- Silver experienced a notable uptick in its price during the Friday trading session following the release of the Producers Price Index (PPI) figures in the United States.

- This unexpected surge in Silver's value can be attributed to the PPI numbers turning out to be cooler than initially anticipated.

- The implications of this development hint at the Federal Reserve possibly gaining better control over the prevailing inflationary pressures, and this has raised the prospect of potential rate cuts in the near future.

However, it's important to acknowledge the current state of the market, which is undeniably turbulent and characterized by substantial confusion among traders. This perplexity is unlikely to dissipate quickly, creating an environment where caution is paramount.

In the silver market, prudent position sizing has always been a key consideration due to its inherent volatility. This practice becomes even more crucial in times of uncertainty like the present. Managing your position size effectively is essentially the only shield you have in a market that can be exceedingly challenging to navigate.

The Big Picture

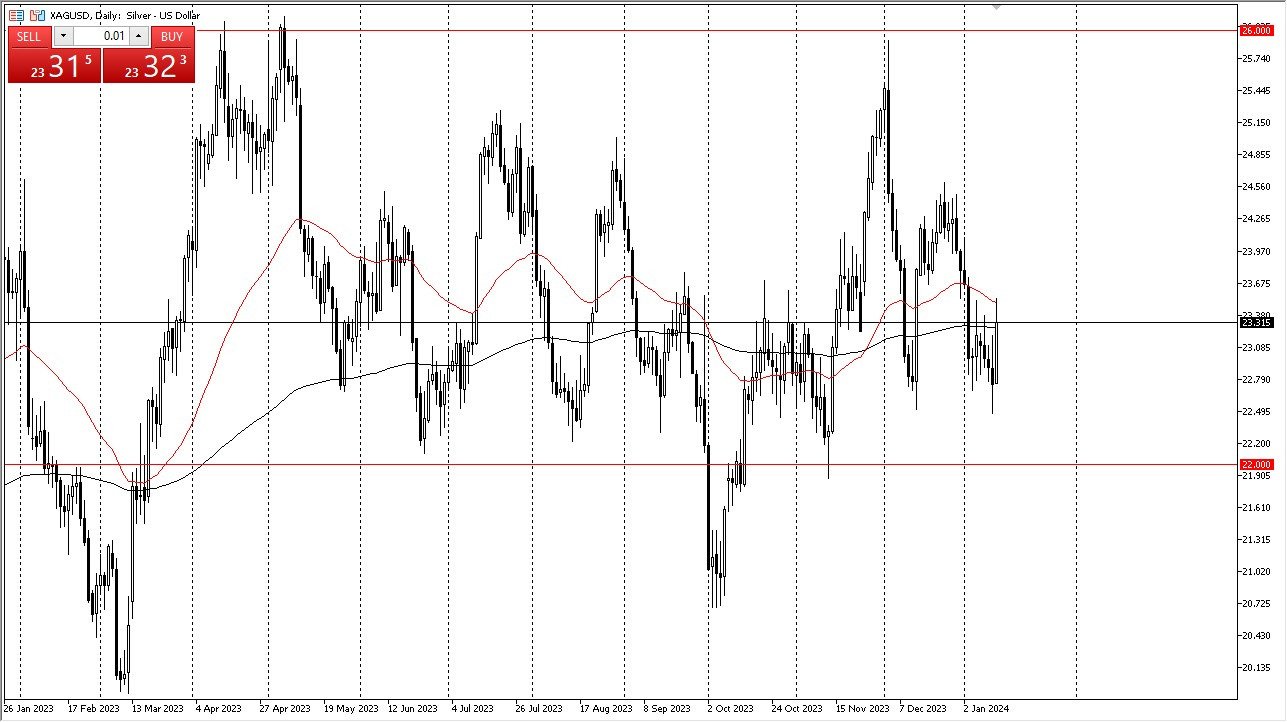

In the larger scheme of things, it seems probable that the recent rally is a response to the market nearing bottom. The $22 level continues to serve as a significant support level, both in the short term and over an extended horizon. While breaking above the 200-day Exponential Moving Average (EMA) might pose a minor resistance, surpassing the 50-day exponential moving average holds the potential for further gains.

Top Forex Brokers

Breaking through the $24.50 level could pave the way for Silver to target the $26 mark, which represents the upper boundary of the long-term trading range. It is essential to recognize that Silver's appeal extends beyond being a precious metal; it also has industrial applications. The anticipation of the Federal Reserve's efforts to stimulate the economy can stimulate activity in the industrial sector, further influencing Silver's performance.

In this dynamic market, a strategy of buying on price dips remains a prudent approach. Starting with small positions and gradually building them up is a sensible way to engage in silver trading. This approach allows traders to capitalize on value as it presents itself, adapting to the ever-evolving conditions of the market.

At the end of the day, Silver's recent rally in response to the unexpected PPI numbers underscores the uncertainty prevailing in the market. While the overall sentiment may be positive, traders must exercise caution and focus on effective position management to navigate the volatile waters of the silver market successfully.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.