- Early on Wednesday morning, the gold market moved slightly, continuing the trend of sideways trading overall.

- That being said, it is worth noting that this market has more of an overall bullish attitude that anything else.

- This market continues to see resilience and this is the main point of the analysis.

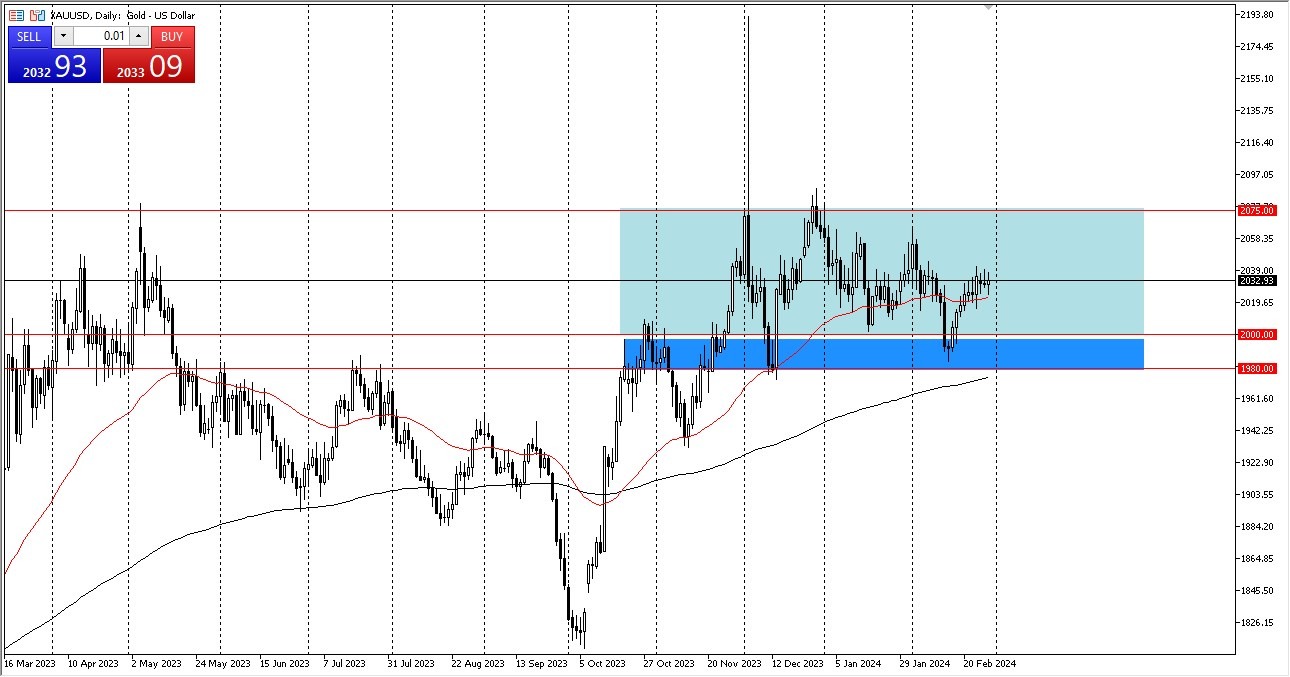

As you can see, gold is still generally grinding sideways and is currently hovering slightly around the 50-day EMA. Given that, I think it would be a good idea to purchase a small amount during a brief decline. Given the number of geopolitical concerns that could propel gold prices higher, I have no interest in shorting this market, at least not anytime soon. Moreover, I believe you have a scenario where the longer-term interest rate environment is still beneficial for gold.

Top Forex Brokers

High Demand Due to Several Factors

Following that, I believe you have a scenario where traders will continue to view this as a market with high demand because of geopolitical concerns and the interest rate environment because the Fed and other central banks should be cutting rates shortly. If that turns out to be the case, you will need to see this through the lens of a market that very certainly has many more reasons to rise in the near future.

Furthermore, gold prices are likely to rise only due to geopolitical concerns. I enjoy purchasing dips because they offer a significant area of interest, and I also like the $2,000 support level underneath. The $1,980 level is then viewed by the market as being within the same support region. Therefore, in general, I don't see any need to short this market, though I do think it makes sense to purchase declines there if the chance arises.

The $2,060 mark above ought to provide resistance. For the time being at least, the $2,075 level above ought to be the upper limit. If that turns out to be the case, then everything above that becomes an instant buy and hold in a market that has the potential to really rocket off. In the end, I prefer purchasing this market. I don't want to short anything. It is also getting closer to that support region, which is another reason, in my opinion, to be quite optimistic about the 200-day EMA.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.