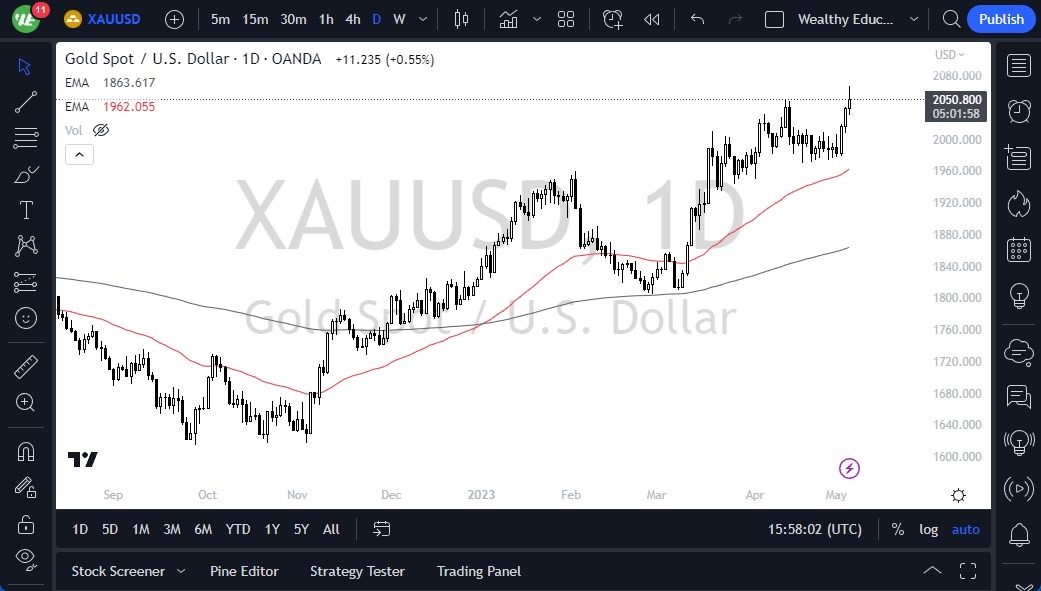

- Gold markets experienced a sharp increase during Monday's trading session, rising to a fresh new high before giving back some of those gains.

- This is not surprising given that the market may have been a little overdone to the upside in the short term.

- However, this does not necessarily indicate a massive selling opportunity, but rather a need for the market to cool off before the next surge higher.

Despite the recent pullback, there is still no interest in shorting this market, as the $2000 level now becomes the "floor in the market." The 50-Day EMA is racing to reach that area, so investors may have an opportunity to buy gold on some type of pullback. If this happens, there should be plenty of people out there willing to take advantage of "cheap gold," as the trend has been so obvious. Ultimately, it is believed that given enough time, gold will break above the $2100 level, which would make it more of a "buy-and-hold" type of market.

The economic conditions remain weak, and this makes a lot of sense in terms of gold attracting a lot of money as far as wealth preservation is concerned. This has been a major driver of what's been going on in gold over the last year. While an area of consolidation may be waiting to happen, there is still a favorable upside trend.

The Economic Conditions Remain Weak

It's important to note that much of the massive gain early in the day occurred during a thin time in the market, and it may have been a little exaggerated. Nonetheless, it still follows the same direction that the market has been trading in for a while, and it does make a certain amount of sense that the trend will continue.

At the end of the day, gold markets experienced a sharp increase followed by a pullback. While this may indicate a need for the market to cool off before the next surge higher, there is still no interest in shorting the market. The $2000 level is believed to be the "floor in the market," and the 50-Day EMA is racing to reach that area. Investors may have an opportunity to buy gold on a pullback, as the trend has been so obvious. Given enough time, it is believed that gold will break above the $2100 level, making it more of a "buy-and-hold" type of market. Overall, the economic conditions remain weak, which makes it likely that gold will continue to attract money as far as wealth preservation is concerned.

Potential signal: Gold has been the hottest market for some time and for good reason. I am a buyer after this pullback, looking to reach the $2070 level eventually. I am buying in small increments, as the volatility in everything increases. If gold were to break below the $2000 level, it would mean bad things. In the meantime, I am using $2020 as a stop loss.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to check out.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to check out.