- The early hours of Monday's trading session saw some negative movement in silver as we continue to move in what appears to be a fairly well-defined consolidation region.

- I think this will continue to be the main driver of silver over the next several weeks, as the area is so obvious for both short-term and longer-term traders in general.

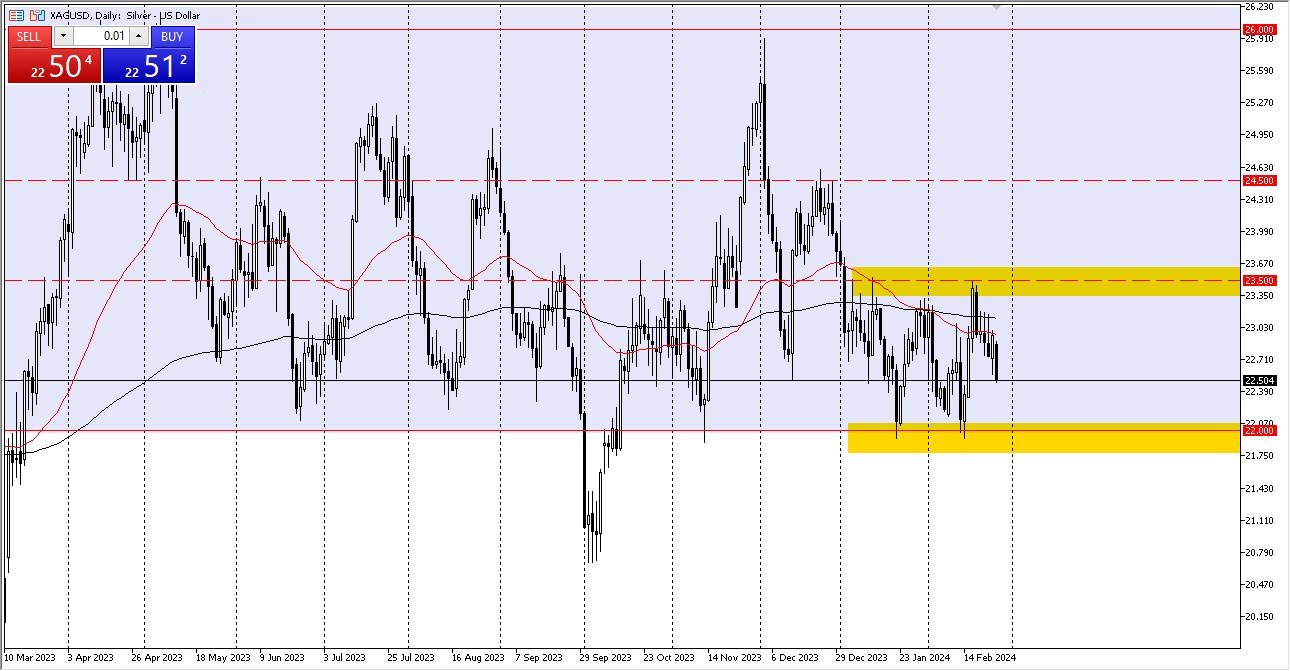

I'm looking at the silver market, and it is clearly very negative early in Monday's trading day, but to be honest, not much is happening to move the markets in any one direction. Having said that, it is quite likely that we will stay in the same range, with the $22 level acting as a big support level below and the $23.50 level acting as a significant resistance barrier above. Given that, I believe your market will continue to fluctuate in this broad area. However, since we are so near to the middle of this trading range, I don't think there is much that can be done.

Top Forex Brokers

The importance of $22

Since $22 has been tested numerous times in the past and has nearly always shown to be significant, I would very much be interested in trying to get long in the silver market whenever we get down to that level. The next significant area is $21, if we were to drop below $22. If we were to break below this level, it may be a very bad sign for silver and would almost surely indicate that the US dollar is soaring against everything. Having said that, I don't think this will occur anytime soon.

Above, a move to the $24.50 level and maybe even 26 is possible if we can break through the $23.50 level. Nevertheless, silver is still making a lot of noise, which makes some sense given that people are not particularly confident about the US currency or interest rate movements. Thus, it goes without saying that you also need to be extremely aware of it while in the air. Therefore, I believe that short-term range-bound trading will continue to exploit small pockets of value that arise from these abrupt pullbacks. That being said, bigger moves are probably further away, but I certainly think that silver has enough support underneath it you need to be looking in one direction overall.

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.