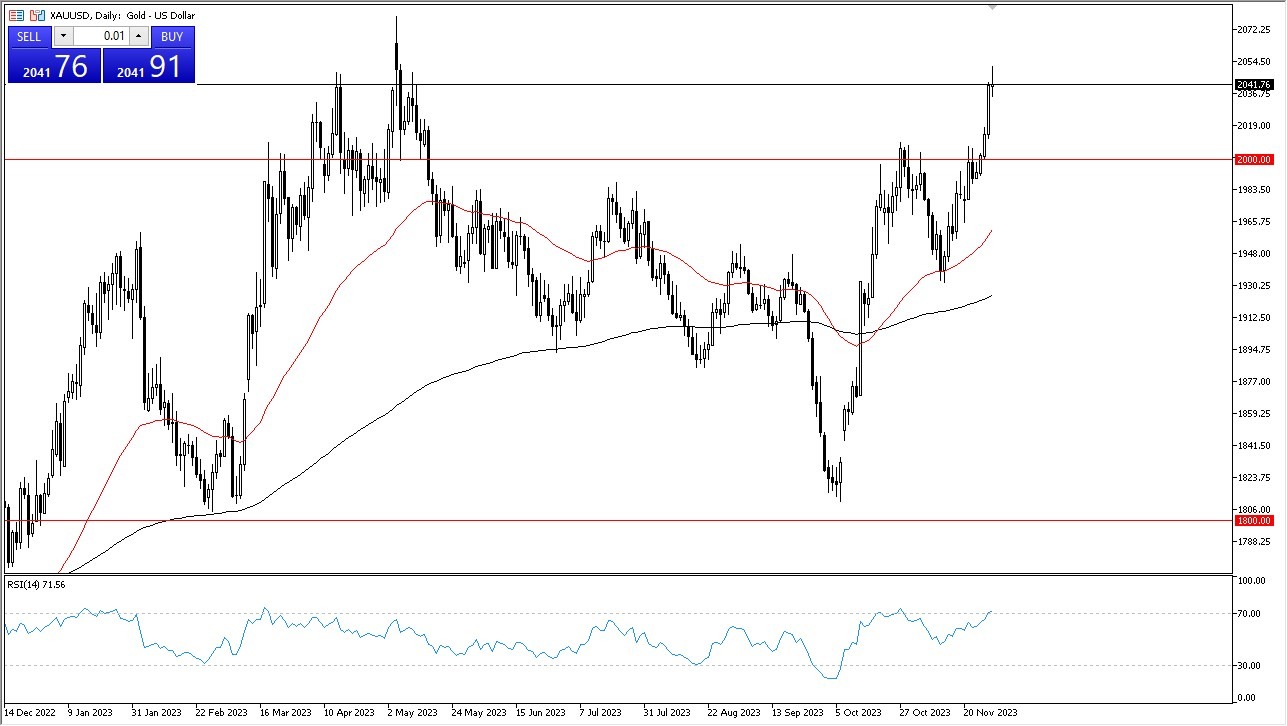

- Gold made an initial attempt to rally during Wednesday's trading session, but it swiftly relinquished those gains, showcasing signs of overextension by nearly any metric one might employ.

- The Relative Strength Index (RSI) is treading perilously close to overbought territory, while we find ourselves confronting a formidable historical resistance level that has thwarted numerous previous advances.

- This rapid ascent, coupled with our current elevated position, implies that a short-term retracement is a logical expectation.

Top Forex Brokers

To be clear, my intention isn't to take a short position in this market. However, if we witness a resurgence in the US dollar, especially in an oversold condition, its effects are likely to reverberate within the gold market. There's undeniably substantial bullish pressure lurking beneath the surface, but it's reasonable to assume that we will eventually need to shed some of the exuberance that has characterized recent trading sessions. Any breakout from this juncture could be perilous, given the nearly vertical trajectory observed over the past few days.

Various Support Levels

Beneath the current price, the $2000 level stands as a crucial support zone, conceivably serving as a robust "floor" for the market. However, it's worth noting that reaching this level may prove to be no small feat. The imminent release of the PCE Core Price Index on Thursday holds the potential to introduce a significant degree of volatility into the markets. This index is the Federal Reserve's favored indicator, making it a possible catalyst for profit-taking in the gold market, given its recent explosive run.

Lately, we've been subjected to a volley of statements from Federal Reserve governors, further contributing to the already volatile market environment. The Federal Reserve has developed a knack for fumbling the ball, often delaying monetary policy adjustments. The prospect of an impending recession looms large, and it remains to be seen how long it will take for the Fed to adapt its stance. As things stand, the most straightforward interpretation of this chart suggests that we've ventured into the territory of "too far, too fast." Value needs to be obtained one way or the other.

In the end, gold's recent trajectory has been marked by a rapid ascent and formidable resistance. The indicators hint at potential retracement, although I'm not advocating for short positions at this juncture. The interplay between the US dollar and gold remains a critical dynamic to watch, and the $2000 level could serve as a resilient support zone. However, the looming release of the PCE Core Price Index introduces an element of uncertainty, and the Federal Reserve's indecisiveness adds to the market's turbulence. The prevailing sentiment suggests that a correction may be in the cards, given the breakneck pace of recent gains. However, gold still looks bullish long-term.

Potential signal: This one is a bit different. I am looking to ADD to an existing position, if we drop anywhere near the $2000 area. A stop at 1980 would be sufficient, and we could look for a $100 gain. This is something that I expect to present itself in the next week or so.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.