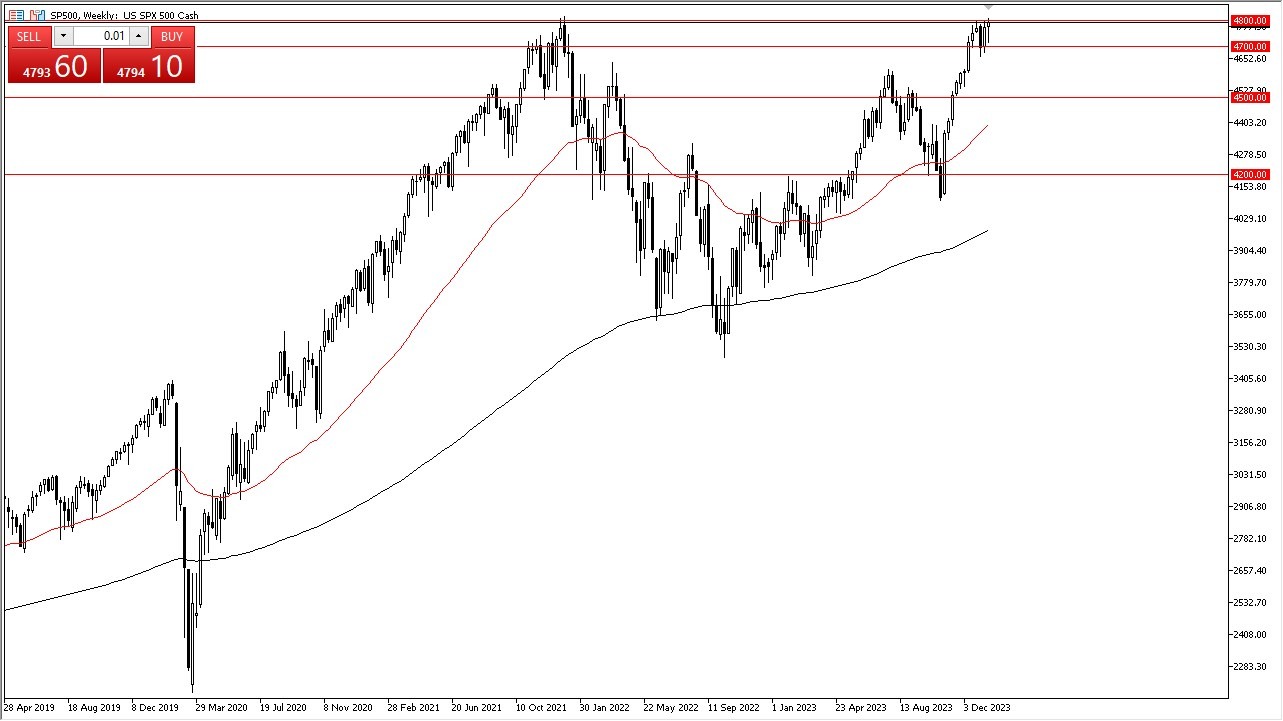

SP 500

The S&P 500 initially pulled back during the course of the trading week to reach down toward the 4700 level. The 4700 level is an area that has been important multiple times. All things being equal, the market has turned around to show signs of life, and it does look like we will eventually break out. Short-term pullbacks are buying opportunities, and I think that given enough time that we could go looking toward the 4900 level, followed by the 5000 level.

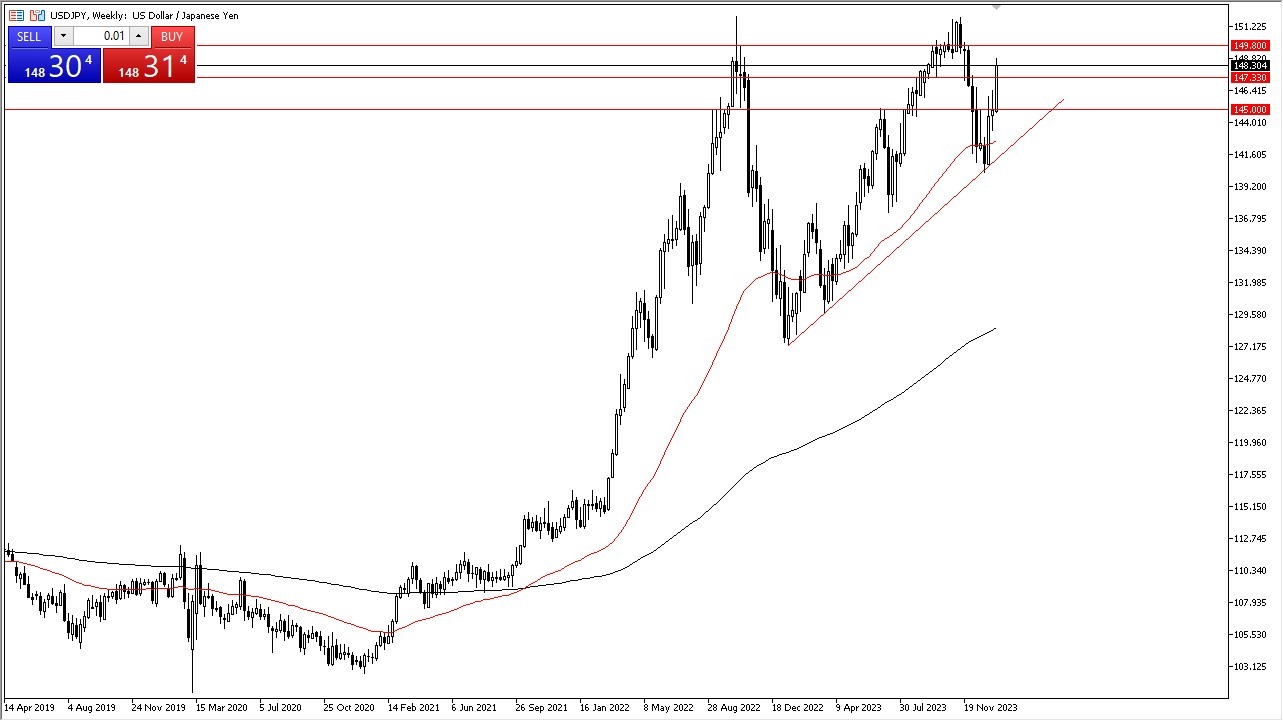

USD/JPY

The US dollar has rallied rather significantly during the course of the trading week to break above the ¥147.33 level, and therefore it’s likely that we will continue to see a lot of upward pressure. All things being equal, if we do see a short-term pullback, there will be plenty of people willing to jump into the market and take advantage of value. The size of the candlestick does suggest that we are going to continue to see buyers, but I would also look for some type of value to take advantage of.

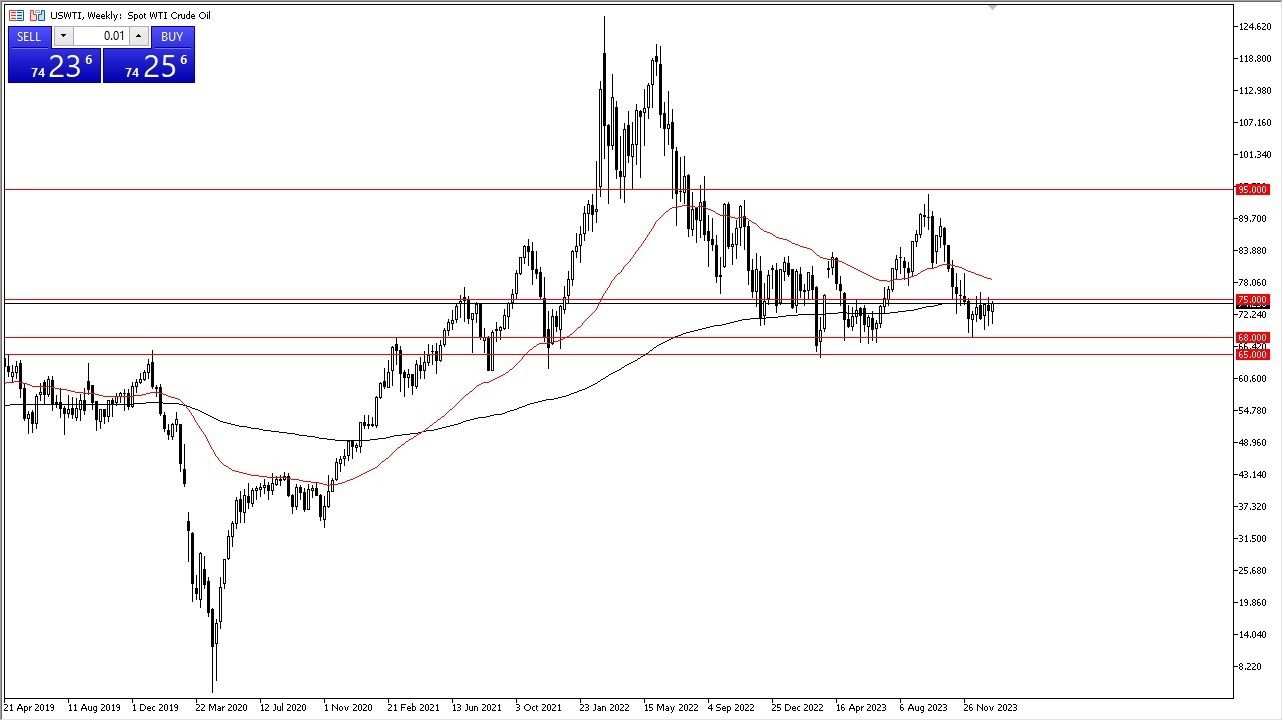

WTI Crude Oil

The West Texas Intermediate Crude Oil market initially pulled back during the course of the week only to turn around and show signs of life. It now looks as if the $75 level will continue to be significant resistance, and therefore we need to pay close attention to whether or not we can get above there. If we are going to break above there, then we could go look at the 50-Week EMA which is closer to the $79 level. Short-term pullbacks continue to be buying opportunities in this market, with the $60 level underneath as a major support barrier.

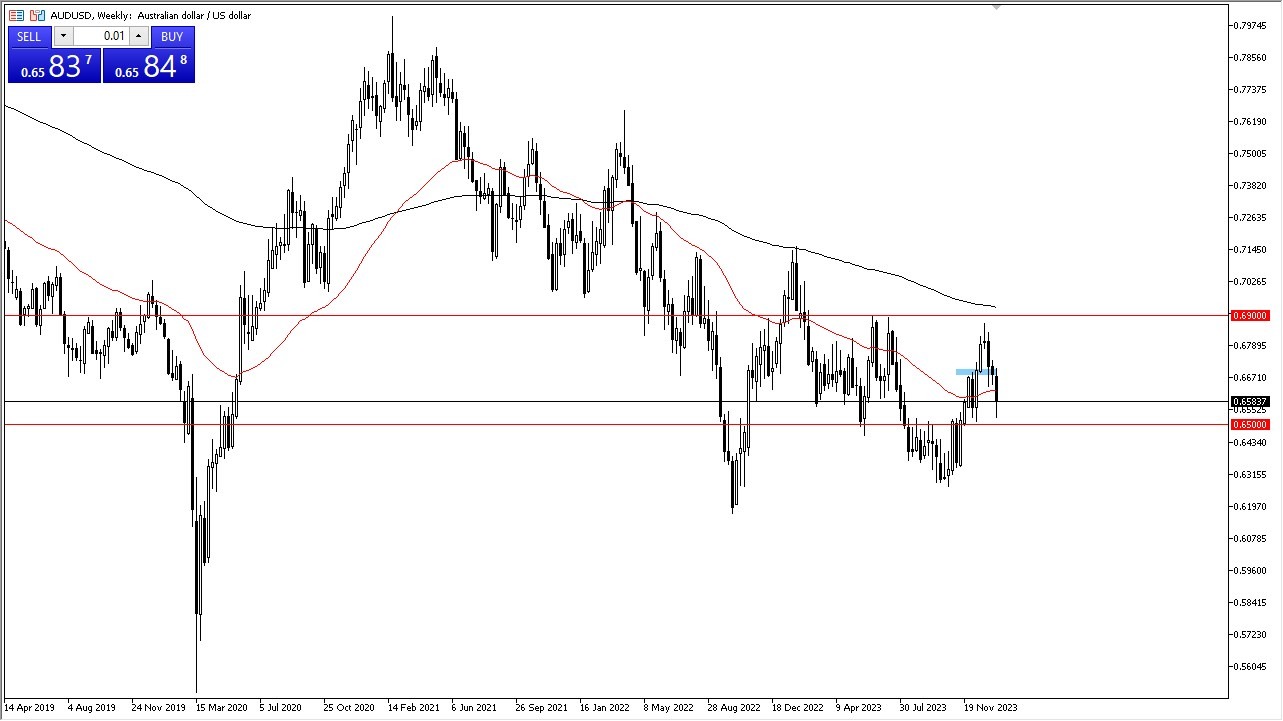

AUD/USD

The Australian dollar has fallen significantly during the course of the trading week to test the 0.65 level. The 0.65 level is an area that previously has been support and resistance both. Because of this, I think this is a market that looks as if we are eventually going to turn around and show signs of life. The 0.67 level above will be the target, which was a major area of interest previously. If we can break above there, then the market is likely to look into the 0.69 level above, which is also an area where the 200-Week EMA is going to show up.

Top Forex Brokers

USD/CHF

The US dollar has exploded to the upside against the Swiss franc as we are closing out the week near the 0.87 level. The 0.87 level is an area where the market is going to continue to see a lot of trouble, but if we can break above there the next target would be the 0.88 level. If we were to break above there, then the US dollar could go looking to the 0.90 level above. On the other hand, if we do see some signs of exhaustion, this could be the top of the recovery. I think the next candlestick is going to be crucial for this pair.

BTC/USD

Bitcoin initially tried to rally during the course of the week, only to turn around and show signs of weakness. The market is sitting on top of the $40,000 level, which of course is a large, round, psychologically significant figure. If we break down below there, then the market could go down to the $38,000 level. All things being equal, I do believe the Bitcoin is going to continue to see a lot of bullish pressure, but it’s probably going to be a situation where value is something that traders will continue to look toward, but now that we have had the Bitcoin ETF announced, we are looking for the next catalyst to make this market go higher.

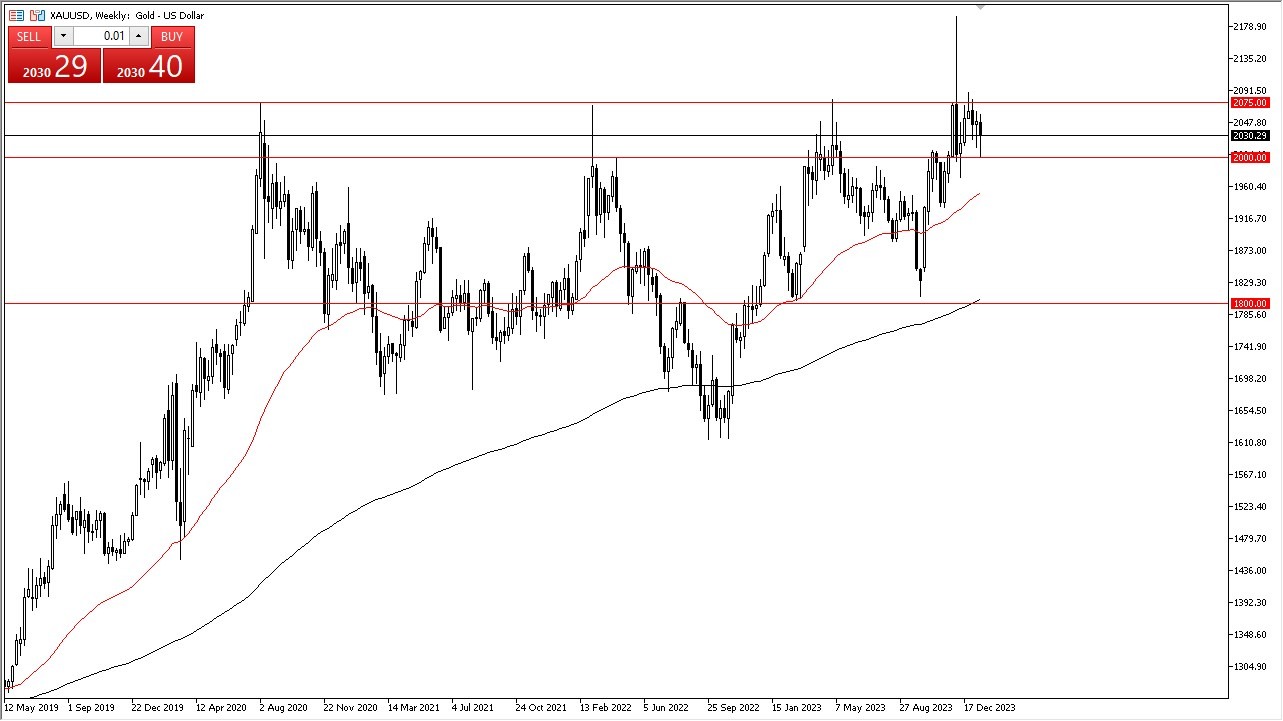

Gold

Gold markets have plunged during the course of the week to test the $2000 level, which is a large, round, psychologically significant figure that traders will pay close attention to. By turning around and showing this type of bullish pressure, then the market will eventually go looking to the $2075 level. In general, this is a market that I think continues to be very noisy, but with that being the case I also think that buyers are willing to pick up “cheap gold” anytime we get an opportunity. Pay close attention to the interest rate markets, because they will have a major influence as well as the negative correlation between interest rates in gold and will remain strong.

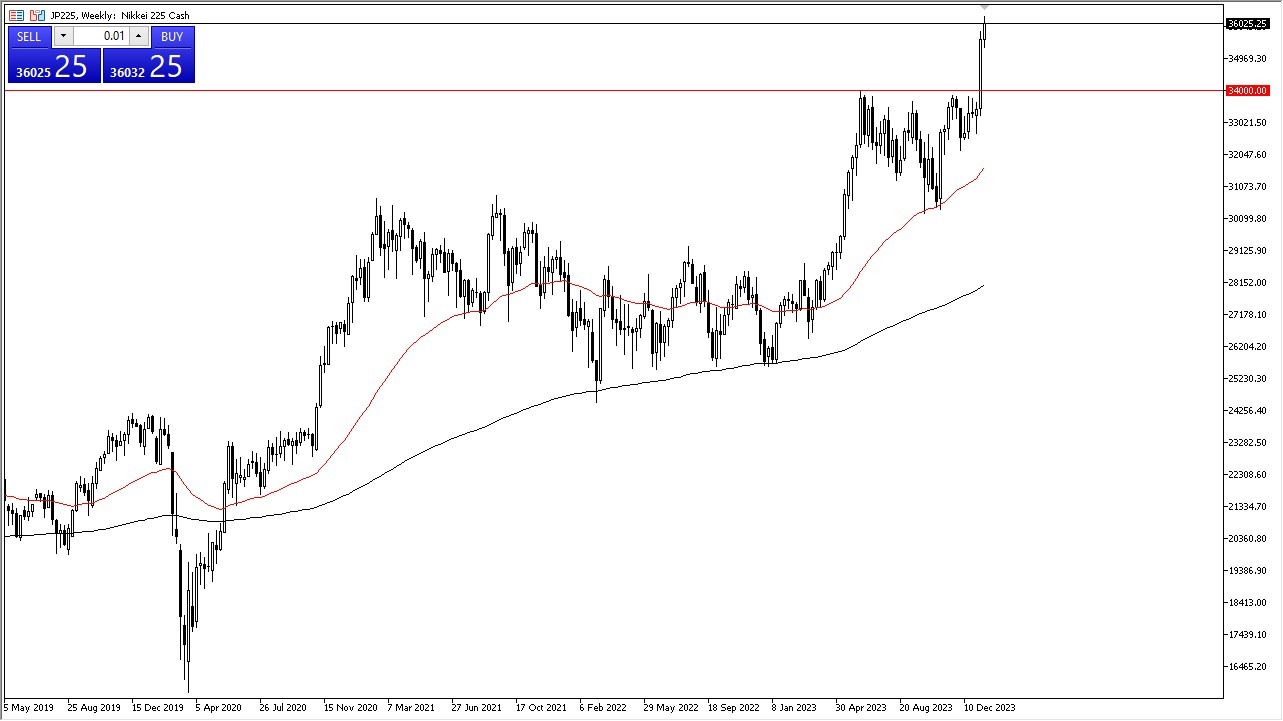

Nikkei 225

Tokyo continues to shoot straight up in the air and at this point in time I think it’s obvious that the Nikkei 225 remains very strong. I think the ¥34,000 level underneath is the “floor in the market”, and therefore it’s likely as low as we go on any pullback. I think pullbacks at this point in time will continue to be buying opportunities, as it’s obvious that the shrinking Japanese Yen has made the Nikkei 225 bullish.

Ready to trade our weekly Forex forecast? Here are the best Forex brokers to choose from.