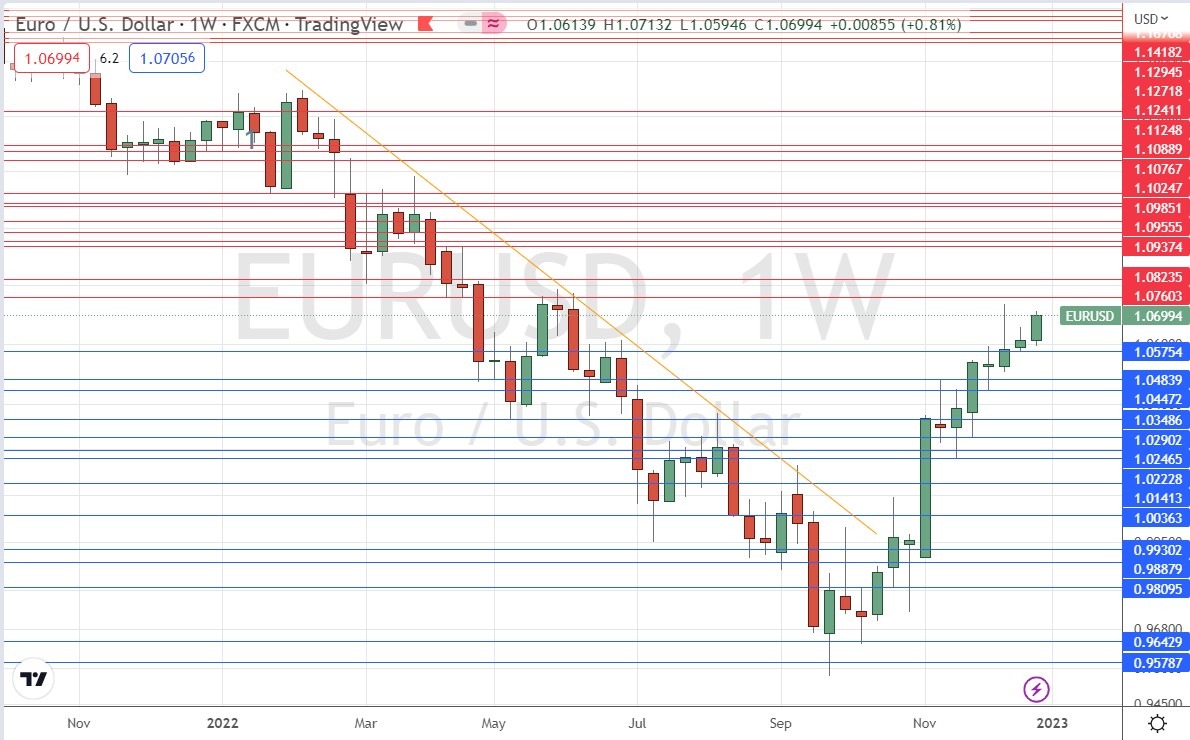

EUR/USD

Last week saw the EUR/USD currency pair rise by printing a firm bullish candlestick which closed near its high, following a bullish breakout from the previous week’s bullish inside candlestick. The price chart below shows how the past several bullish weeks have made a strong, impulsive breakout from the former long-term bearish trend line which had been driving the price lower.

This pair is clearly showing a bullish long-term trend, with the highest weekly close seen since May. Such trends are usually statistically quite dependable in this currency pair, which is also usually the cheapest Forex pair to trade.

As the price ended the week making its highest daily close for months after a period of several days’ consolidation, I am happy to be long of this currency pair.

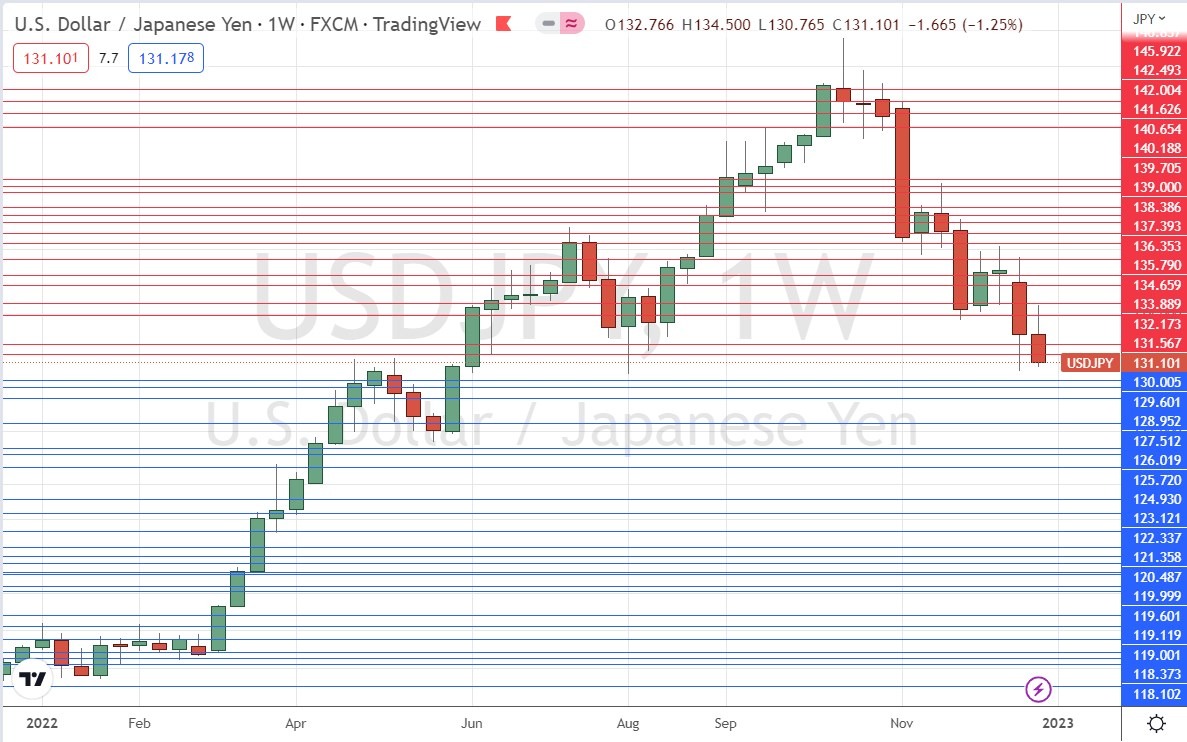

USD/JPY

Last week the USD/JPY currency pair printed a bearish inside candlestick with a healthy range, making the lowest weekly close since May. The price ended the week hard on the low. These are all bearish signs. We are seeing a valid long-term bearish trend and for the second week running, the Yen has been the strongest-performing major currency. The US Dollar has been the weakest, putting this currency pair at the heart of the Forex market.

We need to drill down deeper into what happened in recent weeks: the Bank of Japan made a policy change allowing its 10-year treasury yields to rise, and this made the Yen much more attractive to investors.

As the week closed right on the low, and as this is very close to the previous week’s low, and due to the unique strength of the Yen, I am happy to be short of this currency pair.

Bottom Line

I see the best opportunity in the financial markets this week as likely to be a long trade in Silver against the US Dollar (XAG/USD) following a daily close above $24.15, a long of Gold in USD terms, and the EUR/USD currency pair, and short of the USD/JPY currency pair also.

Ready to trade our weekly Forex forecast? Here are the best Forex brokers to choose from.