The USD/ZAR has powered lower as the currency pair, much to the astonishment of many, has correlated to the broad Forex market. The USD/ZAR is trading near the 18.23100 vicinity as of this writing with typical fast changes in value being demonstrated. Speculators of the USD/ZAR should note that a banking holiday is being observed in the U.S. today which means trading volumes will be lower than normal.

Top Forex Brokers

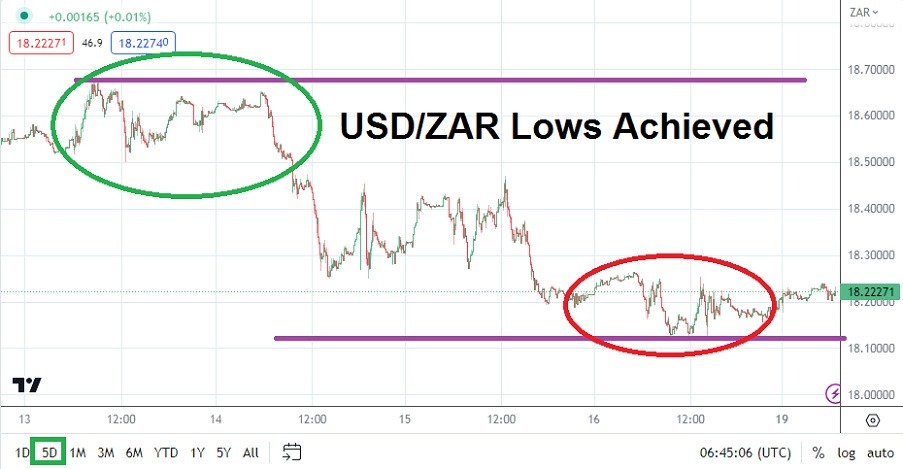

The downward trend of the USD/ZAR began like most other major currency pairs on the 1st of June. Behavioral sentiment has been rather strong based on the belief the U.S. Federal Reserve would not raise interest rate hikes in June, and this was confirmed this past Wednesday when the Fed made its pause official. However, the U.S. central bank did warn it could still raise the Federal Funds Rate towards the end of July. A low of nearly 18.13360 was seen this past Friday.

Support Levels near the 18.200000 Ratio may become the Target for the USD/ZAR

Traders who are intent on trying to pursue lower values in the USD/ZAR are likely looking at the 18.20000 level below as a technically interesting price in the short term. The last time the USD/ZAR traded below the 18.20000 mark for a sustained period of time was in the middle of April, this when the currency pair was largely trading between 18.00000 and 18.25000 with momentary outliers providing volatility.

The ability to move lower in the USD/ZAR and correlate with the broad market is a healthy sign for the South African Rand. However, the political concerns and shadows hovering over South Africa have not disappeared; meaning the value of the USD/ZAR may begin to find some headwinds start to filter into trading results. Yet the downward power of the USD/ZAR demonstrated the past couple of weeks based on the notion the U.S Fed may be reaching the end of its rate hike cycle which has been strong for nearly a year must be given attention.

USD/ZAR Short-Term Trading should be monitored based on its Trend

- The trend lower in the USD/ZAR is not an accident and the question is when will financial institutions start to believe the currency pair has been oversold.

- Certainly, the USD/ZAR traded in an 18.00000 to 18.25000 price range for the first few weeks of April in a rather choppy but sustained manner. However, volatility was evident and risk management was essential then and remains important to guard against sudden spikes.

- Day traders should not get overly ambitious and be willing to cash out quick hitting trades using take profit targets, stop losses are highly encouraged also.

- Looking for fast price velocity today may prove difficult because of the U.S banking holiday.

USD/ZAR Short-Term Outlook:

Current Resistance: 18.27900

Current Support: 18.22100

High Target: 18.35200

Low Target: 18.15600

Ready to trade our daily Forex analysis? Here's a list of the best forex trading platforms South Africa to choose from.